Enova International (ENVA): Assessing Valuation After a 70% Year-to-Date Share Price Surge

Enova International (ENVA) has quietly delivered a strong run lately, with the stock up about 70% this year and roughly 35% over the past month, catching more investors’ attention.

See our latest analysis for Enova International.

The latest share price of $163.85 caps a powerful stretch for Enova International, with momentum clearly building as a strong year to date share price return aligns with robust multi year total shareholder returns and solid growth in revenue and earnings.

If Enova’s surge has you rethinking where the next big mover might come from, it could be worth exploring fast growing stocks with high insider ownership as another source of high conviction ideas.

Yet with the shares hovering near record highs and only a modest gap to analyst targets, the key question now is whether Enova still trades below its true worth or if the market is already baking in future growth.

Most Popular Narrative: 16.5% Overvalued

With Enova’s last close well above the narrative fair value of $140.63, the valuation story hinges on aggressive growth and efficiency assumptions playing out.

The scaling efficiencies of Enova's digital customer base, disciplined cost controls, and continued optimization of marketing effectiveness are driving operating leverage, leading to declining operating expenses as a percent of revenue and contributing to accelerating adjusted EPS growth and improving operating margins.

Want to see what powers this premium price tag? The narrative leans on rapid top line expansion, shrinking margins, and a future earnings multiple that still assumes sustained momentum.

Result: Fair Value of $140.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulation or a sharper than expected credit downturn could quickly challenge Enova’s growth assumptions and put pressure on both margins and valuation.

Find out about the key risks to this Enova International narrative.

Another Angle on Valuation

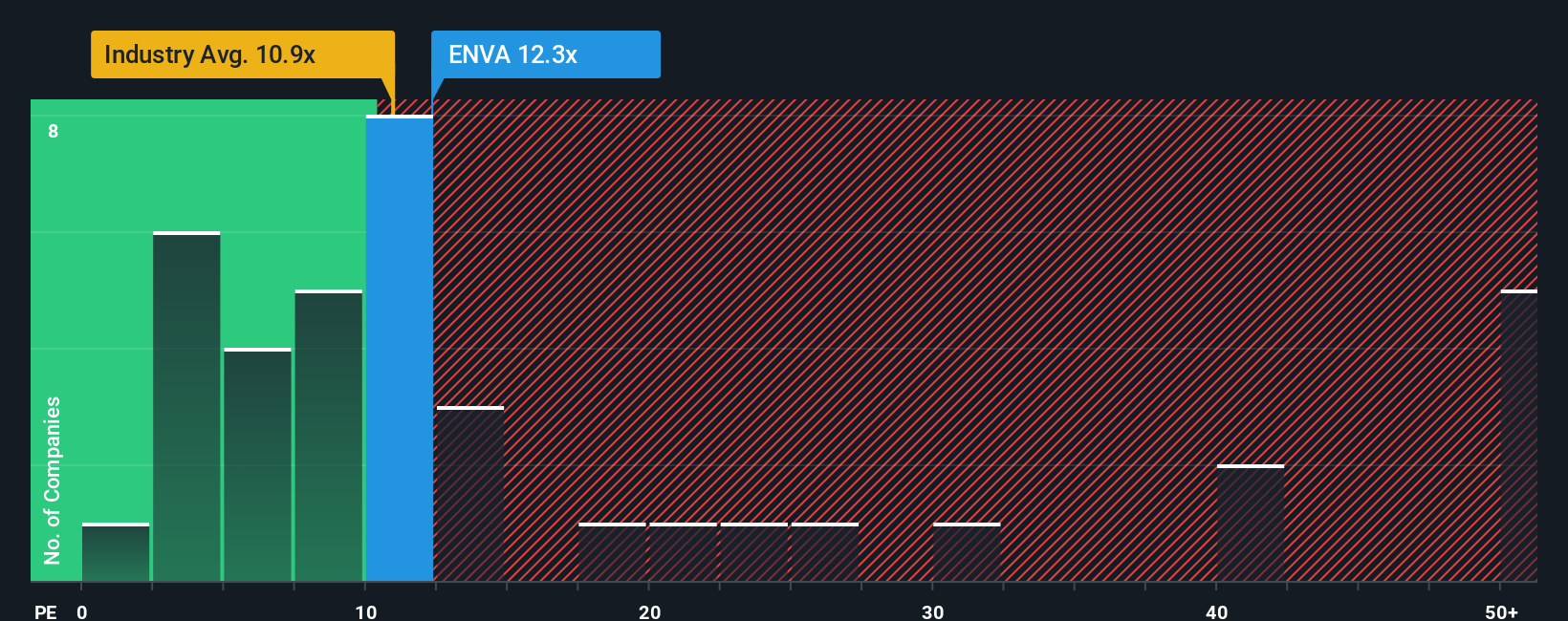

Looking through a simple earnings lens, Enova trades on a 13.9x price to earnings ratio, cheaper than the US market at 19.1x and below a fair ratio of 16.7x, but richer than the 9.7x industry average. This leaves investors to weigh quality against the risk of multiple compression.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enova International Narrative

If you see Enova’s story differently or simply want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next move?

Before the market’s next swing leaves you catching up, put Simply Wall St’s screener to work and line up smart, high conviction opportunities in minutes.

- Target reliable income streams by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while others chase short lived gains.

- Capitalize on structural growth by reviewing these 29 healthcare AI stocks at the intersection of medical innovation and advanced analytics.

- Position yourself ahead of the crowd by assessing these 79 cryptocurrency and blockchain stocks harnessing blockchain and digital asset tailwinds before sentiment shifts again.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报