Tenet Healthcare (THC): Valuation Check as Policy Debates and Cigna Dispute Draw Investor Focus

Tenet Healthcare (THC) has moved into the spotlight after a mix of steady earnings beats, valuation appeal, and headline risk from policy debates and a Cigna contract dispute put its outlook under closer investor scrutiny.

See our latest analysis for Tenet Healthcare.

Even with noise from the Cigna standoff and policy headlines around Affordable Care Act subsidies, Tenet’s share price has quietly climbed, with a strong year to date share price return and powerful multi year total shareholder returns suggesting momentum is still building rather than fading.

If Tenet’s run has you rethinking your healthcare exposure, it could be a good moment to scan the wider space and uncover other potential ideas via healthcare stocks.

With earnings growing, shares near record highs and analysts still seeing upside to intrinsic value estimates, the real question now is whether Tenet remains mispriced or if the market is already baking in the next leg of growth.

Price-to-Earnings of 12.7x: Is it justified?

On a price to earnings basis, Tenet Healthcare's 12.7x multiple, against a last close of $196.33, points to a stock the market is still discounting versus peers.

The price to earnings ratio compares what investors pay for each dollar of current earnings and it is a central yardstick for mature, consistently profitable hospital and ambulatory care operators like Tenet.

Here, the contrast is stark. Tenet trades at roughly half the peer and industry averages in the low to mid 20s, while our SWS fair price to earnings ratio of 24.3x highlights how far sentiment could shift if investors begin to price its earnings stream more in line with comparable US healthcare providers.

Explore the SWS fair ratio for Tenet Healthcare

Result: Price-to-Earnings of 12.7x (UNDERVALUED)

However, policy changes to Affordable Care Act subsidies or an unfavorable resolution to the Cigna contract dispute could quickly cool sentiment around Tenet’s valuation.

Find out about the key risks to this Tenet Healthcare narrative.

Another View: DCF Points to Even Deeper Value

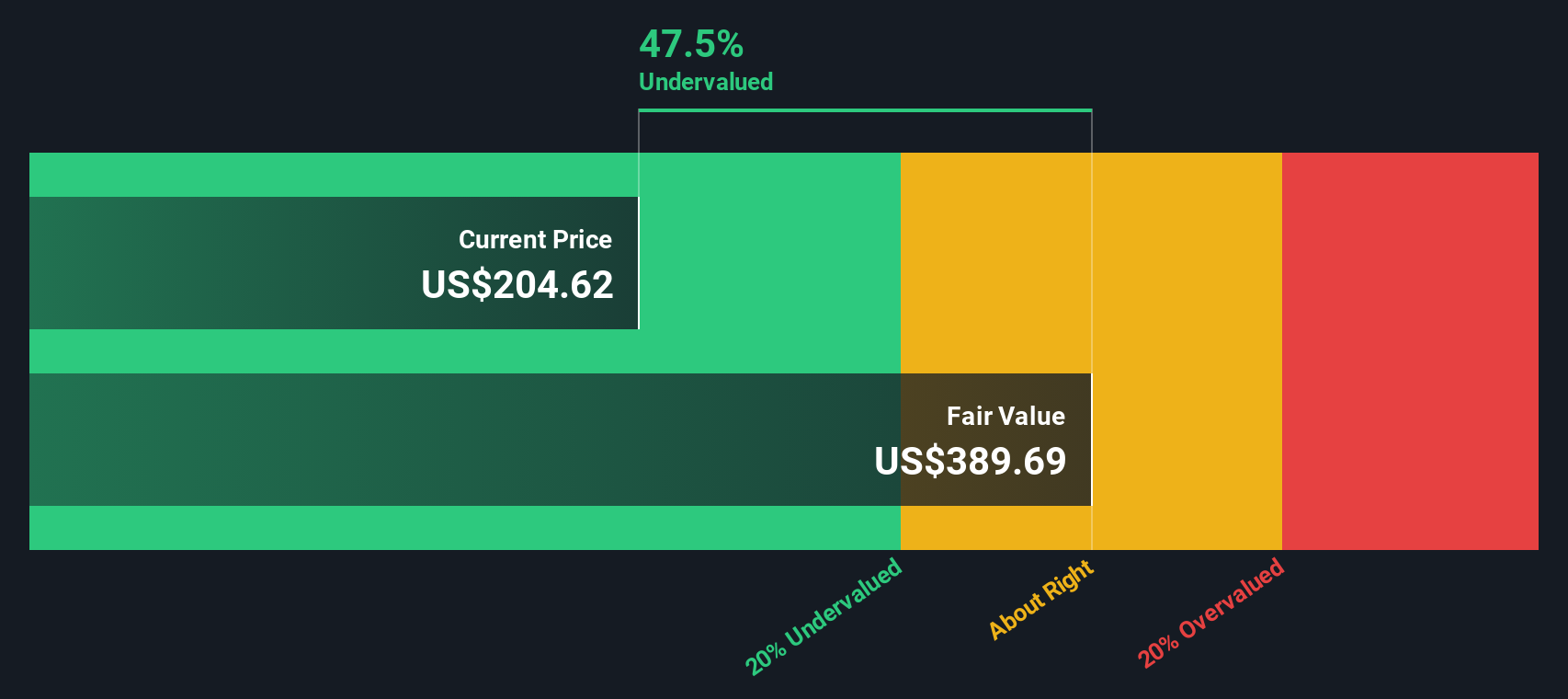

Our DCF model paints an even starker picture, suggesting fair value around $370.12 versus the current $196.33. That is roughly a 47% discount, implying the market may be underestimating the durability of Tenet’s cash flows or bracing for a sharp slowdown.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tenet Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tenet Healthcare Narrative

If this view does not fully resonate with you, or you would rather dig into the numbers yourself, you can build a tailored perspective in just a few minutes: Do it your way.

A great starting point for your Tenet Healthcare research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential opportunity by using the Simply Wall St Screener to spot fresh, data backed ideas that others might miss.

- Capture income potential by targeting reliable payers with these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Ride powerful technology shifts by focusing on these 25 AI penny stocks positioned at the forefront of artificial intelligence innovation.

- Position yourself ahead of the crowd by scanning these 79 cryptocurrency and blockchain stocks shaping the future of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报