Teleflex (TFX): Reassessing Valuation After a Short-Term Rebound and Long-Term Share Price Weakness

Why Teleflex Stock Is Back on Investors' Radar

Teleflex (TFX) has quietly swung higher over the past month, even as its year to date performance looks rough. That kind of disconnect often flags a shift in how the market is reassessing the story.

See our latest analysis for Teleflex.

That recent 15 percent 1 month share price return stands out against a deeply negative year to date share price performance. It hints that investors are starting to re rate Teleflex as execution and growth prospects look more convincing.

If Teleflex has you rethinking your healthcare exposure, it could be worth exploring other opportunities across healthcare stocks to see which names the market may be revaluing next.

With shares still far below their highs but recent execution improving, the debate now shifts to valuation: is Teleflex trading at a meaningful discount, or has the market already started pricing in a multi year recovery?

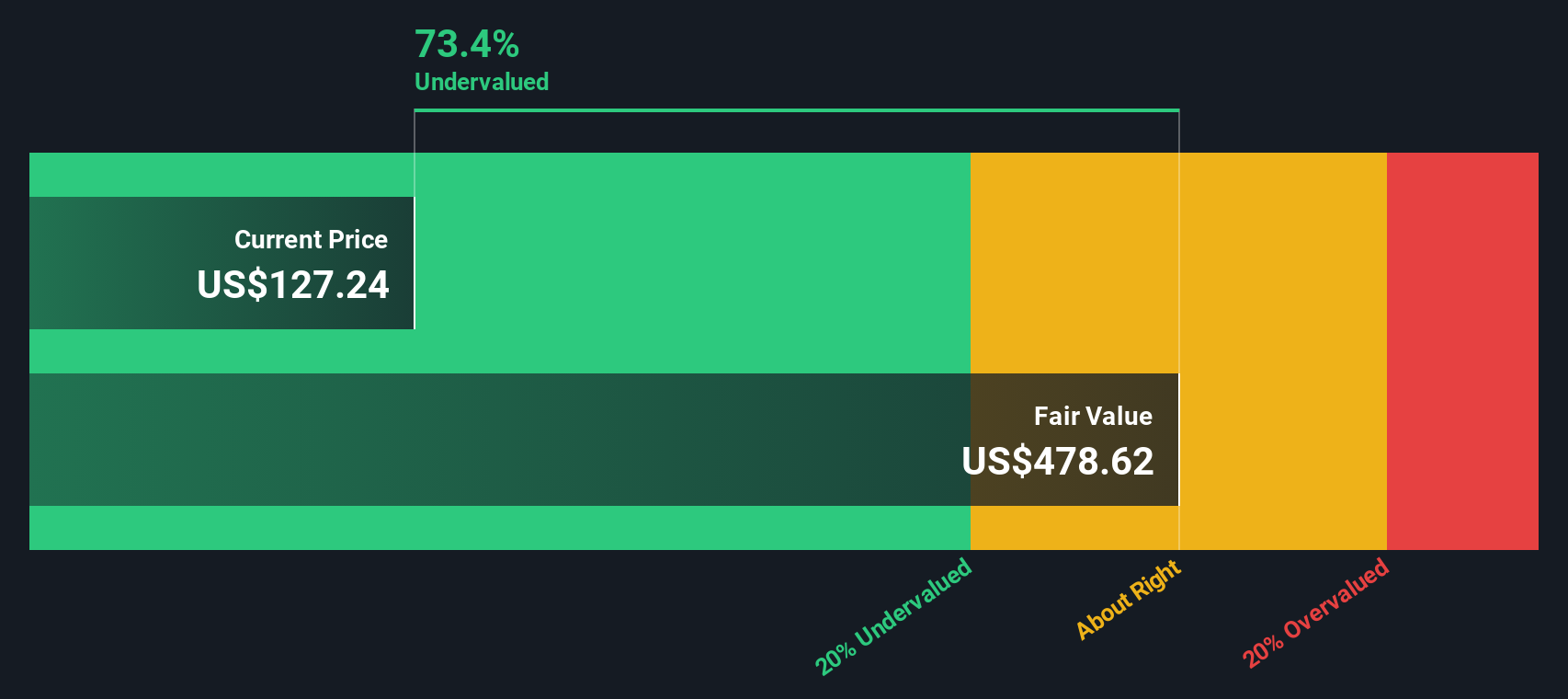

Most Popular Narrative: 1.8% Undervalued

With Teleflex last closing at $121.89 against a narrative fair value near $124, the pricing gap is narrow but points to modest upside.

The analysts are assuming Teleflex's revenue will grow by 8.9% annually over the next 3 years. Analysts assume that profit margins will increase from 6.3% today to 14.1% in 3 years time.

Want to see what justifies that richer margin profile and faster top line? The narrative leans on ambitious profit expansion and a surprisingly restrained future valuation multiple. Curious which specific levers have to fire perfectly to reach that outcome? The full story unpacks the financial roadmap behind this fair value call.

Result: Fair Value of $124.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several pressure points remain, notably ongoing weakness in UroLift and potential integration missteps with the BIOTRONIK acquisition that could derail margin and growth assumptions.

Find out about the key risks to this Teleflex narrative.

Another Lens on Value

Our SWS DCF model paints a far harsher picture than the narrative fair value, putting Teleflex’s worth near $15 per share. That implies the stock could be significantly overvalued if cash flows disappoint. Which story do you think the market will ultimately believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teleflex for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teleflex Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Teleflex research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investment Move?

Before the market races ahead, use the Simply Wall St Screener to uncover fresh ideas that match your strategy and keep your portfolio one step ahead.

- Capture potential mispricings early by targeting these 914 undervalued stocks based on cash flows that could rerate sharply as fundamentals and sentiment realign.

- Position for the next wave of innovation by focusing on these 25 AI penny stocks shaping how businesses harness automation and intelligent data.

- Lock in reliable income streams with these 13 dividend stocks with yields > 3% that can support total returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报