DXC Technology (DXC) Valuation Check After AdvisoryX AI Push and New Digital Leadership

DXC Technology (DXC) just launched AdvisoryX, a global advisory group focused on helping enterprises turn AI ambition into execution, backed by a detailed study on how leaders are actually deploying AI today.

See our latest analysis for DXC Technology.

Those moves around AdvisoryX and DXC's new Chief Digital Information Officer seem to have caught investors' attention, with a 30 day share price return of 28.69 percent helping reverse some of the deeper multiyear total shareholder return losses.

If DXC's AI pivot has you watching the space more closely, this could be a good moment to explore other high growth tech and AI stocks that might be building similar momentum.

Yet with revenue still shrinking, earnings under pressure and the stock trading below some intrinsic valuations but slightly above analyst targets, investors now face a tougher call: is DXC a contrarian AI value play or already pricing in a turnaround?

Most Popular Narrative Narrative: 6.4% Overvalued

With DXC Technology closing at $15.43 against a narrative fair value of $14.50, the story points to modest downside from here driven by cautious forecasts.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 6.6x today. This future PE is lower than the current PE for the US IT industry at 29.7x.

Want to see how shrinking revenues, thinner margins and a sharply higher earnings multiple still combine into a higher value than today? The full narrative unpacks that puzzle in detail.

Result: Fair Value of $14.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue declines and competitive pressure in cloud and AI services could stall DXC's turnaround and undermine the current valuation narrative.Find out about the key risks to this DXC Technology narrative.

Another View: Multiples Point to Deep Value

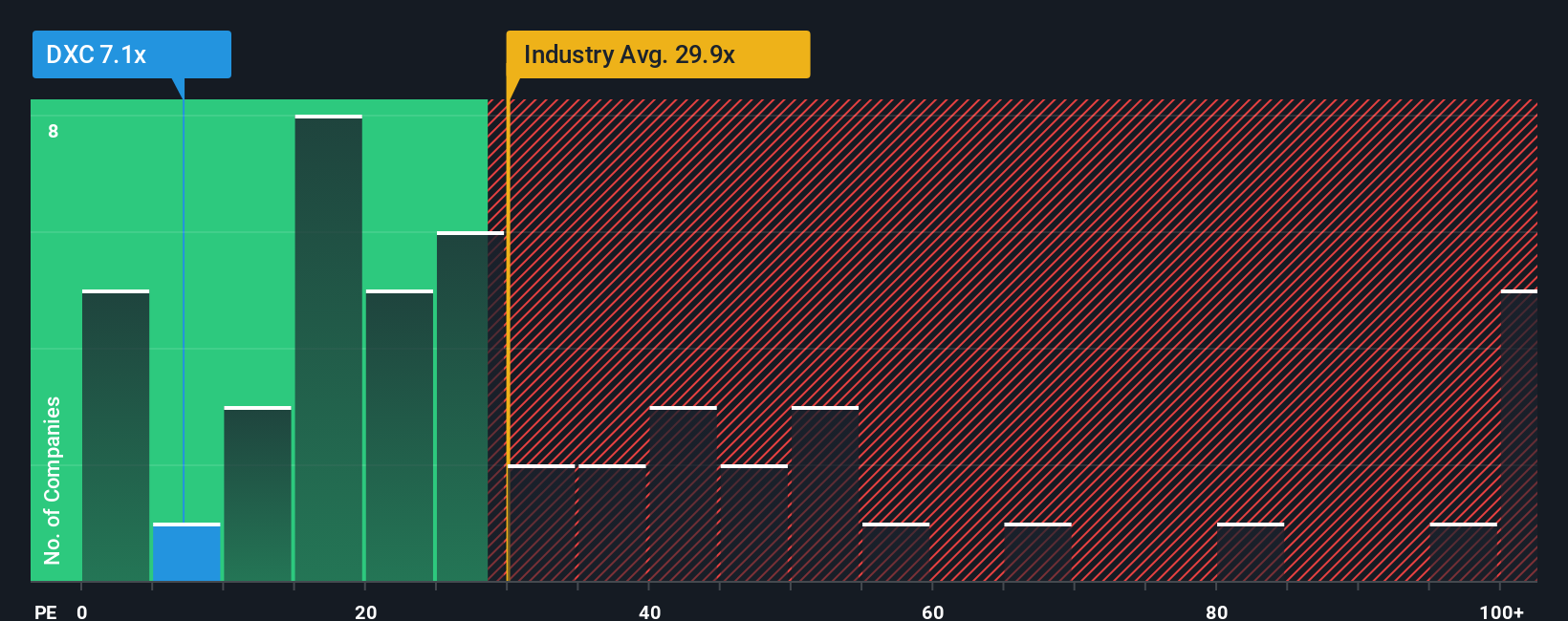

While the narrative fair value suggests DXC is 6.4 percent overvalued, its price to earnings ratio of 7.2 times looks low compared with peers at 19.3 times, the US IT industry at 29.9 times, and a fair ratio of 18.8 times. This points to a potential value gap that investors might be overlooking.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DXC Technology Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a custom DXC view in minutes: Do it your way.

A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at DXC, put Simply Wall Street's powerful Screener to work on other high potential ideas so you are not leaving compelling opportunities on the table.

- Capitalize on major price misalignments by scanning these 914 undervalued stocks based on cash flows that may offer different prospects than mature, fully priced names like DXC.

- Explore the next wave of innovation by targeting these 25 AI penny stocks that are connected to real world adoption, not just buzz.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can complement growth-focused AI exposure with regular cash payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报