HEICO (HEI) Valuation Check After Strong Earnings Growth and New Semiannual Dividend Declaration

HEICO (HEI) just delivered a strong one two punch: higher fourth quarter and full year earnings, plus another semiannual dividend. For investors, that combination reinforces the stock’s quality, cash generation, and staying power.

See our latest analysis for HEICO.

The latest results help explain why HEICO’s share price has climbed to $308.73 and delivered a robust year to date share price return of around 30 percent, while three year total shareholder return has roughly doubled investors’ money. This signals enduring momentum supported by steady acquisitions and recurring aerospace demand.

If you like the mix of resilient earnings and long run compounding, it is worth exploring other aerospace and defense names using our curated aerospace and defense stocks.

But after a blistering multi year run and fresh record results, is HEICO still trading below its intrinsic value, or has the market already priced in years of aerospace growth and acquisition fueled upside?

Most Popular Narrative Narrative: 13% Undervalued

With HEICO last closing at $308.73 against a narrative fair value of $353, the prevailing view suggests the market is still underestimating its earnings power.

The worldwide trend of aging commercial and military aircraft fleets, combined with increasing pressure for cost-effective maintenance solutions, strongly favors HEICO's business model. As airlines and governments seek alternatives to expensive OEM parts, HEICO's FAA-approved PMA parts and repairs continue to gain market share and drive margin expansion, as reflected in rising operating and EBITA margins.

Want to see how steady double digit growth, rising margins, and a rich future earnings multiple all fit together into one valuation story? Dive in.

Result: Fair Value of $353 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying OEM competition and any stumble in HEICO’s acquisition strategy could quickly challenge today’s upbeat growth and valuation assumptions.

Find out about the key risks to this HEICO narrative.

Another Angle on Valuation

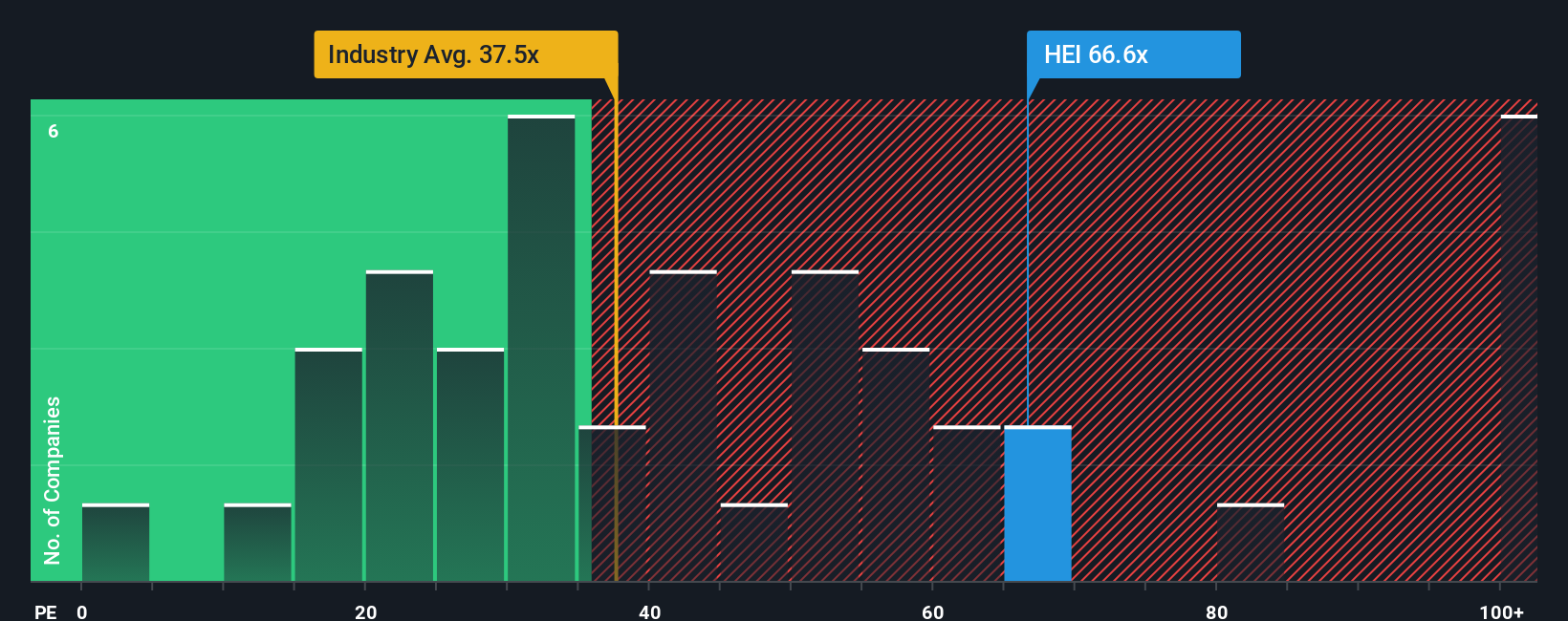

Look beyond the upbeat narrative and HEICO starts to look stretched. The stock trades on a 67 times earnings multiple versus 36.5 times for the US Aerospace and Defense industry and a fair ratio of 29.4 times, implying meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HEICO Narrative

And if this perspective does not fully align with yours, or you would rather rely on your own analysis, you can quickly build a personalized view in under three minutes: Do it your way.

A great starting point for your HEICO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next edge by scanning fresh opportunities across the market using tailored screens that surface quality, growth, and value potential.

- Target income first by reviewing these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow without forcing you into speculative corners of the market.

- Ride structural growth trends by focusing on these 29 healthcare AI stocks that blend innovation with real world demand across hospitals, diagnostics, and medical platforms.

- Capitalize on market mispricing by zeroing in on these 914 undervalued stocks based on cash flows where solid fundamentals and discounted cash flows work in your favor rather than against you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报