HBM Holdings (SEHK:2142): Valuation Check After Bristol Myers Squibb Collaboration Validates Growth Prospects

HBM Holdings (SEHK:2142) just landed a multi year global collaboration and license deal with Bristol Myers Squibb, tying its antibody discovery platform to potentially more than $1.1 billion in future payments.

See our latest analysis for HBM Holdings.

The market has already started to reprice that validation, with a 1 day share price return of 6.6 percent pushing HBM Holdings to HK$13.34. Its roughly 574 percent year to date share price return and nearly 896 percent 1 year total shareholder return hint at powerful, momentum driven rerating rather than a one off reaction.

If this deal has sharpened your interest in healthcare innovation, it could be worth exploring other potential beneficiaries through healthcare stocks to spot what the market may be slow to recognize next.

Yet with the share price now sitting almost exactly at analyst targets after a spectacular 12 month run, investors face a tougher question: is HBM still mispriced, or is the market already baking in years of future growth?

Price to earnings of 20.4x: Is it justified?

HBM Holdings last closed at HK$13.34, a level that embeds a 20.4x price to earnings multiple which looks inexpensive against many biotech peers but rich versus its own fair ratio.

The price to earnings ratio compares what investors pay today with the company’s current earnings, a key lens for a biotech that has already moved into profitability. In HBM’s case, the market is putting a premium on its rapid profit growth, even though both revenue and earnings are forecast to decline over the next three years.

Relative to the Asian biotechs industry average of 38.7x and a peer group average of 74.7x, HBM’s 20.4x multiple looks markedly lower. This suggests the market is not fully pricing it like a high growth biotech success story. However, when set against an estimated fair price to earnings ratio of 14.3x, the current valuation implies investors are already paying ahead of that fair level, leaving less room for disappointment if growth slows.

Explore the SWS fair ratio for HBM Holdings

Result: Price to earnings of 20.4x (OVERVALUED)

However, investors must weigh clinical or regulatory setbacks and slower than expected licensing income; either could quickly puncture today’s optimism-driven valuation.

Find out about the key risks to this HBM Holdings narrative.

Another Take on Value

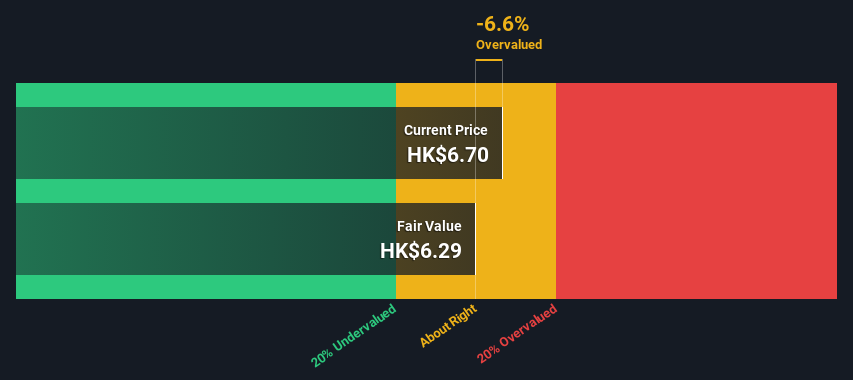

Our DCF model paints a starker picture, suggesting HBM Holdings fair value sits closer to HK$6.16, well below the current HK$13.34 price, which appears overvalued. If cash flows fail to keep pace with today’s optimism, how much downside are investors really accepting?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HBM Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HBM Holdings Narrative

If you see the story differently or prefer to dive into the numbers yourself, you can shape a custom view in just minutes: Do it your way.

A great starting point for your HBM Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities using the Simply Wall Street Screener so you are not chasing the market after it moves.

- Capture mispriced potential with these 914 undervalued stocks based on cash flows that may offer stronger upside than headline grabbing names.

- Ride the next wave of innovation by targeting these 25 AI penny stocks positioned at the intersection of software, automation and intelligent data.

- Strengthen your income strategy through these 13 dividend stocks with yields > 3% that aim to combine reliable payouts with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报