Porsche Automobil Holding (XTRA:PAH3): Revisiting Valuation After a 12% Monthly Share Price Climb

Porsche Automobil Holding (XTRA:PAH3) has quietly climbed about 12% over the past month and 18% in the past year, even as its longer term three year and five year returns remain negative.

See our latest analysis for Porsche Automobil Holding.

That recent 1 month share price return of about 12% looks more like a sentiment shift than a blip, especially given the roughly 18% 1 year total shareholder return against still negative multi year figures. This suggests momentum is rebuilding from a low base.

If Porsche Automobil Holding has you watching the auto space more closely, this could be a good moment to explore other established auto manufacturers that might be lining up similar inflection points.

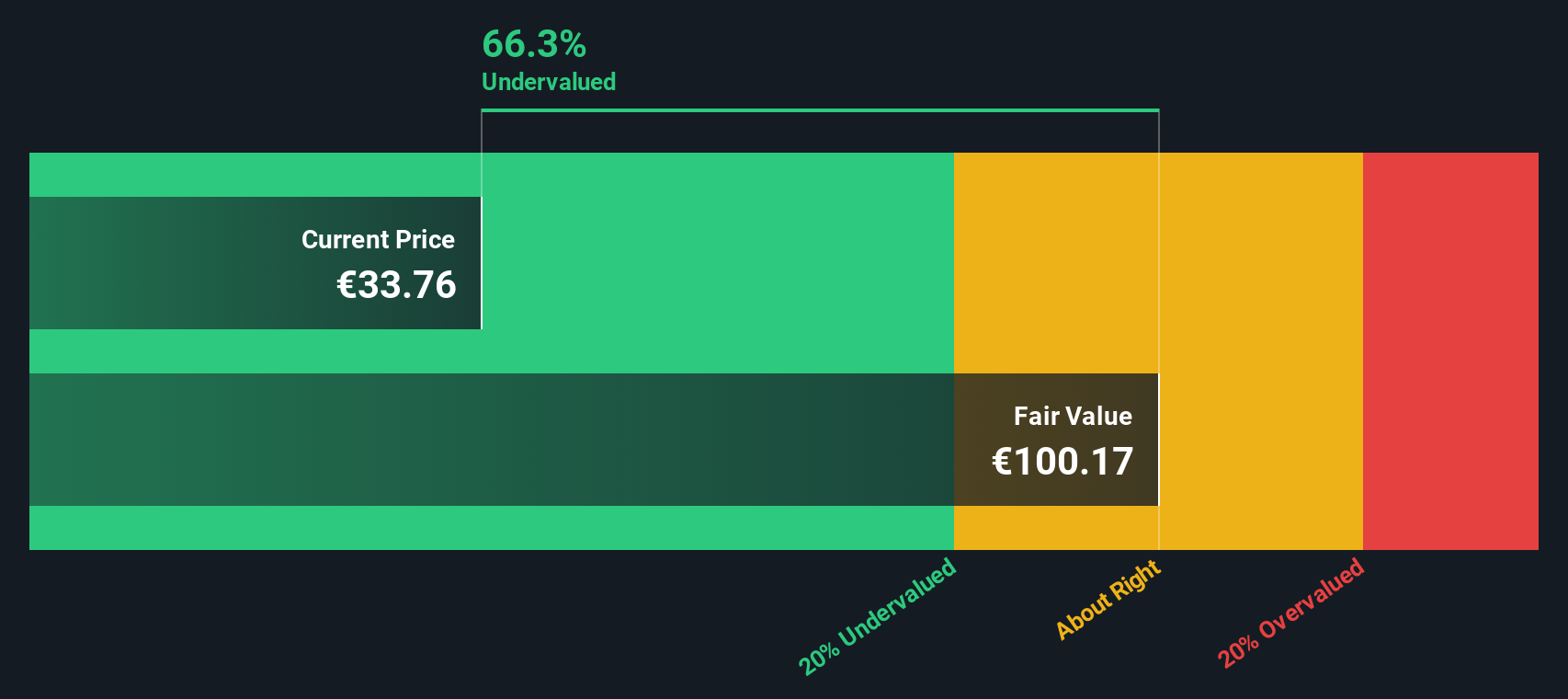

With shares still trading at a significant discount to some intrinsic estimates but hovering just below analyst targets, the real question is whether Porsche Automobil Holding is a bargain in plain sight or if markets are already pricing in the next leg of growth?

Price To Book Of 0.3x, Is It Justified?

On a price to book basis, Porsche Automobil Holding looks inexpensive at the last close of €40, trading well below peer and industry levels.

The price to book ratio compares a company’s market value to the book value of its net assets. This is often a key yardstick for capital intensive groups and holding structures tied to tangible stakes in other businesses.

For Porsche Automobil Holding, the current 0.3x price to book ratio stands out as good value versus both its direct peers at 0.8x and the broader European auto sector at 1x. This implies the market assigns a steep discount to the balance sheet even as earnings are forecast to grow strongly and turn profitable over the next few years.

That gap to sector norms is significant. It suggests investors are pricing in far weaker prospects than the average automaker, despite forecasts that profits should grow and the company is expected to become profitable within three years, which could set the stage for the multiple to move closer to peer levels if confidence continues to rebuild.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 0.3x (UNDERVALUED)

However, persistent losses and the slim 3% upside to analyst targets could signal that value investors are overestimating how quickly sentiment and profitability will recover.

Find out about the key risks to this Porsche Automobil Holding narrative.

Another Way To Look At Value

Our DCF model paints an even starker picture, suggesting Porsche Automobil Holding could be worth about €113.75 a share, roughly 65% above the current €40 level, which is a deep value signal. Is the market missing something big here, or are the model assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Porsche Automobil Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Porsche Automobil Holding Narrative

If you see the numbers differently or want to stress test the assumptions yourself, build a custom view of Porsche Automobil Holding in just minutes, Do it your way.

A great starting point for your Porsche Automobil Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For Your Next High Conviction Idea?

Do not stop at one opportunity; put Simply Wall Street to work and line up your next potential winners before the crowd even notices.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that aim to balance yield with sustainable payout potential.

- Position ahead of the next tech shift by scanning these 25 AI penny stocks where artificial intelligence could drive potential earnings surprises.

- Explore mispriced opportunities with these 914 undervalued stocks based on cash flows that our models flag as trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报