Is Viking’s (VIK) Highclere Castle Pavilion Bet Quietly Redefining Its Experiential Moat?

- Viking Holdings recently announced its support for a new contemporary events pavilion at Highclere Castle, the historic estate and Downton Abbey filming location, designed to blend with the castle’s architecture while adding sustainable features like solar panels and a heat exchanger system.

- This project deepens Viking’s cultural and experiential offering by giving its guests enhanced Privileged Access to Highclere through lectures, roundtable discussions, and upgraded on-site facilities that link heritage with modern visitor expectations.

- We'll now examine how this Highclere Castle pavilion partnership and related analyst enthusiasm may influence Viking Holdings' broader investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Viking Holdings Investment Narrative Recap

To own Viking Holdings, you need to believe that demand for premium, culturally rich travel will sustain pricing power and high occupancy, even as the company expands capacity and manages significant debt. The Highclere Castle pavilion strengthens Viking’s experiential brand but does not materially change the near term focus on filling new ships at attractive yields or the key risk of exposure to affluent older travelers and potential shifts in their spending.

The most relevant recent development alongside the Highclere news is Jefferies’ upgrade of Viking, which highlighted the company’s positioning in the luxury segment and its net yield potential. Together, the analyst support and the Highclere partnership underline how Viking is leaning into differentiated, higher value guest experiences that could help support pricing and capacity absorption, even as rising environmental and operating costs remain a key watchpoint.

Yet while these initiatives may support Viking’s brand and pricing, investors should also be aware of the growing regulatory and cost pressures around decarbonization that could...

Read the full narrative on Viking Holdings (it's free!)

Viking Holdings’ narrative projects $8.5 billion revenue and $2.0 billion earnings by 2028. This requires 13.6% yearly revenue growth and about a $1.3 billion earnings increase from $694.2 million today.

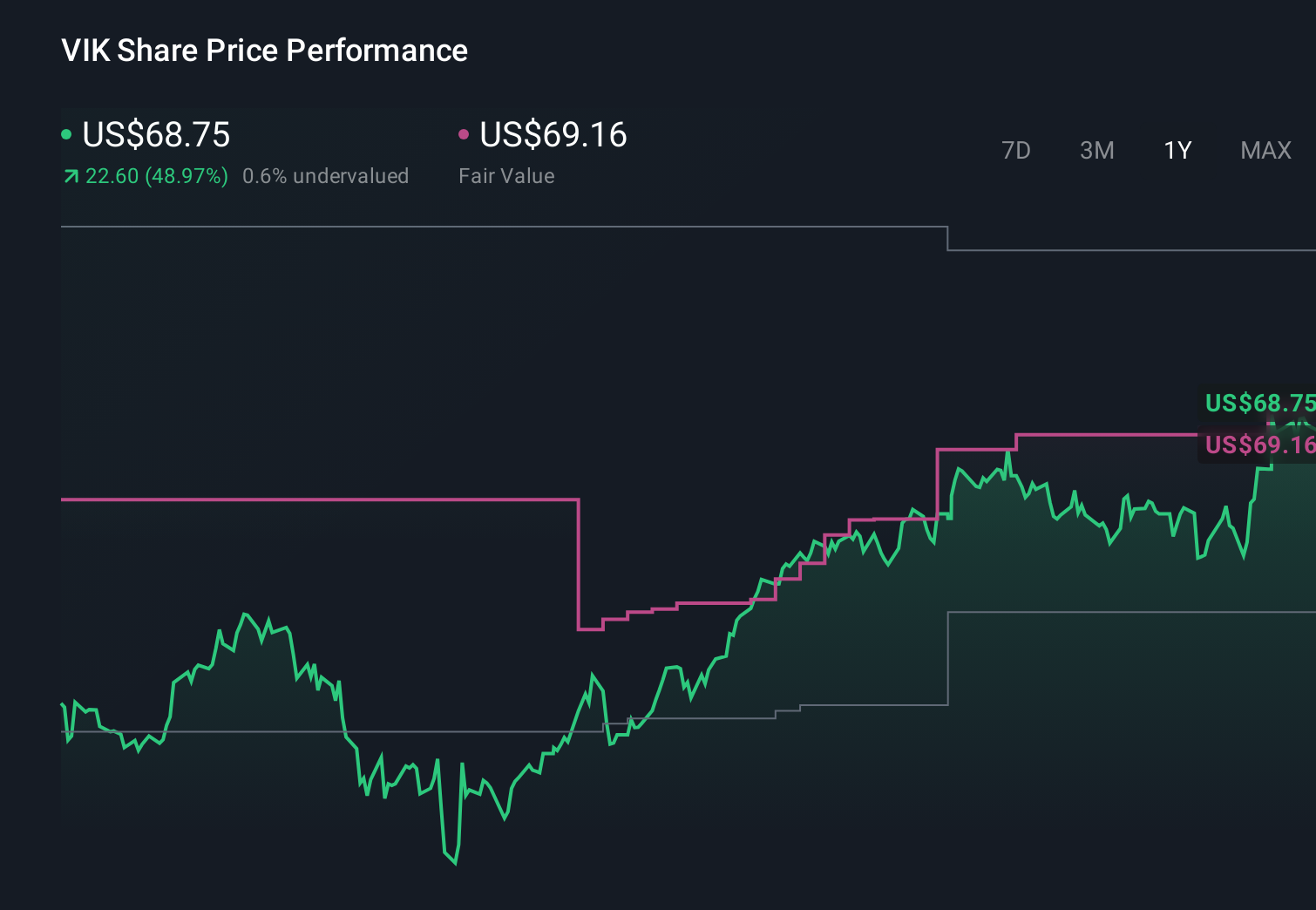

Uncover how Viking Holdings' forecasts yield a $69.16 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently estimate Viking’s fair value between US$34.20 and US$80.21, reflecting wide differences in expectations. You can weigh these against the company’s reliance on affluent older travelers and decide what that might mean for Viking’s resilience if travel preferences or retirement spending patterns change.

Explore 5 other fair value estimates on Viking Holdings - why the stock might be worth as much as 9% more than the current price!

Build Your Own Viking Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viking Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报