The Bull Case For Goldman Sachs Group (GS) Could Change Following Major AI-Focused Debt-Raising Pivot

- In recent weeks, Goldman Sachs filed a US$30.00 billion medium-term note shelf registration and issued multiple fixed-rate senior and subordinated bonds across maturities from 2028 to 2055 as part of its ongoing funding plans.

- These bond sales coincide with Goldman’s push into AI-focused software advisory and enterprise AI investing, underscoring how its balance sheet funding supports a bigger pivot toward technology-driven, fee-based businesses.

- We’ll now examine how Goldman’s expanded debt-raising to fund AI-focused banking and investments may influence its existing investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Goldman Sachs Group Investment Narrative Recap

To own Goldman Sachs, you need to be comfortable with a large, globally systemic bank that is leaning harder into fee-based, technology and AI-enabled businesses while still being tied to market cycles. The recent US$30.0 billion medium-term note shelf and bond issuance look like routine funding steps and do not materially change the key near term catalyst of improving advisory and asset & wealth management fees, or the major risk from evolving capital and regulatory requirements.

Among the recent announcements, Goldman's reorganization of its Technology, Media & Telecom investment banking group around AI and digital infrastructure speaks most directly to this funding activity, because it highlights where new resources may be pointed. Together with its enterprise AI investing via Goldman Sachs Alternatives and moves in wealth and ETF platforms, this reinforces the idea that execution on technology-led, fee-based growth is central to the current story.

Yet while the growth pivot is clear, investors should also be aware that rising capital and regulatory expectations could still...

Read the full narrative on Goldman Sachs Group (it's free!)

Goldman Sachs Group's narrative projects $61.4 billion revenue and $17.0 billion earnings by 2028.

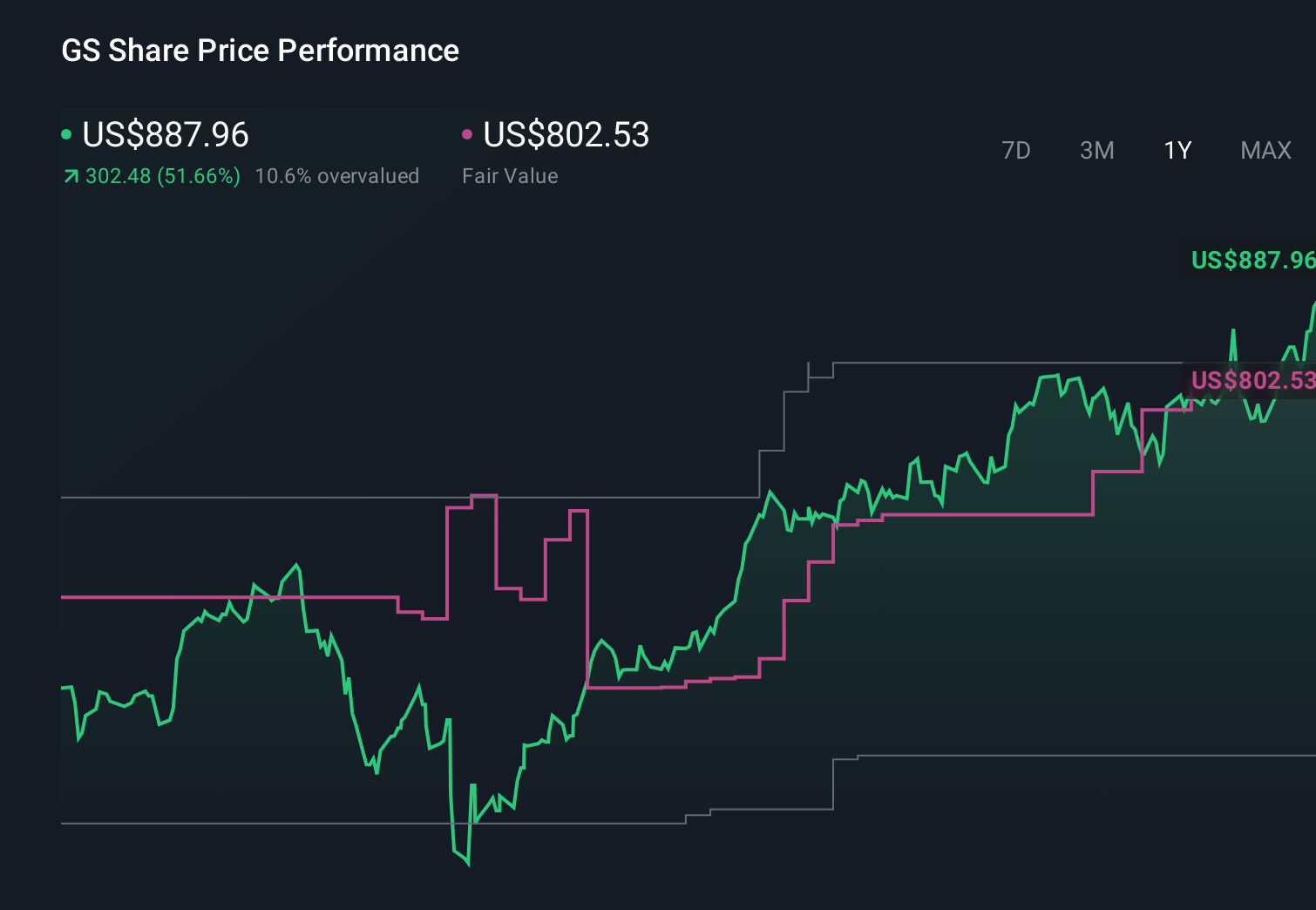

Uncover how Goldman Sachs Group's forecasts yield a $802.53 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community place Goldman Sachs’ fair value between US$500 and US$900, showing a wide spread of conviction. Against that backdrop, the push toward AI focused advisory and asset & wealth management growth could shape how you think about the company’s resilience and earnings mix over time.

Explore 10 other fair value estimates on Goldman Sachs Group - why the stock might be worth as much as $900.00!

Build Your Own Goldman Sachs Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldman Sachs Group research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldman Sachs Group's overall financial health at a glance.

No Opportunity In Goldman Sachs Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报