Taking Stock of Ternium (NYSE:TX) Valuation After Upbeat Analyst Targets and Strengthening Investor Sentiment

Recent analyst moves and improving valuation metrics have pushed Ternium (NYSE:TX) back onto many investors radar, as the stock combines value credentials with a more constructive sentiment backdrop.

See our latest analysis for Ternium.

Those upbeat valuation calls have landed on a stock that already has the wind at its back, with a roughly 30 percent year to date share price return and a 1 year total shareholder return above 40 percent, suggesting momentum is quietly building rather than fading.

If Ternium has you rethinking what value and momentum can look like, this could be a good moment to widen the lens and discover fast growing stocks with high insider ownership.

With analysts nudging targets higher but shares already near those levels and intrinsic value models implying a sizable discount, the key question now is simple: is Ternium a mispriced value play or is future growth already fully reflected?

Most Popular Narrative Narrative: 3.9% Overvalued

With Ternium last closing at $38.23 against a narrative fair value of about $36.81, the outlook leans only modestly rich rather than stretched.

Fair Value Estimate: Unchanged at approximately $36.81 per share, indicating no material revision to intrinsic value.

Discount Rate: Increased slightly from about 8.26 percent to 8.33 percent, reflecting a modestly higher required return.

Curious how a higher required return and steady growth assumptions can still support today’s price? One set of carefully balanced forecasts does the heavy lifting.

Result: Fair Value of $36.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global overcapacity and a heavy, front loaded investment cycle could keep margins under pressure and challenge the assumptions behind today’s fair value.

Find out about the key risks to this Ternium narrative.

Another Lens on Value

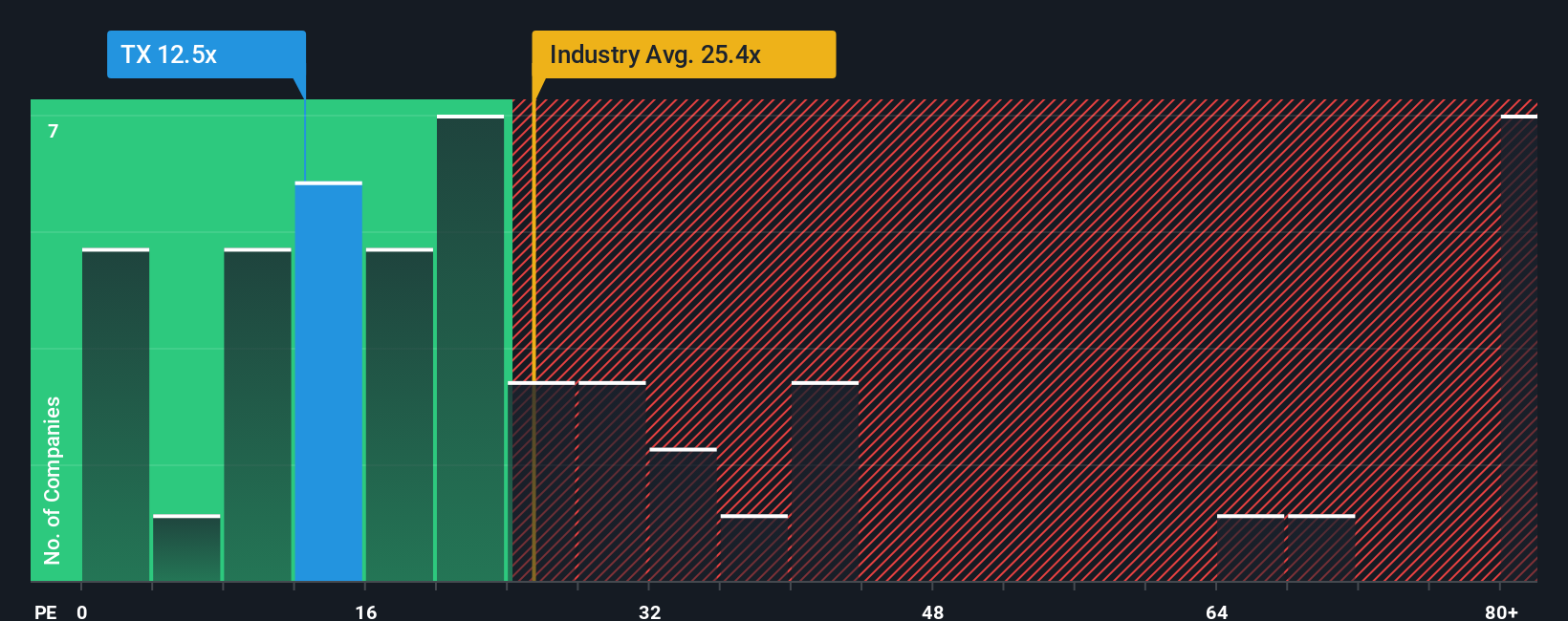

On simple earnings terms, the picture flips. Ternium trades on about 12.9 times earnings versus roughly 24.5 times for the US metals and mining sector and an estimated fair ratio of 23.6 times, hinting at a sizable valuation gap that could narrow over time, or stay wide if risks bite.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ternium Narrative

If this perspective does not quite fit your view, or you prefer to dig into the numbers yourself, you can quickly build a version that reflects your own conviction: Do it your way.

A great starting point for your Ternium research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next steps with focused stock ideas from the Simply Wall Street Screener so potential opportunities do not slip past you.

- Capture overlooked potential by targeting these 914 undervalued stocks based on cash flows that may be trading below what their cash flows truly justify.

- Supercharge your growth hunt with these 25 AI penny stocks tapping into powerful trends in automation, data, and intelligent software.

- Reinforce your income strategy using these 13 dividend stocks with yields > 3% that could keep paying you while markets swing around them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报