Zhuzhou CRRC Times Electric (SEHK:3898): Valuation Check After New Long-Term Supply Deals and Governance Updates

Zhuzhou CRRC Times Electric (SEHK:3898) has just locked in fresh mutual supply agreements with CRRC Group and Qingdao Company for 2026 to 2028, reinforcing long term operating visibility and governance-driven investor confidence.

See our latest analysis for Zhuzhou CRRC Times Electric.

Those long term supply deals land at a time when the share price, now at HK$38.58, has already logged a strong year to date share price return and a solid 1 year total shareholder return. This suggests momentum is gradually building as governance and contract visibility improve.

If these agreements have you thinking about what else could be compounding quietly in the background, it is worth scanning fast growing stocks with high insider ownership for other under the radar growth stories.

But with shares already up strongly this year and trading at a premium to past levels, is Zhuzhou CRRC Times Electric still flying under the radar as a value opportunity, or has the market already priced in its next leg of growth?

Price-to-Earnings of 11.9x: Is it justified?

Based on a price-to-earnings ratio of 11.9x and a last close of HK$38.58, Zhuzhou CRRC Times Electric screens as undervalued relative to both its peers and its estimated intrinsic worth.

The price-to-earnings multiple compares the current share price to per share earnings and is a common way to gauge how much investors are paying for each unit of profit. For an established capital goods and rail technology business with steady earnings growth, this metric is especially useful because profits are relatively visible and less volatile than early stage or speculative names.

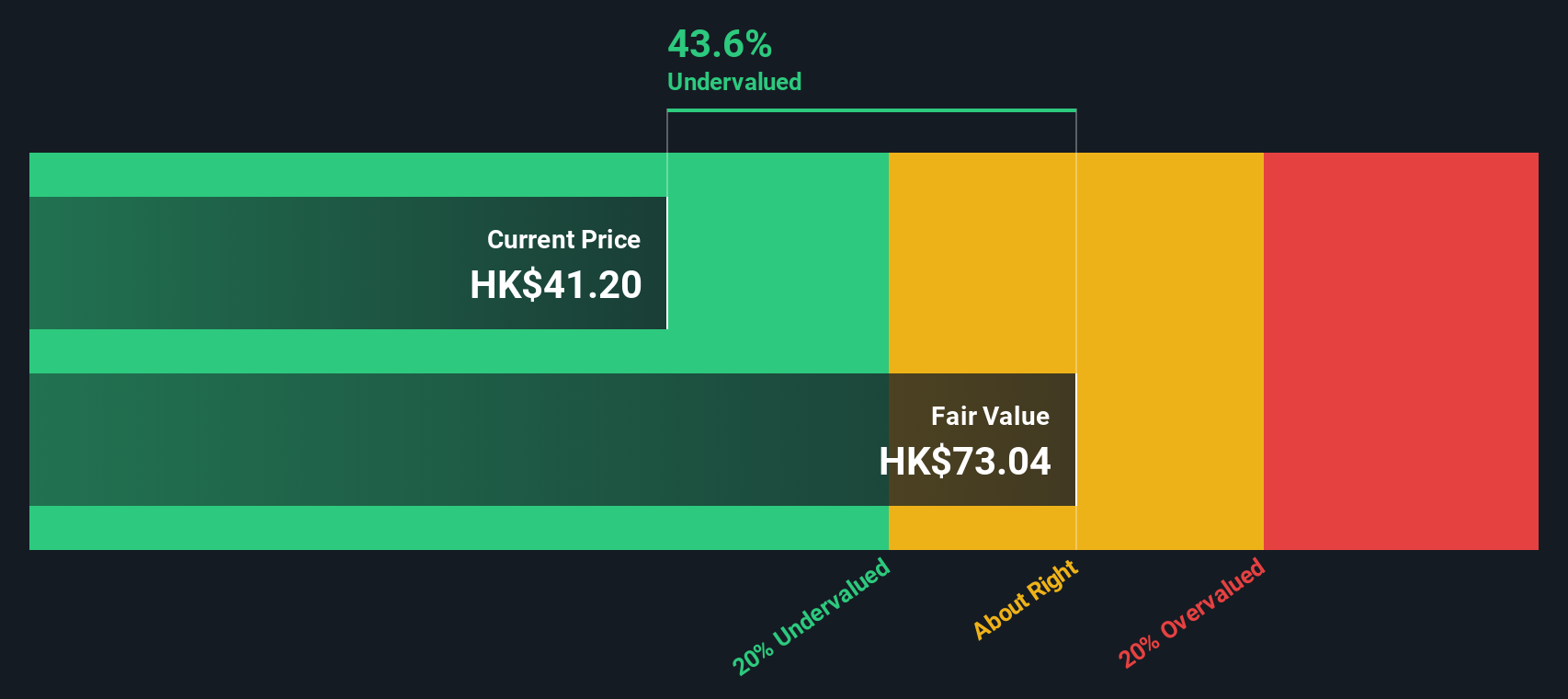

Here, the current P/E of 11.9x sits below the peer average of 15.4x and slightly under the Hong Kong Machinery industry average of 12.3x. This suggests the market is not fully pricing in the company’s earnings profile. At the same time, our DCF work implies the shares are trading at about a 48% discount to an estimated fair value of HK$74.25. This is a level that the market could move towards if the earnings trajectory and cash generation continue to line up with expectations.

Explore the SWS fair ratio for Zhuzhou CRRC Times Electric

Result: Price-to-Earnings of 11.9x (UNDERVALUED)

However, sustained underperformance versus the 15.8% upside to analyst targets, or a slowdown in current double digit revenue and profit growth, could stall momentum.

Find out about the key risks to this Zhuzhou CRRC Times Electric narrative.

Another Angle on Value

Our DCF model paints an even stronger picture, suggesting fair value near HK$74.25 and implying the shares trade at about a 48% discount. That backs up the modest P/E signal, but also raises a question: are expectations still too cautious for a business growing this steadily?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zhuzhou CRRC Times Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zhuzhou CRRC Times Electric Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zhuzhou CRRC Times Electric.

Looking for more investment ideas?

Before the market moves without you, put Simply Wall St to work and scan fresh opportunities tailored to your strategy in just a few focused minutes.

- Capture mispriced quality by reviewing these 914 undervalued stocks based on cash flows that pair strong cash flows with compelling entry points.

- Ride the next wave of innovation by scanning these 25 AI penny stocks positioned at the heart of applied artificial intelligence.

- Strengthen your income engine by targeting these 13 dividend stocks with yields > 3% that can support attractive yields without sacrificing fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报