Assessing Builders FirstSource (BLDR) Valuation After Jefferies’ Downgrade and Cautious Outlook

Builders FirstSource (BLDR) slipped after Jefferies cut its rating to Hold, a change that prompted investors to reassess how much future growth they are willing to pay for in this housing cycle.

See our latest analysis for Builders FirstSource.

That caution is showing up in the tape, with the 1 month share price return still positive at about 8 percent even as the year to date share price return sits near negative 27 percent and the 1 year total shareholder return is down roughly 31 percent. This suggests momentum has cooled after a strong multi year run, which still leaves 3 year and 5 year total shareholder returns at about 59 percent and 146 percent respectively.

If this shift in sentiment has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other compelling ideas.

Yet with shares trading below revised analyst targets and modest earnings growth still coming through, the key question now is whether BLDR is quietly slipping into undervalued territory, or if the market is already pricing in every bit of future growth.

Most Popular Narrative Narrative: 22.8% Undervalued

With the most popular narrative putting fair value well above Builders FirstSource’s last close of $103.79, the implied upside rests on specific long term drivers.

The company is investing heavily in digital transformation and value added solutions (e.g., digital tools, ERP integration, prefabricated components) that are expected to drive higher margin growth, increase operating efficiency, and strengthen customer relationships as the market recovers, improving both future revenue and net margins.

Curious how modest revenue expectations can still support a richer future earnings multiple than many peers? The narrative leans on structural margin power and disciplined growth math you will want to see for yourself.

Result: Fair Value of $134.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged housing softness or slower adoption of Builders FirstSource’s higher margin digital and prefabricated solutions could quickly derail the undervaluation thesis.

Find out about the key risks to this Builders FirstSource narrative.

Another Angle on Valuation

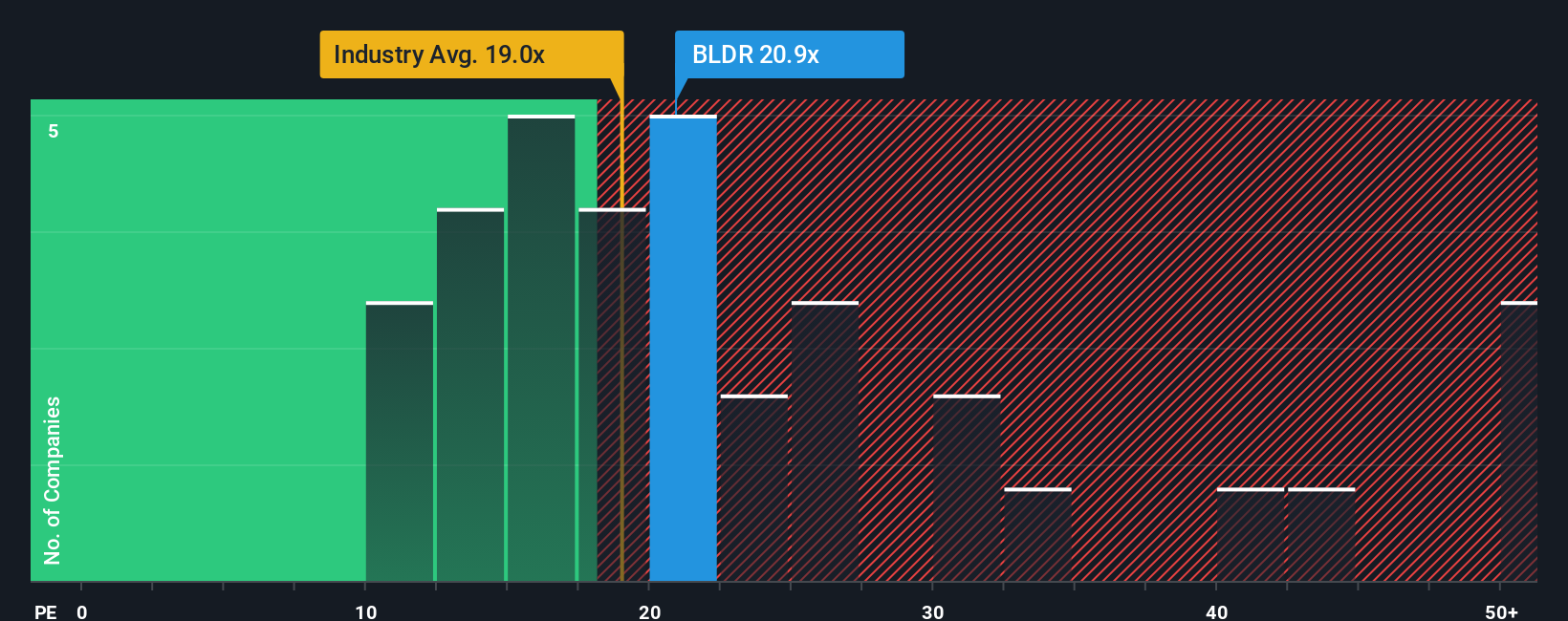

On earnings, Builders FirstSource is actually priced a touch above the US Building group, at about 19.7 times earnings versus roughly 19.3 times for peers. Our fair ratio work, however, points closer to 26.9 times, which leaves room for upside if sentiment shifts back in its favor.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Builders FirstSource Narrative

If you see the numbers differently or simply prefer hands on research, you can spin up a personalized view in under three minutes: Do it your way.

A great starting point for your Builders FirstSource research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more high conviction ideas?

Before you move on, lock in your next watchlist candidates with targeted screeners on Simply Wall St, so you are not chasing the market later.

- Capture potential value leaders by running these 916 undervalued stocks based on cash flows that appear mispriced relative to their cash flows and long term fundamentals.

- Supercharge your growth hunt with these 25 AI penny stocks poised to benefit from AI adoption across industries and accelerating digital transformation.

- Boost your income strategy by scanning these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles and solid balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报