ANZ (ASX:ANZ) Valuation Check After Recent Share Price Climb and Suncorp Integration Progress

ANZ Group Holdings (ASX:ANZ) has been grinding higher this year, and with the share price hovering around A$36, investors are weighing whether the recent climb still leaves room for steady upside.

See our latest analysis for ANZ Group Holdings.

Over the past year, ANZ has quietly turned in a strong run, with solid year to date share price gains and an impressive multi year total shareholder return that signals momentum is still very much on its side.

If ANZ's steady climb has you thinking about what else might be working in this market, it could be a good time to uncover fast growing stocks with high insider ownership.

Yet with ANZ now trading near record levels, solid earnings growth and a mixed view from analysts raise a key question for investors: Is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 2.2% Overvalued

With ANZ Group Holdings last closing at A$36.03 against a narrative fair value of about A$35.24, the current price sits slightly ahead of intrinsic worth, setting up a tension between strong execution and elevated expectations.

The completion of the Suncorp Bank acquisition is expected to yield larger and earlier synergies than initially planned, enhancing scale and growth in Queensland, which should positively impact revenue and net margins. A significant shift towards a lower cost, dual platform system with ANZ Plus and Transactive aims to improve efficiency, reduce costs, and allow faster roll out of new products, which is projected to increase market share and positively impact net margins.

Want to see how this acquisition plus platform overhaul can still support a premium valuation multiple, even with only moderate earnings growth and stable margins? The playbook behind this fair value leans on a carefully staged revenue build, disciplined cost cuts, and a surprisingly assertive earnings multiple baked into the long term view. Curious which assumptions carry the most weight, and how small tweaks could swing the valuation either way? Dive in to unpack the full narrative.

Result: Fair Value of $35.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that narrative could be upended if regulatory costs climb faster than expected or if execution stumbles on ANZ Plus and Transactive’s large scale technology rollout.

Find out about the key risks to this ANZ Group Holdings narrative.

Another Lens on Value

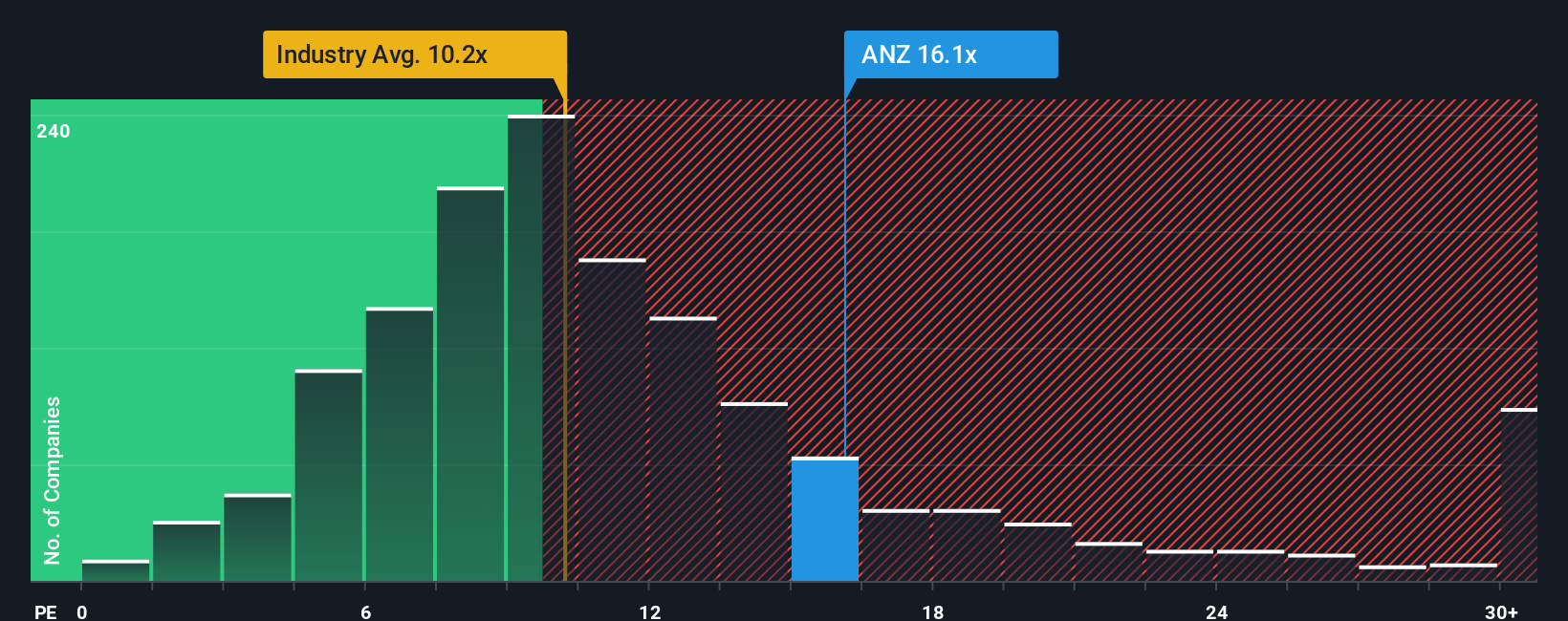

While the narrative fair value suggests ANZ is about 2% overvalued, its 18.2x earnings multiple tells a different story. That is roughly in line with local peers at 18.5x, well above global banks at 10.9x, yet still below a 20.9x fair ratio that the market could drift toward. Is this multiple a warning sign or headroom for a further rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANZ Group Holdings Narrative

If you see things differently, or want to dig into the numbers yourself, you can build a personalised view of ANZ in just a few minutes: Do it your way.

A great starting point for your ANZ Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next watchlist upgrades with targeted stock ideas from the Simply Wall St Screener, built to match your strategy fast.

- Capture early stage momentum by targeting quality names among these 3623 penny stocks with strong financials that still have room to run before the wider market catches on.

- Position yourself for the next wave of innovation by focusing on these 25 AI penny stocks that are turning artificial intelligence into real, scalable earnings power.

- Strengthen your portfolio’s foundation with these 13 dividend stocks with yields > 3% that can help support reliable income even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报