Does Keppel REIT’s S$886m Rights Issue Reshape The Bull Case For Keppel REIT (SGX:K71U)?

- Earlier this month, Keppel REIT announced a follow-on equity offering via a rights issue to raise about S$886.26 million by issuing 923,189,327 new units at S$0.96 each.

- This sizeable capital raise via a rights structure brings dilution risk to existing unitholders while raising questions about how effectively the new funds will be deployed.

- We’ll now explore how this large, potentially dilutive rights issue could reshape Keppel REIT’s previously income-focused investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

Keppel REIT Investment Narrative Recap

To own Keppel REIT, you need to believe in the resilience of prime Asia Pacific offices, especially Singapore Grade A CBD assets, as a source of steady rental income. The large S$886.3 million rights issue introduces near term dilution risk, which could weigh on per unit distributions, making distribution trends the key short term catalyst and execution on capital deployment the biggest current risk.

Against this backdrop, Keppel REIT’s decision in October 2025 to acquire a 75 percent effective interest in Top Ryde City Shopping Centre in Sydney for about S$334.8 million stands out. This move increases exposure to Australia and to retail assets, which may modestly reduce pure office concentration, but also adds to currency risk and execution risk at a time when unitholders are already facing potential dilution from the rights issue.

Yet while the rights issue aims to support growth, investors should be aware that...

Read the full narrative on Keppel REIT (it's free!)

Keppel REIT's narrative projects SGD319.1 million revenue and SGD188.0 million earnings by 2028. This implies a 6.4% yearly revenue decline and an earnings increase of about SGD30 million from SGD157.8 million today.

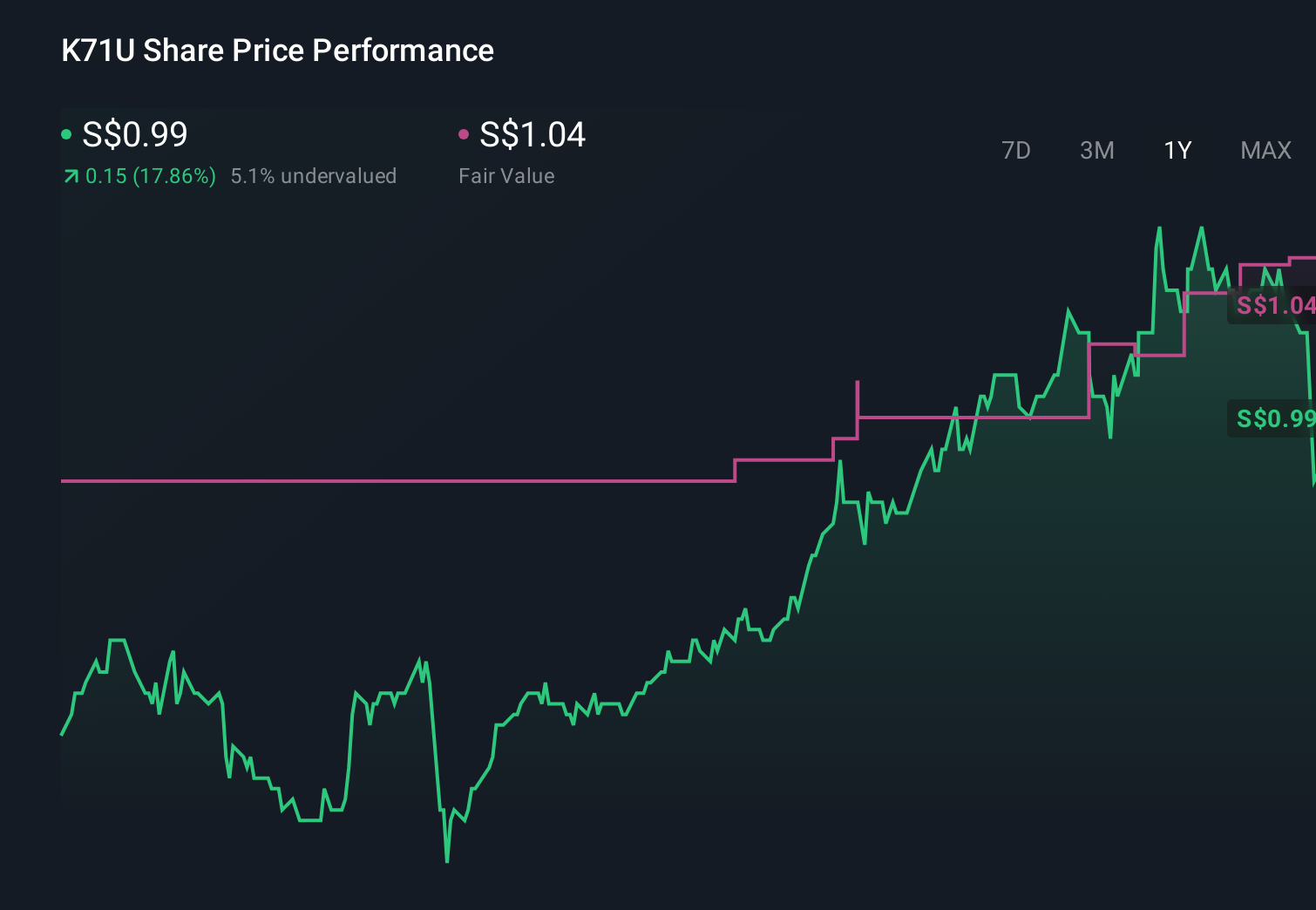

Uncover how Keppel REIT's forecasts yield a SGD1.04 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide S$1.04 to S$1.73 per unit range, underscoring how differently people assess Keppel REIT. When you set those views against the dilution risk from sizable equity fundraising, it becomes even more important to compare several perspectives before deciding what Keppel REIT’s income potential really means for you.

Explore 2 other fair value estimates on Keppel REIT - why the stock might be worth just SGD1.04!

Build Your Own Keppel REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keppel REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Keppel REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keppel REIT's overall financial health at a glance.

No Opportunity In Keppel REIT?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报