Ralph Lauren (RL): Reassessing Valuation After Strong Q2 Beat, Raised Outlook, and Reinforced Dividend Confidence

Ralph Lauren (RL) just delivered a stronger than expected Q2 2026 and raised its full year outlook, a combination that has investors revisiting the stock’s appeal after an already strong run.

See our latest analysis for Ralph Lauren.

The upbeat quarter, higher guidance, and ongoing dividend affirmations are landing on top of a powerful backdrop. A roughly mid teens 3 month share price return and a near 300 percent 5 year total shareholder return are signaling sustained momentum rather than a one quarter pop.

If this kind of steady execution has you thinking more broadly about resilient consumer names, it might be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

With shares now hovering just below Street targets after a huge multiyear run, the key question is whether Ralph Lauren is still trading at a discount to its fundamentals or if the market has already priced in the next leg of growth.

Most Popular Narrative: 1.9% Undervalued

With Ralph Lauren’s fair value pegged just above the last close, the most followed narrative sees only a slim cushion left in the shares.

Significant investments in technology, AI driven inventory management, and automated supply chain operations are driving greater operating efficiencies. This is setting the stage for improved operating margins and inventory turns as scale increases. Early stage momentum in high potential categories like handbags, women's apparel, and luxury accessories, paired with core product strength and expansion of flagship stores in key cities, provides diversified, multi year growth drivers that can compound revenue and profit growth.

Want to see what kind of steady growth, rising margins, and future earnings multiple are baked into that fair value math? The full narrative lays it bare.

Result: Fair Value of $369.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could be derailed if European growth slows sharply or if higher prices and tariffs trigger more consumer pushback than expected.

Find out about the key risks to this Ralph Lauren narrative.

Another View: Multiples Send A Caution Signal

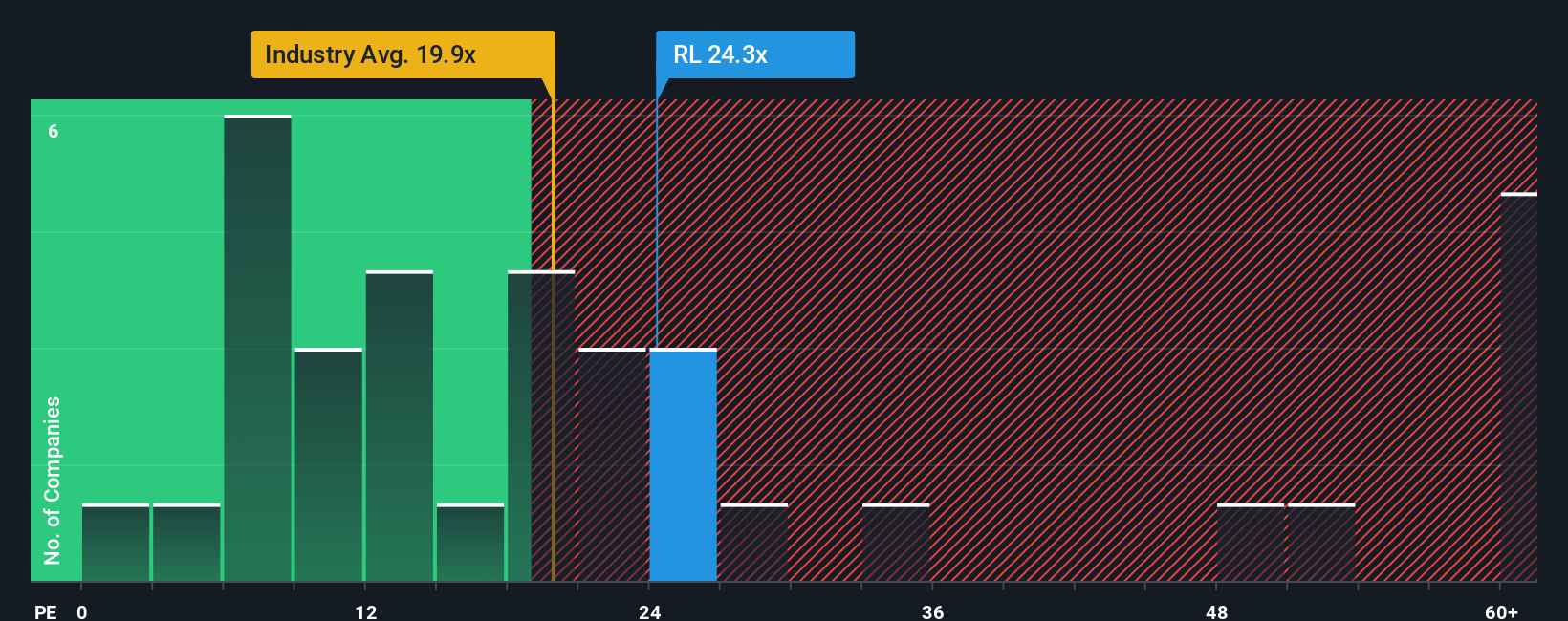

While the narrative based fair value suggests a modest 1.9 percent undervaluation, the market is already paying a rich 25.7 times earnings for Ralph Lauren, well above the US Luxury industry at 20.3 times and a fair ratio of 20 times. This raises the risk of multiple compression if growth cools. Are investors leaning too hard on the brand story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ralph Lauren.

Looking for more investment ideas?

If you stop with Ralph Lauren, you could miss other powerful setups. Let us help you quickly spot where the next wave of returns may build.

- Capture potential multi baggers early by scanning these 3624 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals.

- Capitalize on transformative automation trends by targeting these 25 AI penny stocks shaping everything from enterprise software to edge computing.

- Lock in mispriced quality by focusing on these 914 undervalued stocks based on cash flows that strong cash flow models still flag as overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报