BioGaia (OM:BIOG B): Reassessing Valuation After Strong Q3 Results and Operational Improvements

BioGaia (OM:BIOG B) just delivered a stronger third quarter, with sales and net income both climbing while the balance sheet stayed debt free. That combination, plus fresh product innovations, gives investors plenty to reassess.

See our latest analysis for BioGaia.

The share price tells a more cautious story, with a roughly flat 1 year total shareholder return of about minus 2 percent, even as the latest update hints at improving growth momentum and a healthier earnings profile.

If BioGaia's progress has you rethinking healthcare exposure, this could be a good moment to scan other high quality names across healthcare stocks.

With the shares trailing their recent growth rebound yet still trading at a meaningful discount to analyst targets, the key question now is whether BioGaia is quietly undervalued or if the market is already baking in that brighter future?

Most Popular Narrative Narrative: 23.2% Undervalued

With BioGaia last closing at SEK99.85 versus a narrative fair value of SEK130, the story centers on whether growth and margins can catch up to expectations.

BioGaia's strategic shift to direct sales in new and existing markets (e.g., Netherlands, France, Australia, U.S.) leverages rising consumer demand for natural and clinically-proven solutions, paving the way for improved operating leverage and long-term margin expansion as direct business now represents 36% of sales and continues to grow.

Curious how double digit growth, rising margins, and a lower future earnings multiple can still justify a richer price than today? See how the numbers connect.

Result: Fair Value of $130 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on marketing spend translating into faster growth and on BioGaia reducing its heavy reliance on pediatric products over time.

Find out about the key risks to this BioGaia narrative.

Another Angle on Valuation

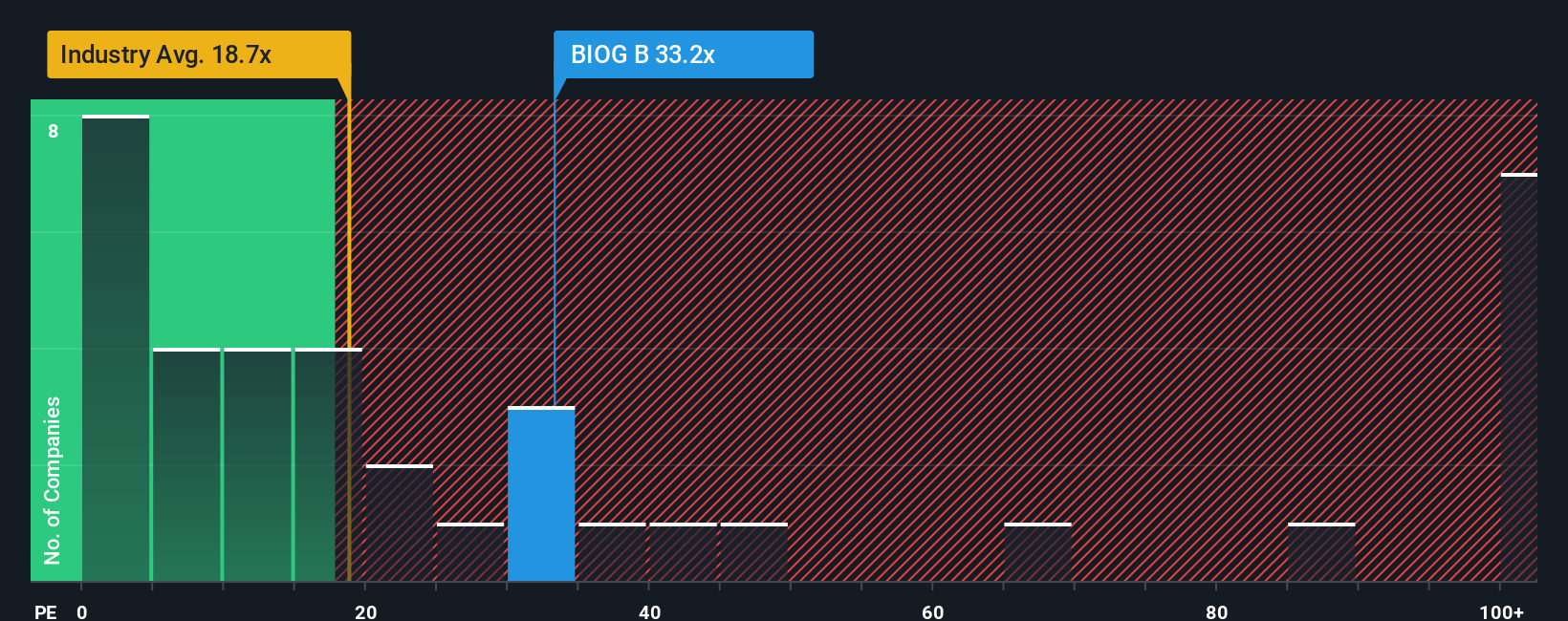

Look at earnings instead of narratives and BioGaia screens as pricey, trading on about 32 times earnings versus 16.9 times for the wider European biotech group, even if peers average nearer 38.6 times and a fair ratio of 38.8 times points to some upside.

That gap cuts both ways. It hints at room for rerating but also leaves less margin for error if growth or margins disappoint from here. How comfortable are you paying up before the story fully proves itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioGaia Narrative

If you see the numbers differently, or would rather dig into the data yourself, you can shape a fresh story in minutes: Do it your way.

A great starting point for your BioGaia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy, so you are not leaving potential returns on the table.

- Capture potential multi baggers early by scanning these 3624 penny stocks with strong financials for smaller companies already backing their stories with real fundamentals.

- Ride structural shifts in automation and data by targeting these 25 AI penny stocks that pair cutting edge innovation with scalable business models.

- Identify attractive entry points by filtering for these 914 undervalued stocks based on cash flows where current prices are below the estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报