The Trade Desk (TTD): Reassessing Valuation After New Layoffs and Ongoing Ad Tech Restructuring

The Trade Desk (TTD) just announced a small round of layoffs, trimming less than 1% of its staff, a follow up to last year's larger restructuring as the ad tech environment continues to tighten.

See our latest analysis for Trade Desk.

Those small cuts sit against a much tougher backdrop, with the 1 year share price return down around 70 percent as investors reassess growth and competitive risks, even though Trade Desk is still growing revenue and margins. As a result, sentiment looks more bruised than the business fundamentals.

If this reset in ad tech has you rethinking your watchlist, it might be worth exploring high growth tech and AI stocks for other high growth names reshaping the digital landscape.

With the shares now trading at a steep discount to analyst targets despite double digit growth in revenue and profits, is the market unfairly punishing Trade Desk or accurately discounting its future expansion and potential upside?

Most Popular Narrative Narrative: 40.2% Undervalued

Compared with Trade Desk's last close of $37.26, the most followed narrative sees long term value closer to the low $60s, underpinned by improving growth and margins.

The full rollout and high adoption of the new AI powered Kokai platform, including new tools like Deal Desk and supply chain innovation (OpenPath, Sincera integration), is already leading to greater than 20 percent better campaign performance and causing existing clients to increase spend at a much faster rate; as the remaining clients transition and the product matures, this should drive step function increases in platform efficiency, gross margin, and average revenue per client.

Want to see how faster client spend, rising margins, and a rich future earnings multiple all connect into that higher fair value math? The narrative lays out the full playbook.

Result: Fair Value of $62.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to large brands and intensifying competition from walled gardens could weaken expectations for sustained revenue growth and multiple expansion.

Find out about the key risks to this Trade Desk narrative.

Another Lens on Valuation

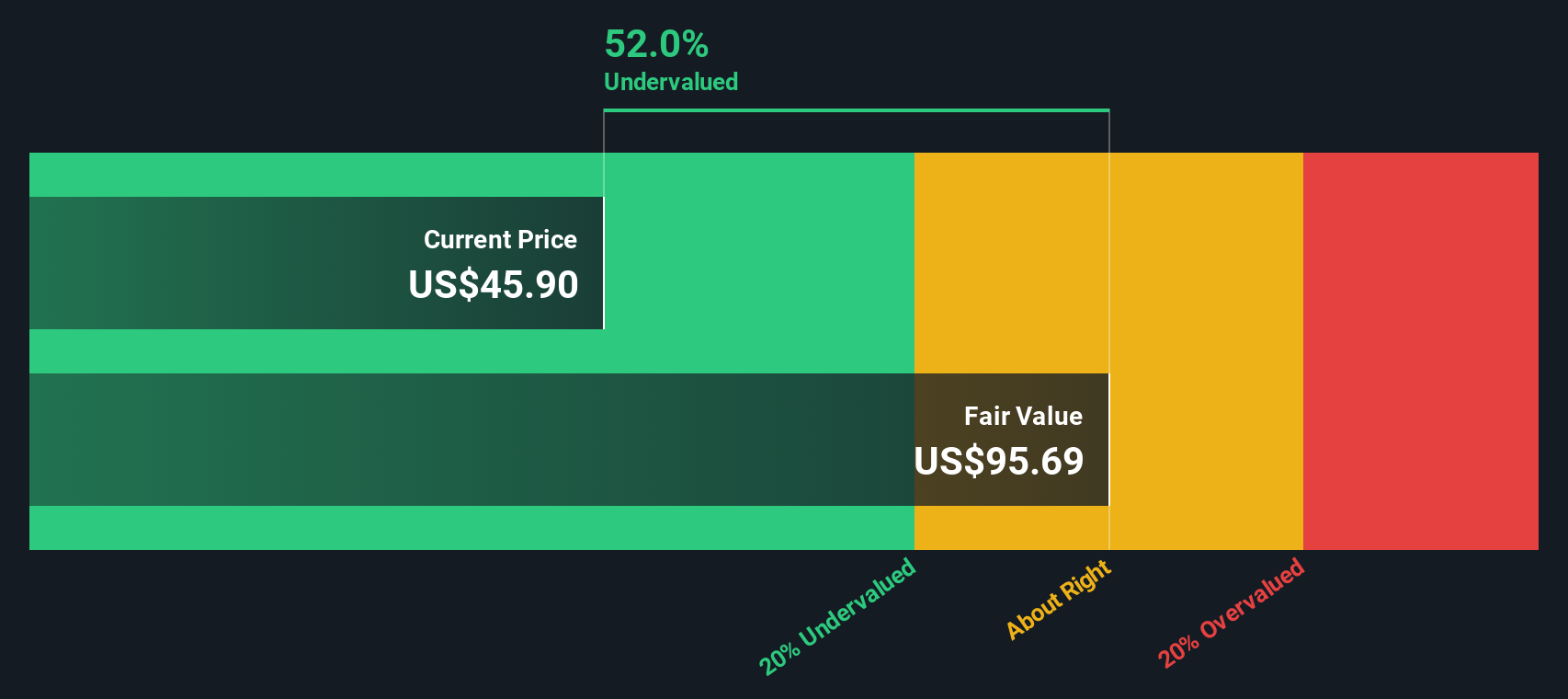

Our DCF model paints a very different picture, suggesting Trade Desk is trading roughly 54 percent below its estimated fair value. This implies the market may be underestimating long term cash flows rather than overpaying for near term earnings. Which signal would you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Trade Desk Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a personalised narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Trade Desk.

Looking for your next investing edge?

Do not stop at one great narrative when you can quickly scan fresh opportunities on Simply Wall St's powerful Screener and stay ahead of slower investors.

- Capture potential multi baggers early by scanning these 3623 penny stocks with strong financials that already back up their promise with solid financials and momentum.

- Position yourself for the AI revolution by targeting these 25 AI penny stocks that are applying machine intelligence to real world products and fast scaling markets.

- Identify value opportunities before their prices change significantly by focusing on these 914 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in the current market price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报