Monarch Casino & Resort (MCRI): Valuation Check After Monarch Rewards Earns Top Newsweek Players Club Ranking

Monarch Casino & Resort (MCRI) is back in the spotlight after its Monarch Rewards program ranked #3 in Newsweek’s 2026 Best Casino Players Club awards, underscoring a guest focused strategy that matters for long term shareholder returns.

See our latest analysis for Monarch Casino & Resort.

The award recognition lands as the share price hovers around $99.62, with a strong year to date share price return of 28.15 percent and a solid five year total shareholder return of 86.68 percent suggesting steady but not euphoric momentum.

If this kind of steady compounding appeals, it could be worth scanning the market for other under the radar ideas using our screen of fast growing stocks with high insider ownership.

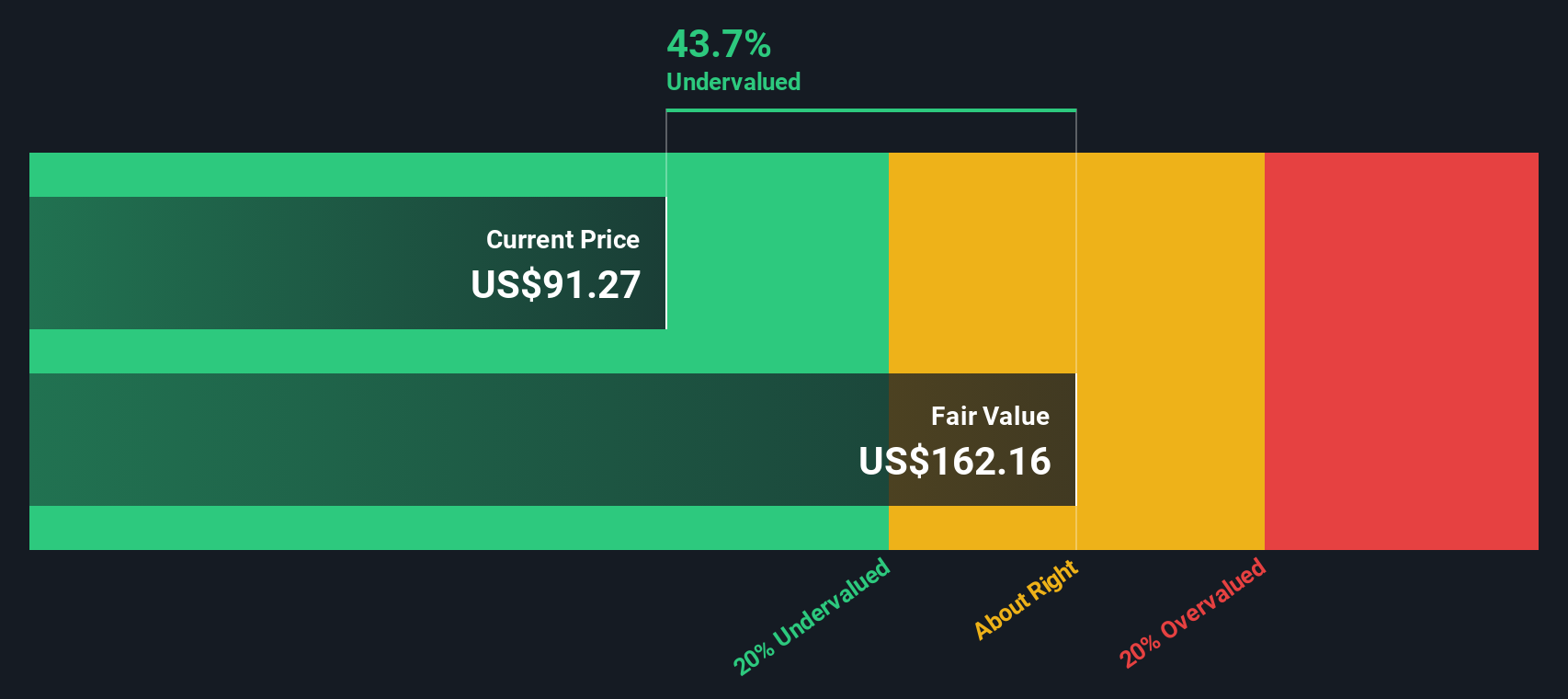

Yet with the stock trading just below analyst targets and screens hinting at a sizeable intrinsic discount, investors face a familiar dilemma: is Monarch still quietly undervalued, or is the market already pricing in its next leg of growth?

Price to Earnings of 22x: Is it justified?

Monarch Casino & Resort trades on a 22x price to earnings multiple at the last close of $99.62, a level that sits between modest industry value and richer fair value models.

The price to earnings ratio compares what investors are willing to pay today for each dollar of current earnings. For a mature hospitality and gaming operator, it reflects expectations that earnings will keep growing, but at a measured pace rather than hyper growth.

In Monarch’s case, the market is paying a premium to its statistically derived fair price to earnings ratio of 16.3x, suggesting investors are assigning extra value to its quality of assets and management track record. Compared with peers, however, the 22x multiple still sits slightly below the broader US hospitality average of 23.5x, underlining how Monarch straddles a line between being relatively expensive versus its own fundamentals yet still competitive against sector valuations.

Explore the SWS fair ratio for Monarch Casino & Resort

Result: Price-to-Earnings of 22x (ABOUT RIGHT)

However, softer 2.6 percent revenue growth and a 7.6 percent discount to analyst targets suggest that execution missteps or macro weakness could quickly unwind optimism.

Find out about the key risks to this Monarch Casino & Resort narrative.

Another View: Our DCF Model Points Much Higher

Our DCF model paints a very different picture, putting fair value around $159.95, roughly 38 percent above the current $99.62 share price. If those cash flow assumptions hold, the gap looks more like a missed opportunity than a premium, but could it also signal model risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Monarch Casino & Resort for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Monarch Casino & Resort Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a complete, personalized view in just minutes: Do it your way.

A great starting point for your Monarch Casino & Resort research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

If Monarch has caught your attention, do not stop here, the Simply Wall St Screener uncovers other powerful opportunities you would regret overlooking.

- Capture potential multi baggers early by scanning these 3624 penny stocks with strong financials that pair tiny market caps with solid underlying fundamentals.

- Ride structural growth in automation and data by targeting these 25 AI penny stocks positioned at the intersection of software, semiconductors, and intelligent infrastructure.

- Find value oriented opportunities with these 914 undervalued stocks based on cash flows that look cheap on cash flow but still have credible growth prospects to evaluate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报