ExlService Holdings (EXLS): Valuation Check After Strong Quarter and Targeted Share Repurchase from Orogen Echo LLC

ExlService Holdings (EXLS) just checked two big boxes for investors: delivering double digit revenue and earnings growth while also completing a targeted share repurchase from Orogen Echo LLC that tightens the float.

See our latest analysis for ExlService Holdings.

Even with a solid quarter and that focused buyback from Orogen Echo LLC tightening the float, the latest $42.91 quote still leaves ExlService with a slightly negative year to date share price return. Its five year total shareholder return above 100% shows the longer term growth story remains intact and suggests momentum is starting to rebuild.

If EXL’s mix of data, AI and digital operations has your attention, this could be a good moment to scout other specialised players using our high growth tech and AI stocks.

With revenue and earnings still growing around 11 to 12 percent and the stock trading at a roughly 25 percent discount to intrinsic value estimates, is EXL quietly undervalued or already priced for future AI‑fueled expansion?

Most Popular Narrative Narrative: 17.9% Undervalued

With the most followed narrative placing fair value well above ExlService Holdings recent close, the gap hinges on ambitious yet specific growth and profitability assumptions.

The analysts have a consensus price target of $54.143 for ExlService Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $326.3 million, and it would be trading on a PE ratio of 33.2x, assuming you use a discount rate of 7.1%.

Curious what kind of revenue ramp, margin lift, and premium earnings multiple are stitched together to justify that valuation gap? The full narrative unpacks those bold assumptions in detail, and the specific milestones ExlService is expected to hit along the way.

Result: Fair Value of $52.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid AI advances and stricter global data regulations could pressure margins and client demand, forcing a rethink of today’s upbeat valuation narrative.

Find out about the key risks to this ExlService Holdings narrative.

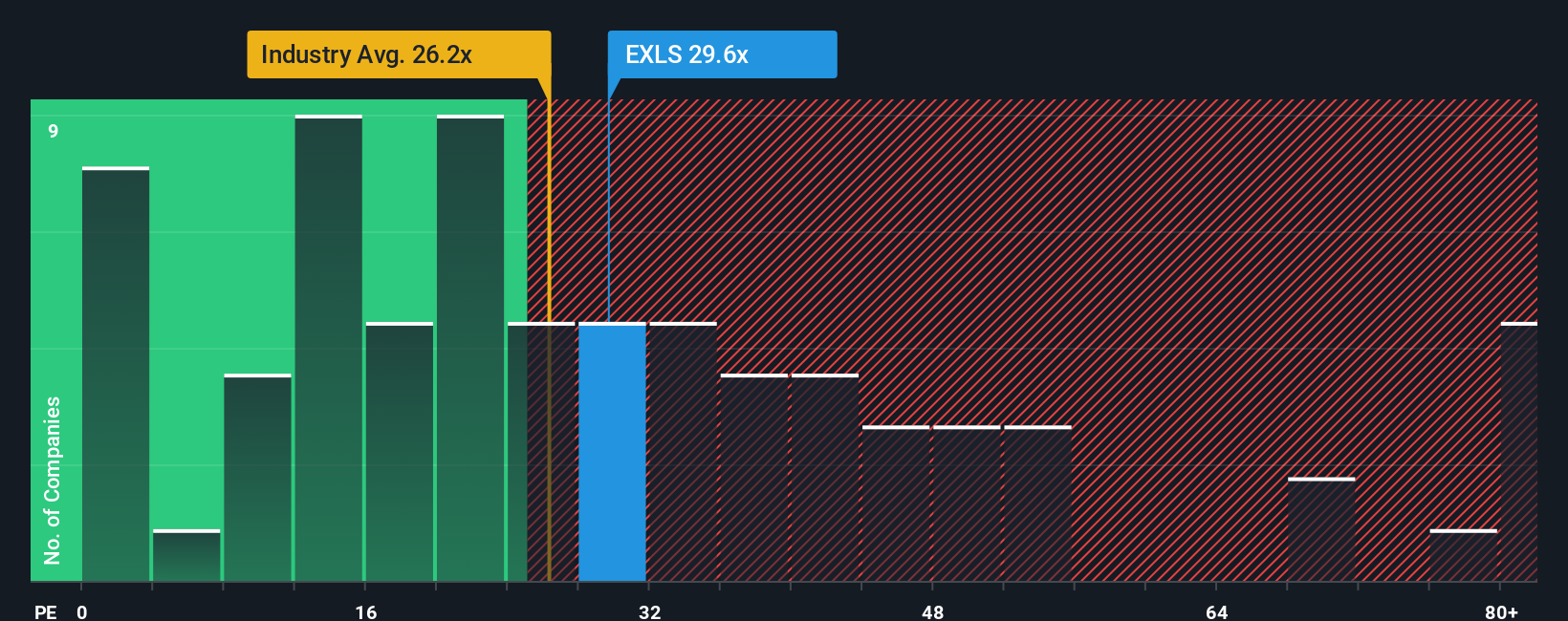

Another View: Market Ratios Flash a Caution Signal

While narrative based fair value points to upside, the current 28.2 times earnings is richer than both the industry at 24.2 times and peers at 26.7 times, and above a fair ratio of 24.4 times. Is this a quality premium or downside risk if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ExlService Holdings Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a fresh view in minutes: Do it your way.

A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You are already ahead of most investors, so keep that edge by hunting for fresh opportunities on Simply Wall St that match your strategy before the crowd catches on.

- Seek more stable portfolio income by targeting companies in these 13 dividend stocks with yields > 3% that offer attractive yields supported by solid fundamentals and consistent cash flows.

- Explore innovation at the frontier of technology by scanning these 28 quantum computing stocks that may benefit from advances in computing power and enterprise adoption.

- Consider asymmetric upside by filtering these 3614 penny stocks with strong financials that combine smaller market capitalizations with strong financials and meaningful growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报