Kamigumi (TSE:9364) Valuation Check as Board Weighs Change in Representative Director President

Kamigumi (TSE:9364) has called a December 12 board meeting to consider changing its Representative Director, President. This leadership move could subtly reshape strategy and how investors think about this long established logistics group.

See our latest analysis for Kamigumi.

The leadership review comes after a strong run, with Kamigumi’s share price delivering a robust year to date return of about 46.7 percent and a three year total shareholder return of roughly 108 percent. This suggests positive momentum as investors reassess its growth and risk profile.

If this leadership shift has you rethinking your logistics exposure, it could be a smart moment to scan the market for fast growing stocks with high insider ownership that might offer similar or even stronger upside potential.

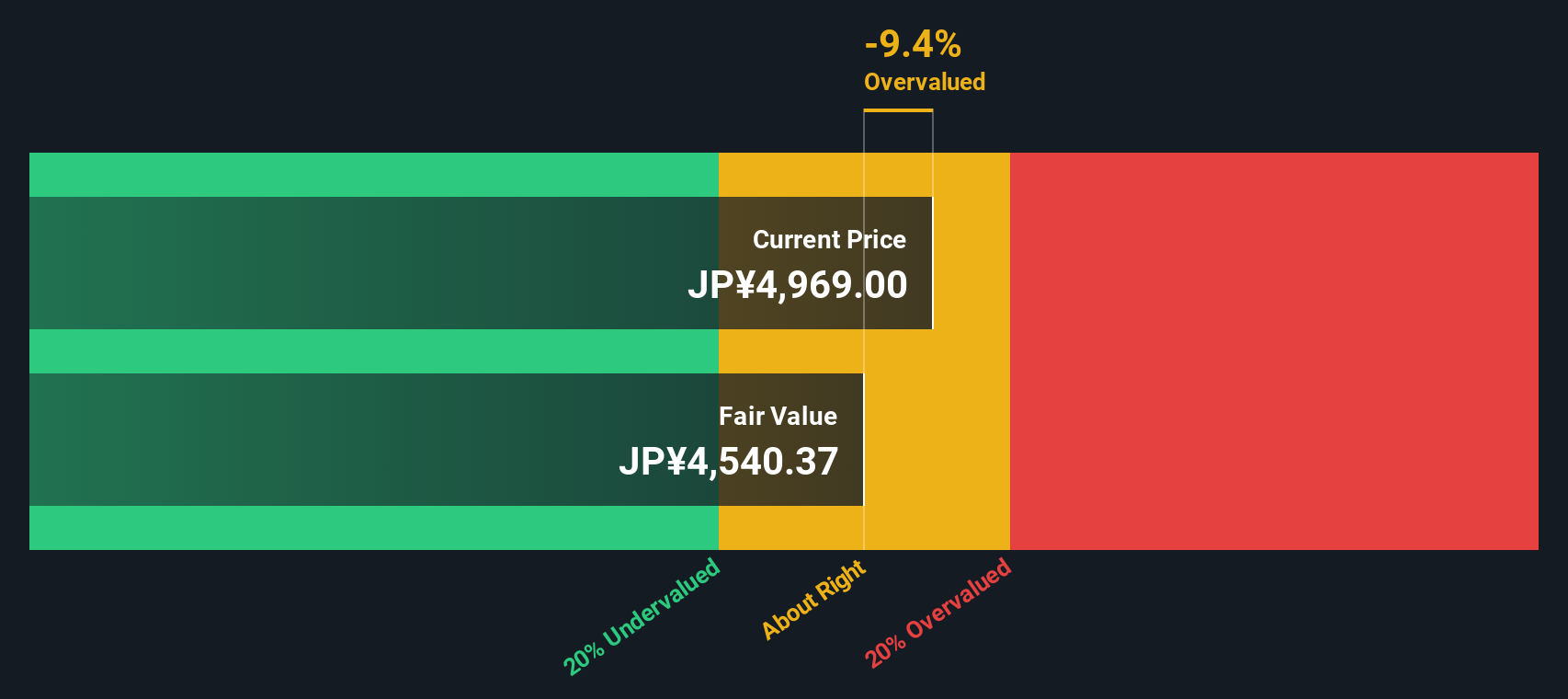

With the share price already near analyst targets and solid, if unspectacular, earnings growth, the key question now is whether Kamigumi still trades below its true value or if markets are already pricing in its next leg of expansion.

Price-to-Earnings of 17.8x: Is it justified?

Kamigumi last closed at ¥5,069, and based on a price to earnings ratio of 17.8 times, the shares look expensive relative to peers and the wider infrastructure space.

The price to earnings multiple compares what investors pay for each unit of current earnings, making it a straightforward way to judge how richly a mature, profitable logistics and infrastructure operator is valued.

Here, the market is assigning Kamigumi a premium price to earnings of 17.8 times, which stands well above both the Asian infrastructure industry at 13.8 times and the peer average of roughly 10 times. It is also above an estimated fair price to earnings level of 13.7 times that our models suggest the market could eventually gravitate toward.

That gap between the current 17.8 times and the 13.8 times industry benchmark, as well as the 13.7 times fair price to earnings ratio, implies investors are paying markedly more for Kamigumi’s earnings stream than for comparable companies. Any disappointment in future growth or profitability could see the multiple compress back toward those lower reference points.

Explore the SWS fair ratio for Kamigumi

Result: Price-to-Earnings of 17.8x (OVERVALUED)

However, leadership uncertainty and any slowdown in earnings growth or logistics demand could quickly challenge the premium multiple that investors are currently paying.

Find out about the key risks to this Kamigumi narrative.

Another View on Value

Our DCF model similarly flags Kamigumi as overvalued, with the current ¥5,069 price sitting above an estimated fair value of about ¥4,811. If both earnings multiples and cash flow point to a rich price, is this a quality premium worth paying or a margin of safety eroding?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kamigumi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kamigumi Narrative

If you prefer to dig into the numbers yourself and challenge this view, you can quickly build a personalized take in just minutes, Do it your way.

A great starting point for your Kamigumi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Kamigumi alone. Put Simply Wall Street’s powerful screener to work and line up your next set of high conviction opportunities today.

- Capture potential multi baggers early by scanning these 3624 penny stocks with strong financials that pair tiny market caps with solid business fundamentals and room to run.

- Capitalize on secular technology shifts with these 25 AI penny stocks positioned at the heart of machine learning, data infrastructure, and automation tailwinds.

- Lock in quality at better prices by targeting these 914 undervalued stocks based on cash flows that trade below estimated cash flow driven fair value, before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报