What MBX Biosciences (MBX)'s Goldman Sell Rating and Pipeline Progress Means For Shareholders

- Goldman Sachs recently initiated coverage of MBX Biosciences with a Sell rating, citing concerns about the company’s ability to validate its platform beyond lead candidate canvuparatide and the potential differentiation of upcoming post-bariatric hypoglycemia data expected in 2026.

- At the same time, MBX Biosciences is moving its endocrine and metabolic pipeline toward later-stage development, including Phase 3 planning for canvuparatide and increased visibility through events such as the J.P. Morgan Healthcare Conference.

- Against this backdrop, we’ll examine how Goldman Sachs’ cautious stance on MBX’s platform beyond canvuparatide shapes the company’s investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is MBX Biosciences' Investment Narrative?

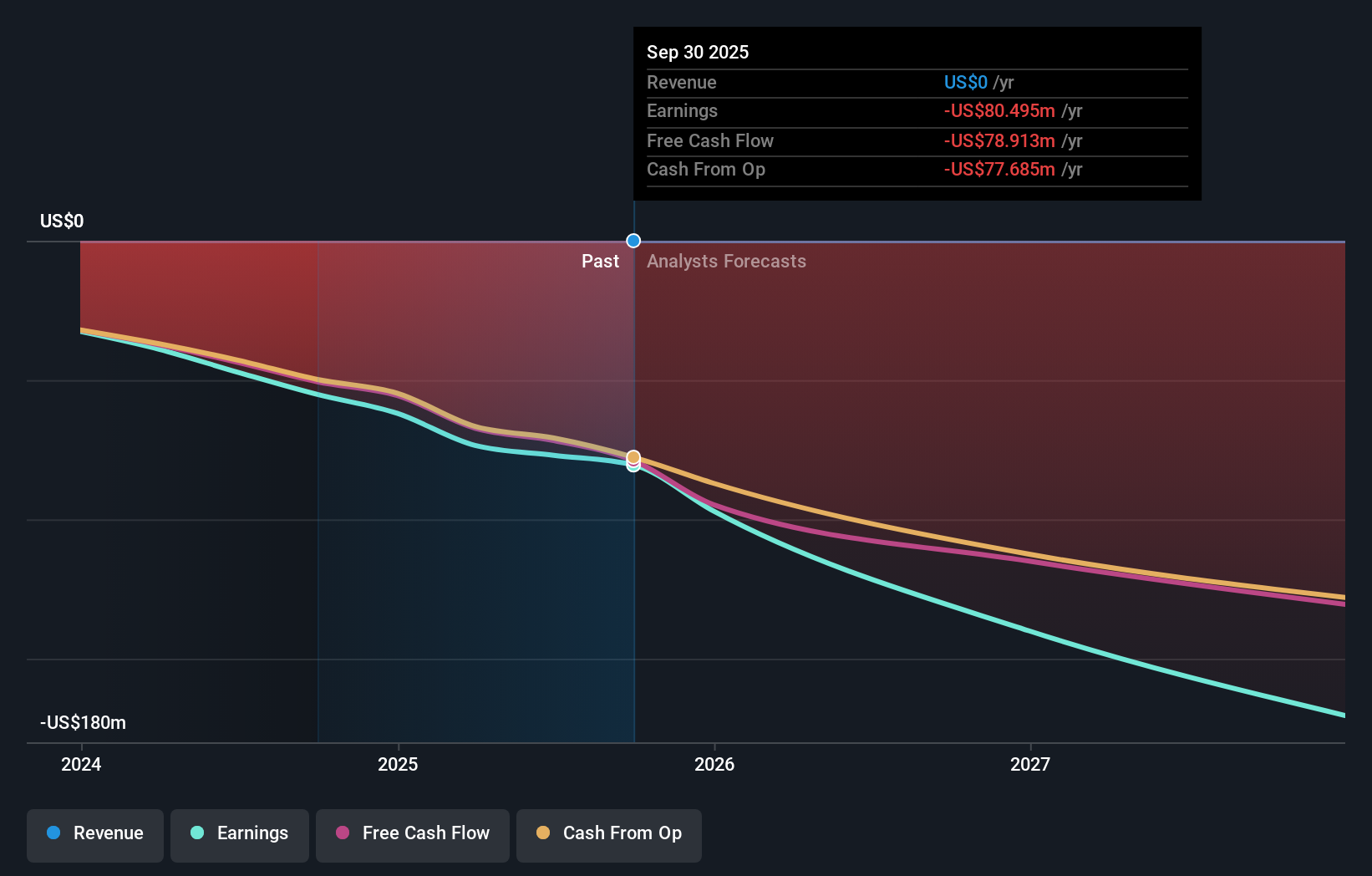

To own MBX Biosciences, you first have to buy into a fairly concentrated story: that canvuparatide can successfully progress through Phase 3 and eventually support a viable commercial business, while MBX’s broader endocrine and metabolic pipeline matures behind it. The recent Goldman Sachs initiation with a Sell rating directly challenges confidence in that second part, arguing the platform is still unproven beyond canvuparatide and questioning how differentiated the post-bariatric hypoglycemia program might look when data arrive in 2026. That view does not alter the near term catalyst stack much, which still centers on Phase 3 preparations, regulatory interactions and financing execution after recent equity offerings, but it does sharpen the risk that MBX remains a single-asset story for longer. In a stock that has already moved very sharply, that concentration risk matters.

However, there is one platform risk in particular that current shareholders may be underestimating. Our comprehensive valuation report raises the possibility that MBX Biosciences is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 2 other fair value estimates on MBX Biosciences - why the stock might be worth less than half the current price!

Build Your Own MBX Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MBX Biosciences research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free MBX Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MBX Biosciences' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报