Will Jerome Guillen’s Tesla Experience Quietly Rewire Ingersoll Rand’s Operational Edge and ESG Story (IR)?

- Ingersoll Rand has expanded its Board of Directors to ten members and appointed former Tesla president Jerome Guillen, effective January 1, 2026, also naming him to the Compensation and Sustainability Committees.

- Guillen’s background in scaling advanced manufacturing, automation, and sustainable technologies across Tesla and Daimler brings fresh operational and innovation-focused oversight to Ingersoll Rand’s governance structure.

- We’ll now explore how Guillen’s Tesla-honed expertise in production efficiency and sustainable technology may influence Ingersoll Rand’s existing investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ingersoll Rand Investment Narrative Recap

To own Ingersoll Rand, you generally need to believe in its ability to compound earnings through energy efficient products, aftermarket services, and disciplined M&A, despite recent earnings volatility and a rich valuation multiple. Jerome Guillen’s appointment does not materially change the near term earnings catalyst or the key risks around acquisition execution, cyclical demand, and softer organic growth in core businesses.

The most relevant recent announcement here is the Q3 2025 earnings release, which showed higher sales but compressed profit margins partly tied to one off items and prior M&A choices. Guillen’s manufacturing and efficiency background now sits alongside these financial trends, framing how governance and oversight might influence how Ingersoll Rand balances growth acquisitions with protecting margins and return on capital.

Yet investors should also be aware that if acquisition integration stumbles or goodwill pressures resurface, the impact on margins and capital returns could...

Read the full narrative on Ingersoll Rand (it's free!)

Ingersoll Rand's narrative projects $8.8 billion revenue and $1.4 billion earnings by 2028. This requires 6.1% yearly revenue growth and about an $877 million earnings increase from $522.6 million today.

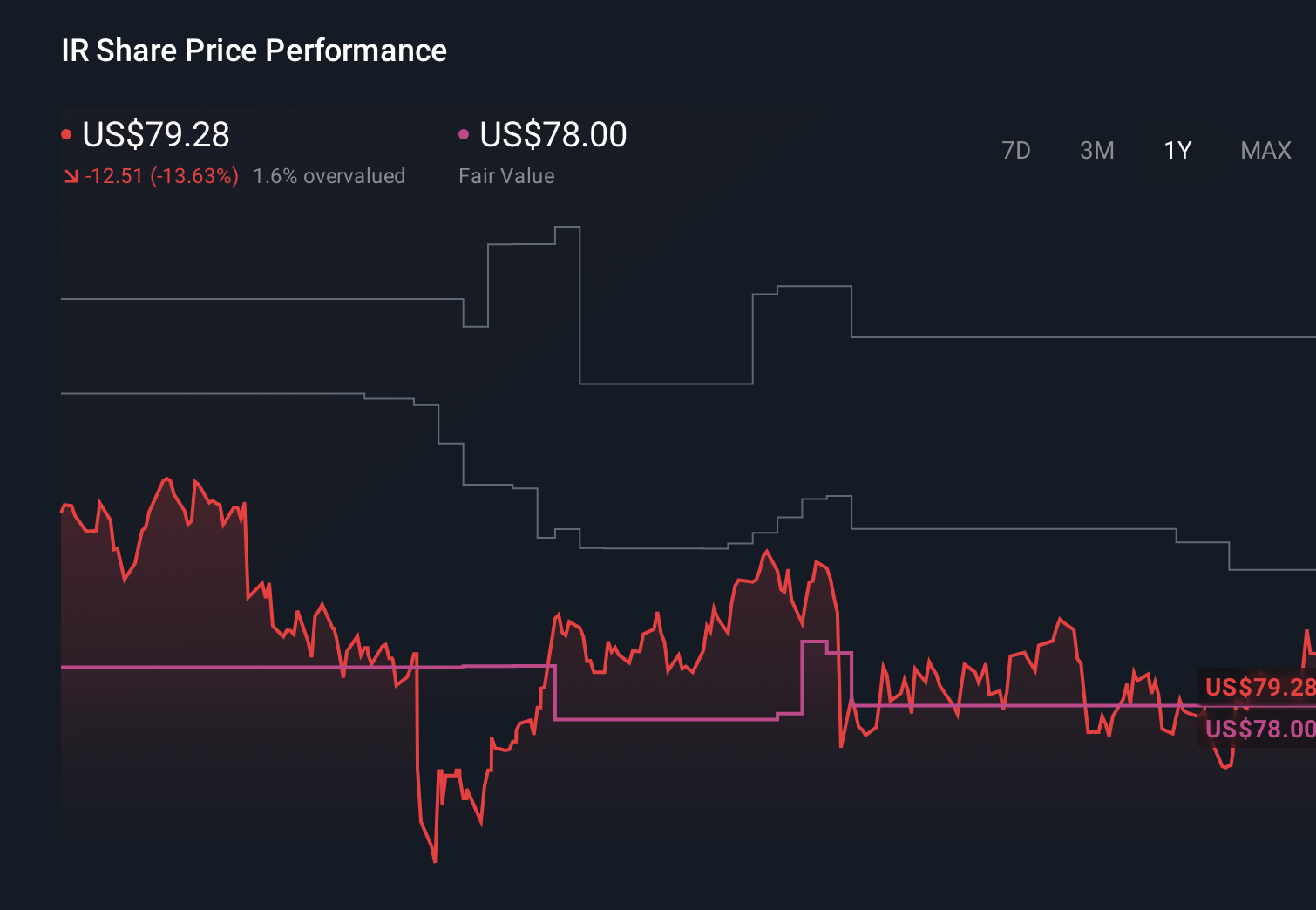

Uncover how Ingersoll Rand's forecasts yield a $87.70 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently see Ingersoll Rand’s fair value clustered in a tight US$86.52 to US$88.30 range, highlighting how close some see price to value. Against this, concerns about acquisition related impairments and integration risk may lead you to weigh these community views alongside the possibility of further pressure on margins and returns, and to explore several alternative viewpoints before deciding how to act.

Explore 3 other fair value estimates on Ingersoll Rand - why the stock might be worth as much as 11% more than the current price!

Build Your Own Ingersoll Rand Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ingersoll Rand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ingersoll Rand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ingersoll Rand's overall financial health at a glance.

No Opportunity In Ingersoll Rand?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报