Is It Too Late To Consider State Street After Its 31% Year To Date Surge?

- If you are wondering whether State Street is still a smart buy after its big run, or if you are late to the party, this breakdown will help you think through whether the current price really matches the underlying value.

- The stock has quietly put up strong numbers, with the share price up 0.7% over the last week, 12.7% over the past month, 31.2% year to date, 34.9% over the last year, and 110.0% over five years. This naturally raises questions about how much potential upside remains compared with how much risk has already been priced out.

- Recent headlines around the asset management and custody banking space, including shifting expectations for interest rates and flows into passive and ETF products, have helped support sentiment for State Street and its peers. At the same time, regulatory developments and industry wide cost cutting initiatives have investors reassessing which players are best positioned to defend margins and grow fee income.

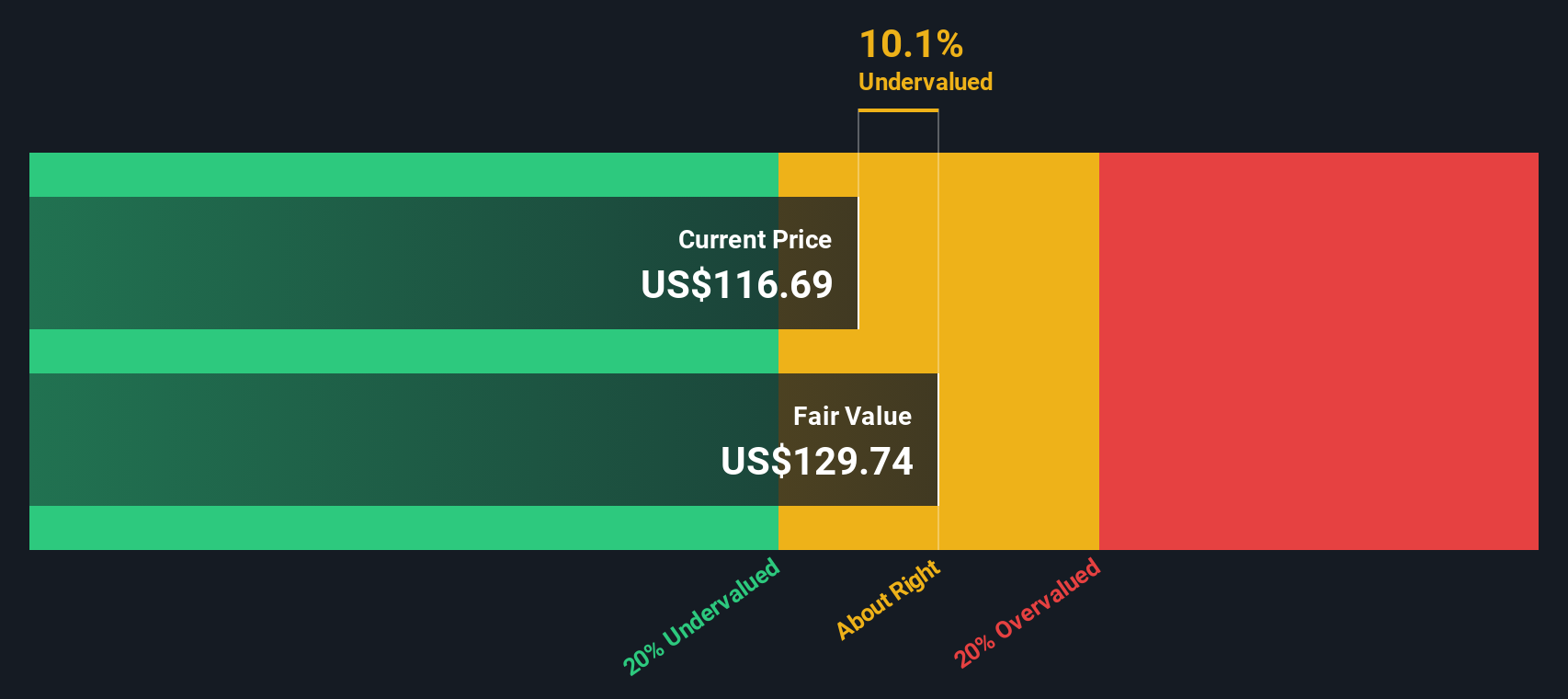

- Right now, State Street scores a 4 out of 6 on our valuation checks, as shown in its valuation score, suggesting it looks undervalued on several, but not all, metrics. Next we will unpack what different valuation approaches say about the stock, and then return to a broader way to think about valuation by the end of this article.

Approach 1: State Street Excess Returns Analysis

The Excess Returns model looks at how much value State Street creates above the return investors demand on its equity, rather than focusing on short term earnings or cash flows. It starts from the company’s book value base and asks whether future returns on that equity are high enough to justify today’s share price.

For State Street, the model uses a Book Value of $85.33 per share and a Stable Book Value projection of $94.12 per share, supported by an Average Return on Equity of 12.89. That level of profitability underpins a Stable EPS estimate of $12.13 per share, compared with an implied Cost of Equity of $9.17 per share. The gap between these figures is the Excess Return of $2.97 per share, which is capitalized to arrive at an intrinsic value estimate of about $139.90 per share.

