Equifax’s Accelerating AI Patent Build-out Might Change The Case For Investing In Equifax (EFX)

- In the second half of 2025, Equifax secured 27 new patents, bringing its 2025 total to 62 and expanding its AI, cloud and security capabilities across nearly 700 issued or pending patents in 15 countries.

- This rapid build-out of EFX.AI and Equifax Cloud intellectual property, including responsible AI techniques used in customer-facing solutions, could strengthen the company’s differentiation in risk assessment, fraud prevention and credit decisioning.

- We’ll now examine how Equifax’s accelerated build-up of AI-related patents could reshape its existing investment narrative around growth and resilience.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Equifax Investment Narrative Recap

To own Equifax, you have to believe its data, cloud and AI platforms can keep driving new products fast enough to offset margin pressure from high debt and ongoing litigation. The latest AI-heavy patent wins reinforce the long term technology story, but do not materially change the near term tug-of-war between earnings growth as a key catalyst and elevated legal and compliance costs as the main risk.

The December launch of Income Qualify, which pulls verified income and employment data from The Work Number into the prequalification stage for mortgages, ties the AI and cloud story to a concrete growth lever in core lending workflows. It illustrates how Equifax’s data assets and EFX.AI ambitions can translate into new verification products that support its thesis of multi-data solutions and help diversify away from more cyclical mortgage credit volumes.

Yet behind the patent momentum and new products, investors should still pay close attention to rising litigation and data privacy risk...

Read the full narrative on Equifax (it's free!)

Equifax's narrative projects $7.8 billion revenue and $1.3 billion earnings by 2028. This implies 9.9% yearly revenue growth and an earnings increase of about $660 million from $639.7 million today.

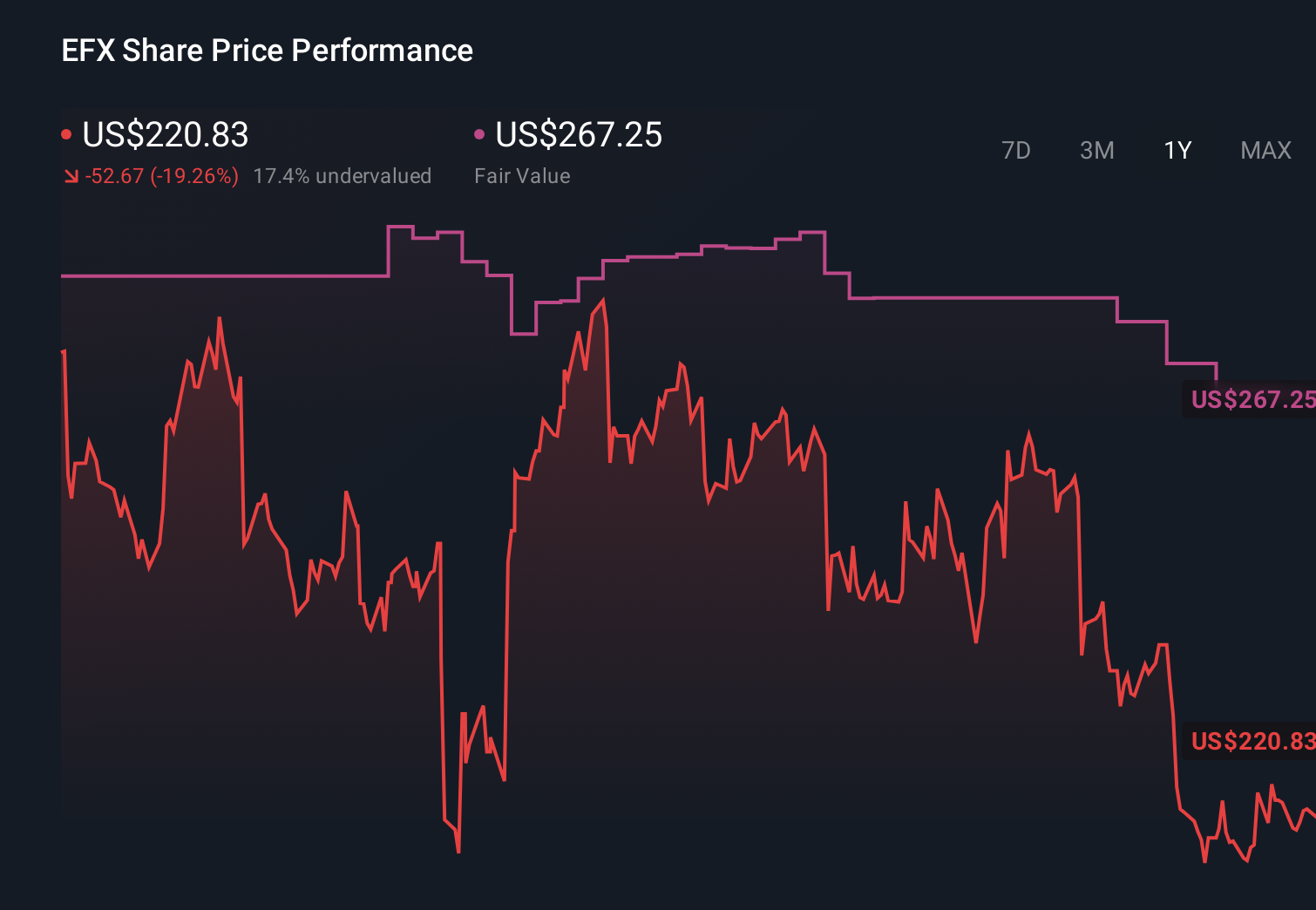

Uncover how Equifax's forecasts yield a $267.25 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$256.57 to US$544.26, underscoring how far apart views on Equifax can be. Against this wide range, concerns about sustained litigation expenses and margin pressure may be just as important for you to weigh as the company’s expanding AI patent portfolio and cloud driven product pipeline.

Explore 6 other fair value estimates on Equifax - why the stock might be worth just $256.57!

Build Your Own Equifax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equifax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equifax's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报