Phillips 66 (PSX): Assessing Valuation After Recent Share Price Weakness

Market context and recent performance

Phillips 66 (PSX) has been drifting lower in recent weeks, with the stock down around 9% over the past week and roughly 4% over the past month, even as its one year return remains solidly positive.

See our latest analysis for Phillips 66.

With the share price now at $129.13 and recent weakness reflected in its 7 day and 30 day share price returns, the longer term picture still looks constructive. This is supported by a 1 year total shareholder return above 20 percent, suggesting momentum is cooling rather than collapsing.

If this kind of cyclical energy move has you thinking about where else to allocate capital, it might be worth scanning fast growing stocks with high insider ownership for fresh ideas beyond the refiners.

Given that Phillips 66 trades below analyst targets yet boasts strong multi year returns, are investors overlooking a still reasonable valuation here, or is the current price already factoring in most of its future growth?

Most Popular Narrative Narrative: 51.9% Undervalued

With Phillips 66 last closing at $129.13 against a narrative fair value more than double that level, the story points to substantial upside driven by margins and growth expectations.

Phillips 66 (PSX) is often considered undervalued for several reasons. Investment analysis typically looks at various factors to determine if a company's stock might be undervalued and whether it has the potential to achieve higher profit margins.

Want to see why, according to mschoen25, modest revenue growth assumptions still support a far higher valuation? The real twist lies in how future margins and the chosen earnings multiple interact. Curious which levers do most of the heavy lifting in this model, and how they justify such a large gap to today’s price?

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer refining margins or a sharper than expected downturn in fuel demand could quickly erode the upside implied by this bullish valuation case.

Find out about the key risks to this Phillips 66 narrative.

Another lens on value

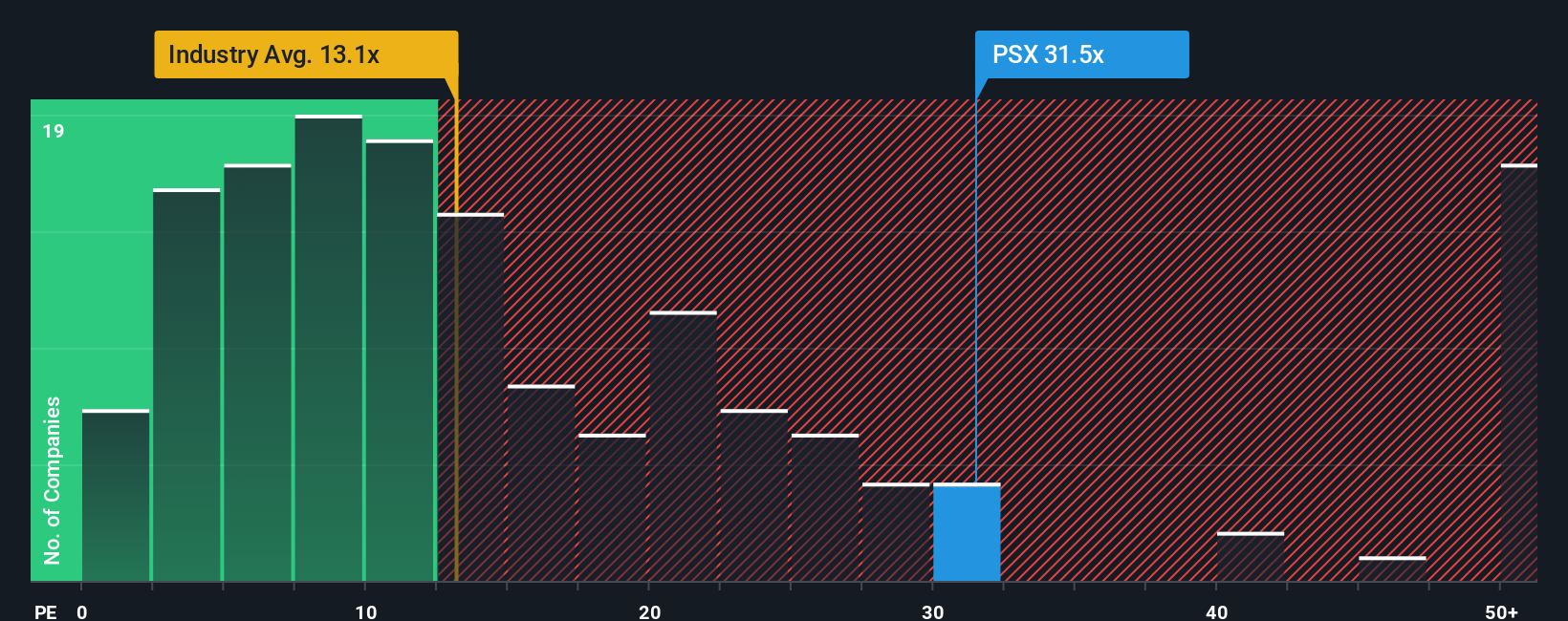

Market based valuation paints a very different picture. On a price to earnings basis, Phillips 66 trades at about 34.8 times earnings, well above the US Oil and Gas industry average of 13 times and a fair ratio of 24.6 times, suggesting investors are already paying up for its earnings power.

That kind of premium can work if earnings grow as hoped, but it also raises the risk that any setback in margins or cash flow could compress the multiple quickly. Is this a case of a quality story that deserves a higher bar, or a valuation that leaves little room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you prefer to challenge these assumptions or dig into the numbers yourself, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your watchlist to work by tapping into fresh opportunities across sectors so you are not stuck relying on a single thesis.

- Capture early growth stories by scanning these 3616 penny stocks with strong financials that already show financial strength instead of speculation alone.

- Position yourself for the next wave of innovation by targeting these 25 AI penny stocks that connect powerful AI trends with scalable business models.

- Lock in income and potential upside by focusing on these 13 dividend stocks with yields > 3% that combine reliable payouts with fundamentally sound balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报