Assessing XPEL (XPEL)’s Valuation After Big Capex Plans, Insider Buying, and Growing Margin Optimism

XPEL (XPEL) has announced an aggressive two-year capital spending plan of up to $150 million, and insiders are backing it with their own money, as six executives have recently bought shares.

See our latest analysis for XPEL.

The backdrop to this spending push is a stock that has caught a strong tailwind, with a 30 day share price return of 20.0 percent and a 90 day share price return of 54.0 percent. However, a three year total shareholder return of negative 13.7 percent shows that longer term holders are still waiting for a full comeback. This suggests that momentum is clearly building, but the broader rerating story is still playing out.

If this kind of insider backed growth story appeals, it could be a good moment to see what else is shaping up in the auto space via auto manufacturers.

With ambitious capex plans, robust earnings growth and insiders buying in, XPEL looks fundamentally stronger than its recent history suggests. However, with shares near analyst targets, investors may question whether this is a genuine buying opportunity or if future growth is already priced in.

Most Popular Narrative: 1.9% Undervalued

With XPEL shares last closing at $51.00 against a narrative fair value near $52.00, the story hangs on whether margins can structurally improve.

Product innovation continues to be a focus, with the launch of new offerings such as colored paint protection films and Windshield Protect; these higher margin, differentiated products cater to growing consumer demand for vehicle personalization and premium protection, likely supporting margin expansion and boosting earnings growth.

Curious how a margin upgrade narrative, steady double digit growth, and a lower future earnings multiple still add up to a higher fair value? The full breakdown reveals which financial levers do the heavy lifting, how far profitability is expected to climb, and why the valuation model assumes investors will pay less for each dollar of future earnings. Want to see exactly how those moving parts balance out?

Result: Fair Value of $52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and faster OEM factory adoption could squeeze pricing power and undermine the margin expansion that underpins this modest undervaluation story.

Find out about the key risks to this XPEL narrative.

Another Angle on Valuation

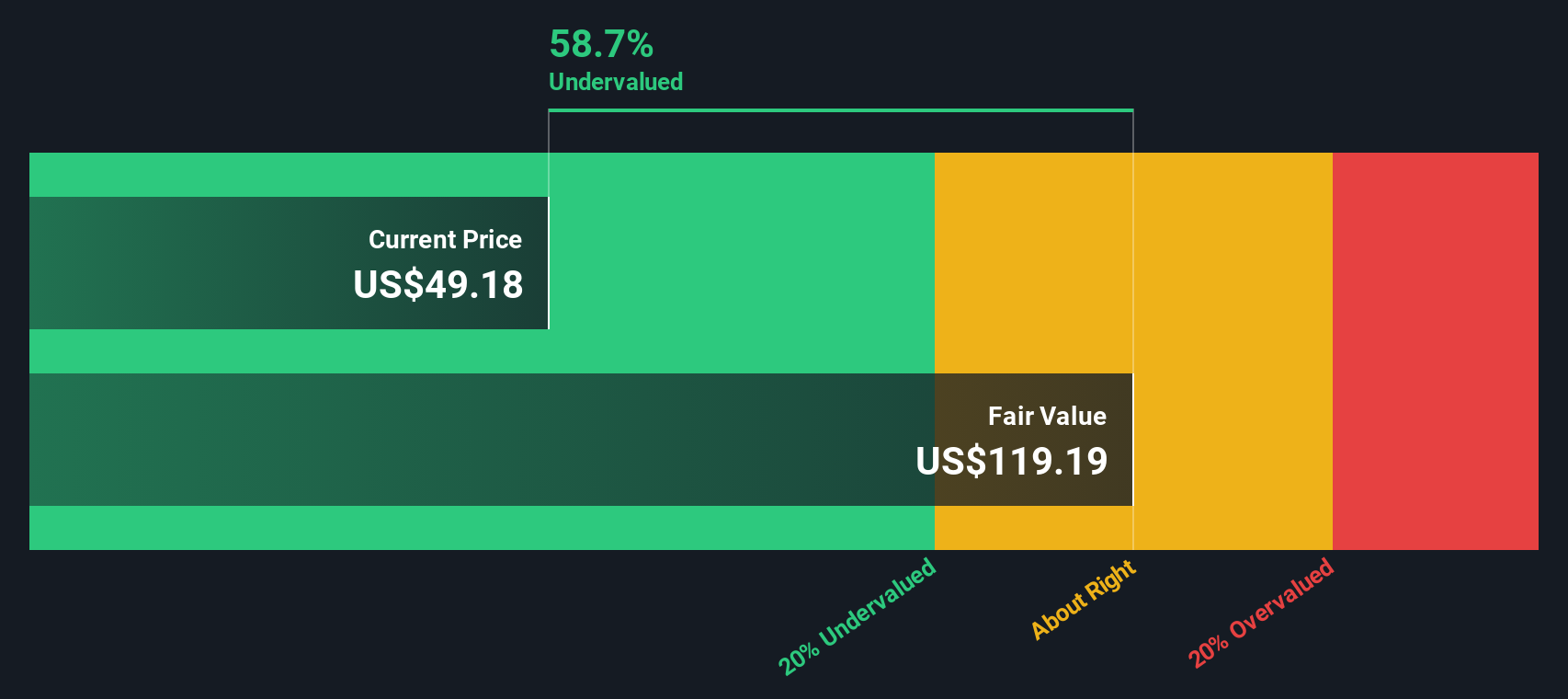

Our DCF model paints a very different picture, suggesting XPEL could be worth around $119 per share, which is far above both the current price and the $52 narrative fair value. If cash flows really compound like this, is the market underestimating the long game?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own XPEL Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding XPEL.

Ready for more investment ideas?

Before you move on, lock in your next opportunity using the Simply Wall St Screener so you are not watching from the sidelines when markets move.

- Capture high potential names trading below their intrinsic value by targeting these 914 undervalued stocks based on cash flows built on detailed cash flow estimates and fundamentals.

- Harness the growth wave in automation and machine learning by focusing on these 25 AI penny stocks that could reshape entire industries.

- Strengthen your income strategy by zeroing in on these 13 dividend stocks with yields > 3% that may offer sustainable payouts and resilience through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报