Ferguson (FERG) valuation check after earnings beat, dividend hike, guidance upgrade and ongoing buybacks

Strong quarter and shareholder moves put Ferguson in focus

Ferguson Enterprises has packed a lot into this update, combining a strong earnings quarter, a dividend hike, higher full year sales guidance around 5% growth, and steady buyback execution.

See our latest analysis for Ferguson Enterprises.

Those solid results, the 7% dividend lift, and ongoing buybacks seem to be underpinning confidence. A 31.99% year to date share price return and a 5 year total shareholder return of 115.59% point to momentum that is still broadly intact rather than fading.

If Ferguson's combination of growth, cash returns, and capital discipline has caught your eye, this could be a good moment to widen the lens and discover fast growing stocks with high insider ownership.

Yet with the shares already up strongly this year and trading only modestly below analyst targets, the key question now is whether Ferguson still offers upside or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 12% Undervalued

With Ferguson Enterprises last closing at $228.85 against a most popular narrative fair value near $259.91, the story leans toward upside built on steady compounding.

Analysts expect earnings to reach $2.4 billion and earnings per share of $12.65 by about September 2028, up from $1.6 billion today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, down from 28.0x today.

Curious how mid single digit growth, margin gains, and shrinking share count can still justify a richer future earnings multiple? The narrative lays out the full blueprint.

Result: Fair Value of $259.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity led deflation and weaker residential demand could compress margins and slow growth, which may challenge expectations for ongoing multiple expansion and buyback support.

Find out about the key risks to this Ferguson Enterprises narrative.

Another Angle on Valuation

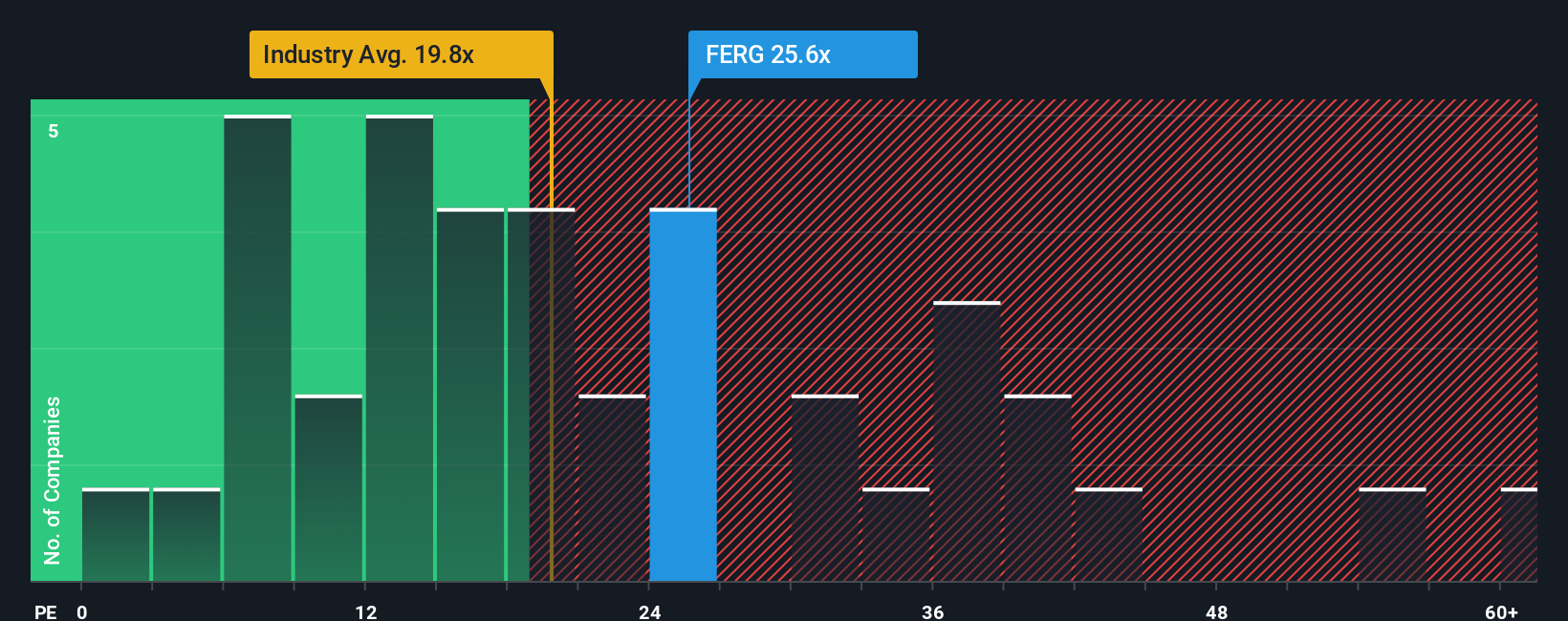

On earnings, Ferguson looks less clear cut. Its price to earnings ratio of 22.9 times is higher than the US Trade Distributors industry at 20.1 times, yet below a fair ratio of 28.5 times and slightly under peer average at 23.6 times, leaving investors weighing upside against multiple risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferguson Enterprises Narrative

If you see the numbers differently or want to stress test your own assumptions, you can pull the data together and Do it your way in just a few minutes.

A great starting point for your Ferguson Enterprises research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Ferguson, you could miss standout opportunities. Put the same lens to work and let the Simply Wall St Screener guide your next moves.

- Capitalize on potential mispricings by targeting these 914 undervalued stocks based on cash flows that combine solid fundamentals with room for sentiment and multiples to catch up.

- Ride powerful technology themes by focusing on these 25 AI penny stocks that tap into real world AI adoption rather than hype alone.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that can support reliable cash returns through varying market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报