Tyson Foods (TSN): Is The Stock Undervalued After Its Recent 10% One-Month Gain?

Tyson Foods (TSN) has quietly outperformed the broader meat sector over the past month, climbing about 10% as investors warm up to improving earnings trends and steadier demand across beef, pork, and chicken.

See our latest analysis for Tyson Foods.

Zooming out, that recent 10.2% 1 month share price return has only nudged Tyson Foods to a modest 4.4% 1 year total shareholder return. Investors are still treating the latest operational improvements as early stage momentum rather than a full re rating.

If you like the idea of a steady compounder but want to see what else is gaining traction, now is a good time to explore fast growing stocks with high insider ownership.

Yet with earnings inflecting higher, the share price still lagging its intrinsic value estimates, and only a small discount to Wall Street targets, investors face a key question: is Tyson Foods a quiet bargain, or is the market already baking in the next leg of growth?

Most Popular Narrative: 6.7% Undervalued

With Tyson Foods last closing at $58.47 against a narrative fair value near $62.67, the current gap frames a modest upside case grounded in profitability.

Net Profit Margin expectations improved, rising from 3.54% to 4.05%, driven by anticipated operational efficiencies.

Future Price-to-Earnings (P/E) Ratio has fallen significantly, changing from 13.04x to 11.23x.

Want to see the math behind that gap between today’s price and fair value? The entire story hinges on rising margins, accelerating earnings, and a surprisingly conservative future multiple. Curious how those pieces fit together into that single upside number?

Result: Fair Value of $62.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if persistent cattle supply constraints drag out or raw material inflation squeezes margins faster than pricing can adjust.

Find out about the key risks to this Tyson Foods narrative.

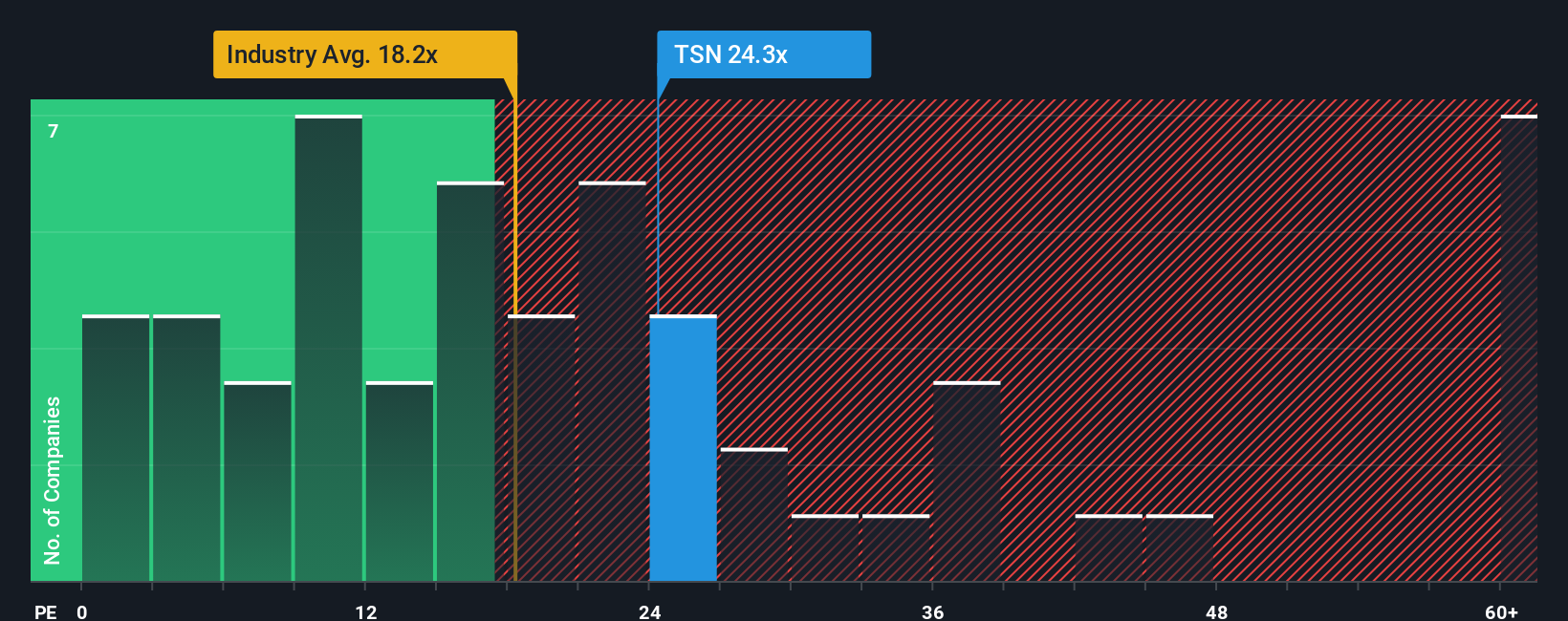

Another View: Market Ratios Send A Different Signal

While the narrative fair value suggests upside, the current earnings multiple tells a more cautious story. Tyson trades on a rich 43.6x P/E, well above both the US Food industry at 19.4x and its own 28.8x fair ratio, which hints at limited margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyson Foods Narrative

If you are not fully aligned with this perspective, or would rather dig into the numbers yourself, you can build a personalized view in minutes, Do it your way.

A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Tyson. Use the Simply Wall Street Screener to uncover fresh opportunities that match your style before other investors catch on.

- Strengthen your long term income potential by targeting dependable payers through these 13 dividend stocks with yields > 3% that can support growing cash flows and resilient portfolios.

- Position your portfolio at the heart of generative models and automation breakthroughs with these 25 AI penny stocks harnessing real world demand for artificial intelligence solutions.

- Capitalize on misunderstood value by filtering for companies trading below intrinsic worth via these 914 undervalued stocks based on cash flows before the broader market re rates them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报