Compared with the current market price, this suggests the stock is roughly 8.2% undervalued. This is close enough to treat the shares as broadly in line with fair value rather than a deep discount.

Result: ABOUT RIGHT

State Street is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: State Street Price vs Earnings

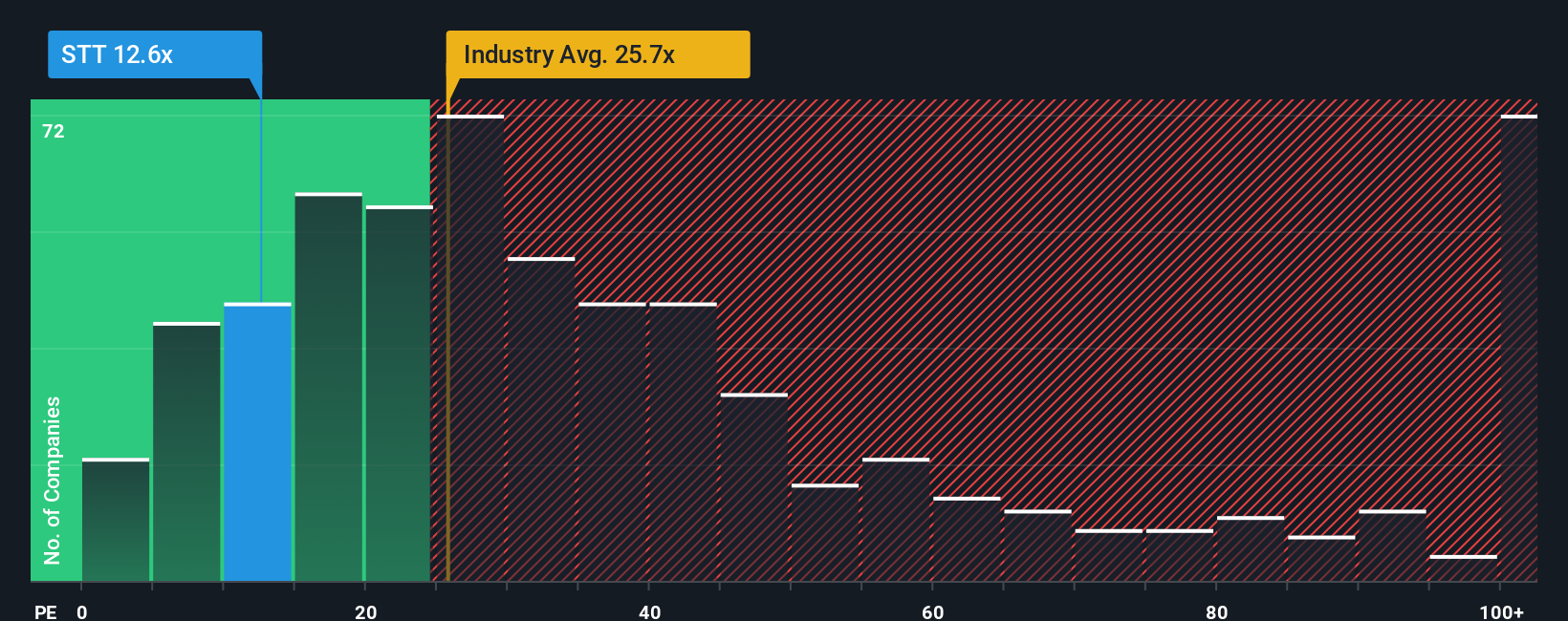

For a profitable, established financial institution like State Street, the price to earnings ratio is a straightforward way to judge whether investors are paying a reasonable price for each dollar of current profits. What counts as a normal or fair PE ratio depends on how quickly earnings are expected to grow and how risky those earnings are, with faster growing or lower risk businesses usually justifying higher multiples.

State Street currently trades at about 13.0x earnings, which is below both the broader Capital Markets industry average of roughly 25.3x and the peer average of about 18.0x. Simply Wall St uses a Fair Ratio of 16.25x for State Street, a proprietary estimate of what the PE should be once factors like its earnings growth outlook, profitability, industry, market value and risk profile are taken into account. This makes it more tailored than simple comparisons with peers or the sector, which can be skewed by very high growth or unusually risky names.

Comparing the Fair Ratio of 16.25x with the current 13.0x suggests the market is applying a discount to where the shares arguably deserve to trade on earnings alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your State Street Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about State Street to the numbers by linking your view of its future revenues, earnings, and margins to a financial forecast and then to a Fair Value you can compare against today’s share price. On Simply Wall St’s Community page, used by millions of investors, you can choose or create a Narrative that reflects how you think State Street’s fee growth, cost savings, and capital returns will play out, and the platform will translate that story into a dynamic valuation that automatically updates as new news or earnings arrive. For example, one investor might build a bullish State Street Narrative that supports a Fair Value near $131 per share. Another more cautious investor might lean toward a Narrative closer to $95 per share. Each can then decide whether to buy, hold, or sell by seeing how their chosen Fair Value stacks up against the current market price.

Do you think there's more to the story for State Street? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报