China Risun Group (SEHK:1907): Valuation Check After New Debt Guarantee for Majority-Owned Joint Venture

China Risun Group (SEHK:1907) just signed up to guarantee up to US$269.6 million of debt for its majority owned joint venture, Risun Wei Shan, tying its balance sheet more closely to the project.

See our latest analysis for China Risun Group.

The guarantee news lands against a mixed backdrop, with the share price at HK$2.27 seeing a modest 1 month share price return but a weaker year to date share price return, suggesting near term sentiment is stabilising even as longer term total shareholder returns remain under pressure.

If this kind of balance between risk and opportunity interests you, it could be worth scanning fast growing stocks with high insider ownership to see what other companies with strong growth stories are doing right now.

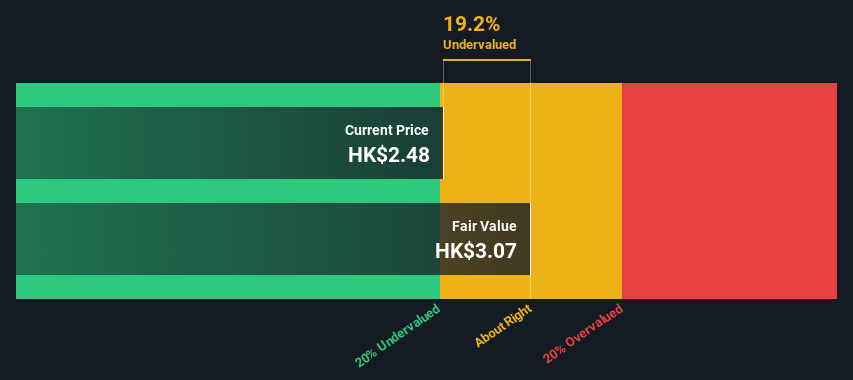

With earnings rebounding but the share price still trailing analysts’ targets, investors face a key question: is China Risun now trading below its true value, or is the market already pricing in any future growth?

Price-to-Sales of 0.2x: Is it justified?

On a price-to-sales ratio of roughly 0.2x at the last close of HK$2.27, China Risun screens as attractively valued against peers and its own fair ratio.

The price-to-sales multiple compares the company’s market value to its annual revenue. This can be a useful yardstick for cyclical, currently unprofitable chemicals businesses where earnings can be volatile or negative.

For China Risun, the market is applying a discount that is below the estimated fair price-to-sales ratio of 0.4x, below the Hong Kong chemicals industry average of 0.5x, and below a 0.6x peer group average. This implies investors are pricing in weaker prospects than these benchmarks suggest and may leave room for the multiple to move closer to those levels if sentiment improves.

Explore the SWS fair ratio for China Risun Group

Result: Price-to-Sales of 0.2x (UNDERVALUED)

However, investors should still weigh reliance on debt guarantees and recent net losses, as any prolonged margin pressure could justify a persistent valuation discount.

Find out about the key risks to this China Risun Group narrative.

Another View: Our DCF Signals Caution

While the 0.2x price to sales ratio hints at value, our DCF model paints a cooler picture. It suggests fair value is closer to HK$1.74 versus the current HK$2.27, which implies the shares may be overvalued and raises the question of which signal deserves more weight.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Risun Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Risun Group Narrative

If you would rather rely on your own research and judgment, you can quickly build a personalised view of China Risun in just a few minutes, Do it your way.

A great starting point for your China Risun Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Smart investors never stop upgrading their watchlist, and the Simply Wall Street Screener surfaces fresh ideas fast so you are not the one catching up later.

- Capture potential mispricings early by reviewing these 914 undervalued stocks based on cash flows that signal strong cash flow support for their current market prices.

- Ride structural growth in technology by targeting these 25 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Strengthen your income strategy with these 13 dividend stocks with yields > 3% that can help balance volatility while keeping your capital working.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报