Does Trane’s Data Center and AI HVAC Push Reshape the Bull Case For Trane Technologies (TT)?

- In recent months, Trane Technologies has rolled out new circularity impact metrics tied to its 2030 Sustainability Commitments, announced acquisitions in data center-focused digital cooling and AI HVAC optimization, and reported higher adjusted EPS alongside record enterprise bookings and backlog.

- These moves, combined with renewed STEM education funding and workplace culture recognition, highlight how Trane is using sustainability, talent, and data center exposure to reinforce its competitive positioning in climate solutions.

- Next, we’ll assess how Trane’s push into data center and AI-enabled HVAC solutions could reshape its investment narrative for long-term margins.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Trane Technologies Investment Narrative Recap

To stay on board as a Trane shareholder, you need to believe that its focus on high value commercial HVAC, especially data centers, can support healthy margins despite weakness in transport and macro uncertainty. Recent news around record bookings, rising backlog and analyst upgrades reinforces the near term catalyst of sustained data center demand, while the biggest risk remains a slowdown in those same verticals that could expose the company’s reliance on pricing and backlog conversion.

The acquisition of Stellar Energy’s digital business, alongside BrainBox AI, is especially relevant here because it deepens Trane’s data center and AI enabled HVAC offering, directly tied to current order strength. These capabilities could help the company support recurring service revenue and energy efficiency outcomes for large customers, which matters for both its sustainability narrative and its ability to offset softness in more cyclical segments over time.

Yet even with strong data center orders, investors should still be aware of how exposed Trane is if demand in those key verticals suddenly...

Read the full narrative on Trane Technologies (it's free!)

Trane Technologies' narrative projects $25.4 billion revenue and $3.7 billion earnings by 2028. This requires 6.9% yearly revenue growth and about an $0.8 billion earnings increase from $2.9 billion today.

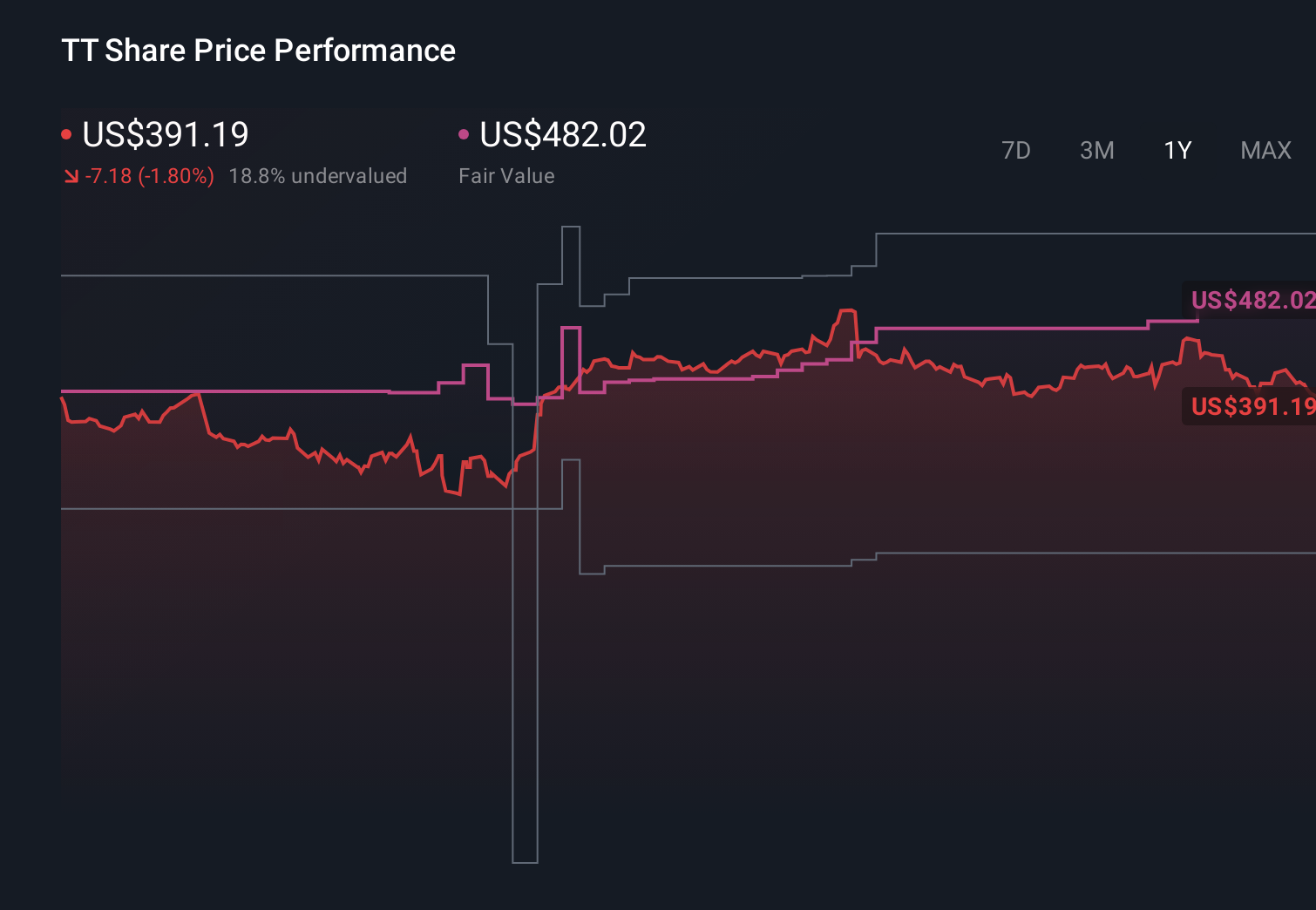

Uncover how Trane Technologies' forecasts yield a $482.28 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$308 to US$482 per share, showing very different views on Trane’s upside. When you set that against the current data center driven backlog strength, it underlines why understanding both the growth opportunity and the risk of a slowdown in those verticals really matters for judging the company’s future performance.

Explore 4 other fair value estimates on Trane Technologies - why the stock might be worth as much as 25% more than the current price!

Build Your Own Trane Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trane Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trane Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trane Technologies' overall financial health at a glance.

No Opportunity In Trane Technologies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报