Huntington Bancshares (HBAN): Assessing Valuation After a Recent Share Price Rally

Huntington Bancshares (HBAN) has quietly put together a solid run, with shares up around 15% over the past month and roughly 9% this year. The stock has outpaced many regional banking peers.

See our latest analysis for Huntington Bancshares.

Trading around $17.69, Huntington Bancshares is showing renewed momentum, with a strong 30 day share price return feeding into a solid year to date climb, while its multiyear total shareholder returns point to a steadily compounding story rather than a short term spike.

If Huntington’s recent move has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

With earnings still growing and the stock trading below analyst targets and some intrinsic value estimates, Huntington’s recent rally raises the key question: is this a fresh entry point, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 10.9% Undervalued

With Huntington Bancshares closing at $17.69 against a most popular fair value of $19.85, the current narrative implies modest upside from here.

The analysts have a consensus price target of $19.32 for Huntington Bancshares based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $15.4.

Curious how a mature regional bank earns a premium style valuation? The narrative leans heavily on ambitious growth, margin resilience, and a future earnings multiple that looks more tech than traditional banking. Want to see the exact assumptions powering that gap between today’s price and tomorrow’s target?

Result: Fair Value of $19.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Cadence integration stumbles or loan growth in newer Southeast and Texas markets proves weaker than expected, the bullish narrative could quickly unwind.

Find out about the key risks to this Huntington Bancshares narrative.

Another Lens on Value

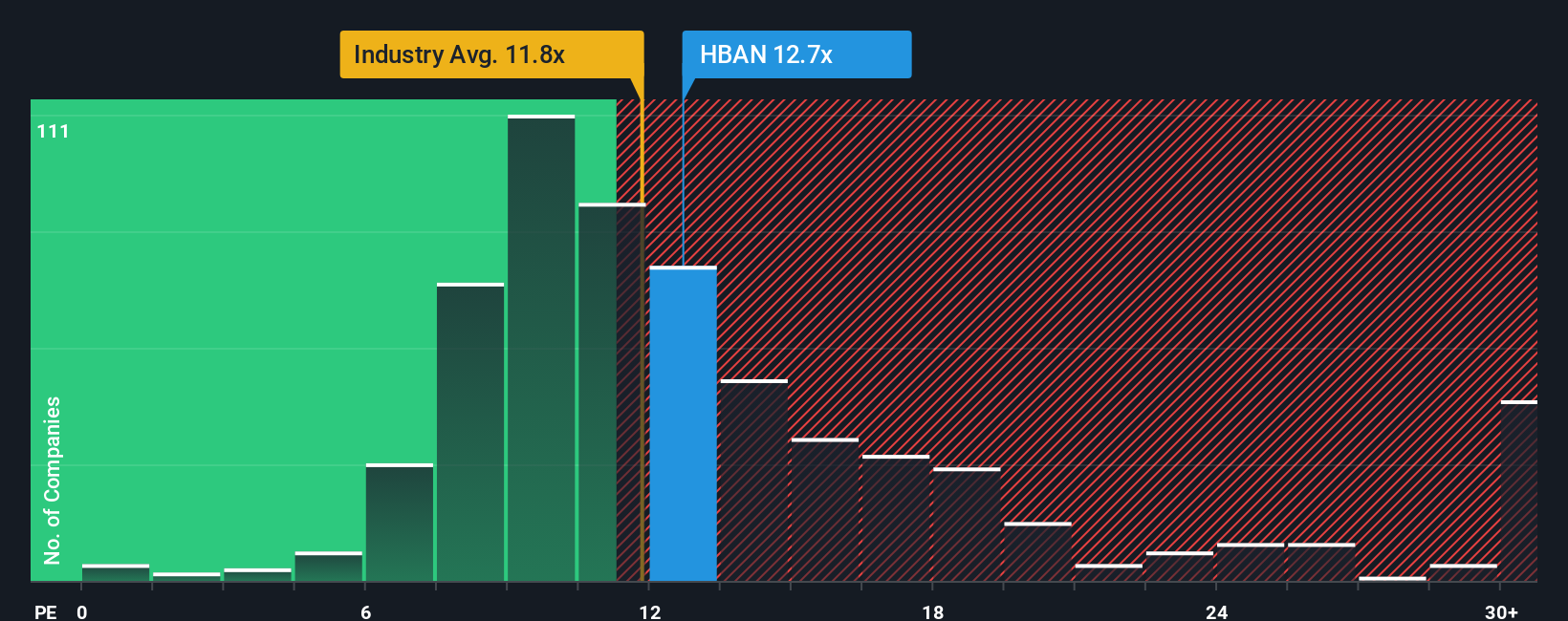

On simple earnings multiples, Huntington looks anything but cheap, trading at about 13.2 times earnings versus roughly 12 times for the wider US banks group and 13.1 times for close peers. Yet our fair ratio suggests the market could ultimately move closer to 19.7 times. Is this a value trap in the making, or a patient re rating story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Huntington Bancshares Narrative

If you see the story differently, or would rather dive into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Huntington Bancshares.

Looking for more investment ideas?

If you want to stay ahead of the next wave of opportunities, let the Simply Wall St Screener surface focused ideas instead of leaving it to chance.

- Capture early momentum in overlooked names by scanning these 3623 penny stocks with strong financials that also boast strong underlying financials.

- Position yourself for structural growth by targeting these 29 healthcare AI stocks at the intersection of medicine, data, and automation.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% offering yields above 3% backed by solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报