B. Riley Financial (RILY) Is Up 12.5% After One‑Off Driven Profit Rebound And Debt Cut - Has The Bull Case Changed?

- B. Riley Financial, Inc. reported its previously delayed second‑quarter 2025 results, showing revenue of US$225.3 million and net income of US$139.47 million, a sharp swing from a large loss a year earlier, alongside a US$314 million reduction in total debt and timely filing of its Form 10‑Q to meet Nasdaq requirements.

- Beyond the headline profit rebound, one-off gains from the sale of GlassRatner and senior note exchanges played a central role in the earnings turnaround and helped stabilize the company’s regulatory standing.

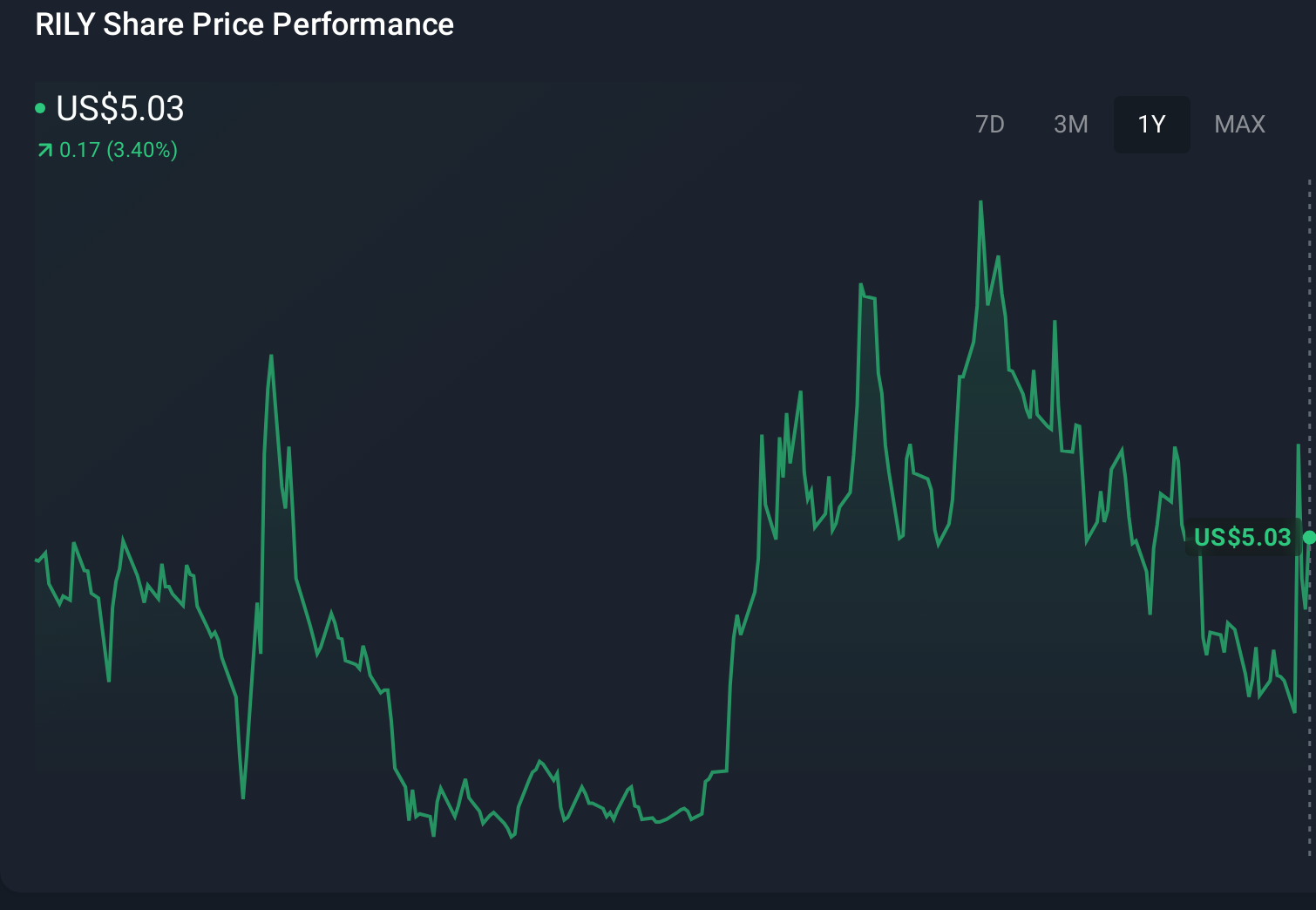

- With a recent 7‑day share price gain, we’ll explore how the return to profitability and debt reduction reshape B. Riley’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is B. Riley Financial's Investment Narrative?

For anyone considering B. Riley, the story you need to buy into is a messy balance between a battered balance sheet and a company trying to reset. The latest quarter’s profit swing, debt cut of about US$314 million, and restored Nasdaq compliance ease some immediate pressure, and the sharp 7‑day share price bounce shows how sensitive sentiment is to survival signals. But a big part of the earnings lift came from one‑off gains like the GlassRatner sale and senior note exchanges, which do not resolve prior years of losses, negative equity and a history of delayed filings. Short term, the key catalysts now revolve around hitting the next 10‑Q deadline, maintaining access to funding and proving that underlying operations can stand without special items. The biggest risks are execution missteps, renewed compliance issues and any re‑emergence of stress in its investments and funding costs.

However, one core financial risk still sits largely in the background that investors should be aware of.B. Riley Financial's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for B. Riley span roughly US$14.53 to a very large US$154.14 per share, underscoring how far apart individual views can be. Set that against the recent profit helped by one off gains and lingering balance sheet fragility, and it is clear you are looking at a stock where sentiment and risk appetite can shift quickly. Exploring several of these viewpoints can help frame how different investors weigh the turnaround story against those structural concerns.

Explore 4 other fair value estimates on B. Riley Financial - why the stock might be worth just $14.53!

Build Your Own B. Riley Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your B. Riley Financial research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free B. Riley Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate B. Riley Financial's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报