MGM China (SEHK:2282): Assessing Valuation After Kenneth Xiaofeng Feng Steps In as CEO

MGM China Holdings (SEHK:2282) has just promoted long time insider Kenneth Xiaofeng Feng to chief executive officer, a leadership shift that could subtly reshape how investors think about the company’s Macau centric growth story.

See our latest analysis for MGM China Holdings.

The timing of Feng’s promotion coincides with strong momentum at MGM China. The share price stands at HK$16.61, with a year-to-date share price return of 64.78 percent contributing to a 1-year total shareholder return of 78.58 percent and a 3-year total shareholder return of 115.14 percent. Together, these figures suggest investors view the leadership change as part of a broader Macau recovery story rather than a sudden pivot.

If this leadership change has you rethinking your exposure to gaming and leisure, it could also be worth exploring fast growing stocks with high insider ownership for other fast moving names backed by committed insiders.

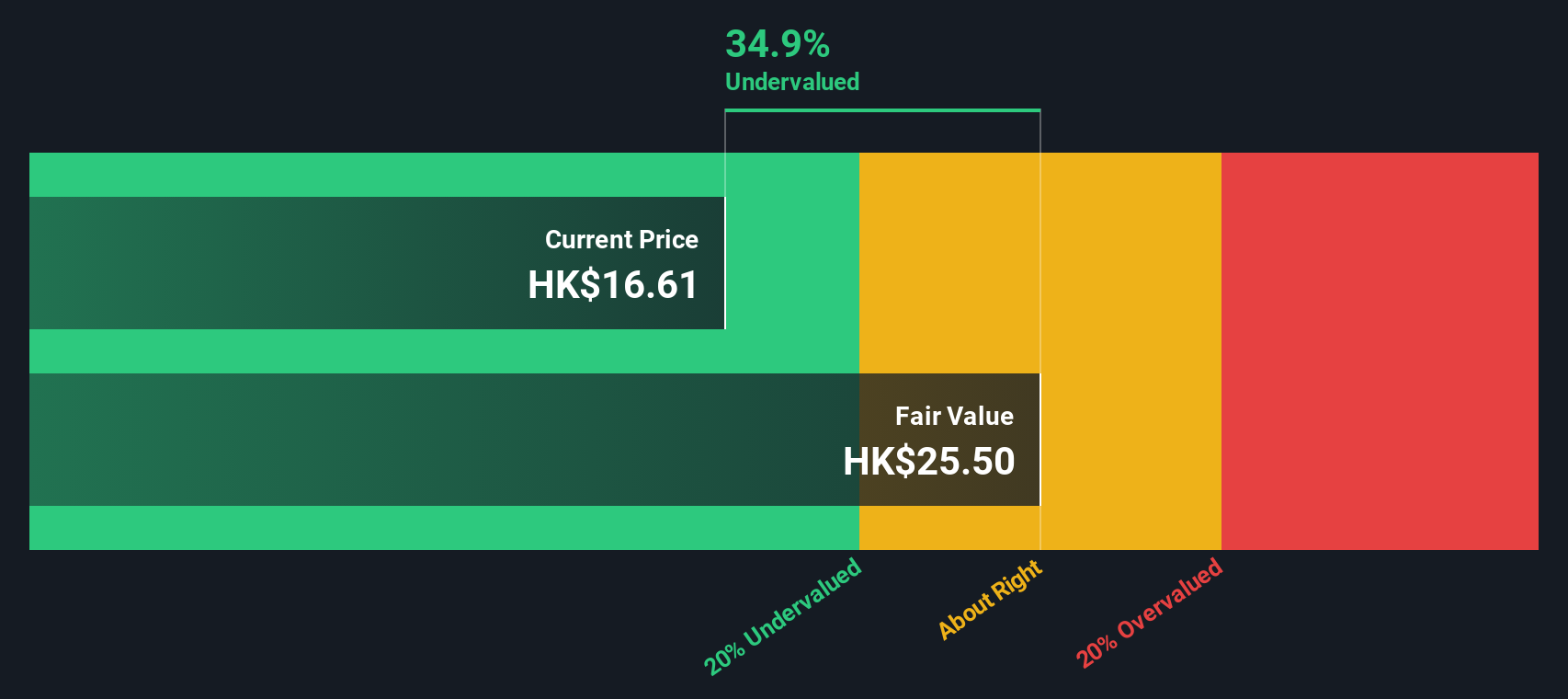

With shares already up sharply and trading about 16 percent below the average analyst target, is MGM China still undervalued based on its cash flow potential, or are investors already pricing in most of the future Macau growth?

Price-to-Earnings of 14.7x: Is it justified?

At a last close of HK$16.61, MGM China trades on a 14.7x price to earnings ratio, a level that screens as attractively discounted versus peers.

The price to earnings multiple links what investors pay today to the company’s current earnings power. This makes it a key gauge for mature, cash generative resort and gaming businesses.

For MGM China, the 14.7x multiple sits below both the Hong Kong Hospitality industry average of 16.9x and the peer group average of 17.2x. This suggests the market is not fully pricing in its forecast 10.22 percent annual earnings growth and very high projected return on equity. Relative to the estimated fair price to earnings ratio of 16.8x, there is also room for the market to re rate the shares closer to what fundamentals might justify if execution continues to hold.

Explore the SWS fair ratio for MGM China Holdings

Result: Price-to-Earnings of 14.7x (UNDERVALUED)

However, rising regulatory scrutiny in Macau and any slowdown in inbound tourism could quickly compress margins and challenge the upbeat earnings growth assumptions.

Find out about the key risks to this MGM China Holdings narrative.

Another View: What Our DCF Says

Our DCF model paints an even stronger value story, suggesting fair value around HK$25.65 versus the current HK$16.61, roughly a 35 percent discount. That is a much steeper gap than the earnings multiple implies. This raises the question: are investors underestimating MGM China’s cash flow power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MGM China Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MGM China Holdings Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in just minutes using Do it your way.

A great starting point for your MGM China Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high potential ideas?

Do not stop at a single opportunity; use the Simply Wall St Screener to pinpoint focused, data backed stock ideas that fit your exact strategy and risk appetite.

- Capture potential market mispricing by targeting companies trading below intrinsic value through these 914 undervalued stocks based on cash flows, and position yourself ahead of a possible sentiment shift.

- Ride powerful structural tailwinds in automation and data by pinpointing early movers in intelligent software and infrastructure via these 25 AI penny stocks.

- Strengthen your income stream by focusing on reliable payers with attractive yields using these 13 dividend stocks with yields > 3%, so you are not relying solely on capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报