3 Growth Companies With High Insider Ownership Seeing Earnings Growth Up To 68%

As the U.S. stock market experiences a surge, particularly in tech shares, investors are closely monitoring growth companies with high insider ownership as potential opportunities amidst this renewed risk appetite. In such an environment, stocks that combine robust earnings growth with significant insider stakes can offer insights into management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.9% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.3% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.2% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

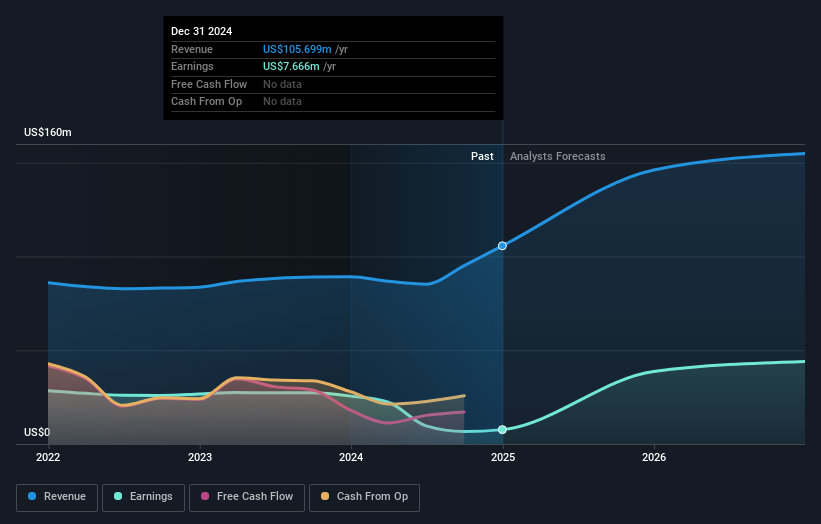

Community West Bancshares (CWBC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Community West Bancshares is the bank holding company for Central Valley Community Bank, offering a range of commercial banking services to small and middle-market businesses and individuals in California, with a market cap of $444.09 million.

Operations: The company generates revenue of $138.04 million from its banking operations segment, providing commercial banking services in California.

Insider Ownership: 12.3%

Earnings Growth Forecast: 23.3% p.a.

Community West Bancshares demonstrates strong growth potential with expected earnings growth of 23.3% annually, surpassing the US market average. Trading at a significant discount to its fair value, the company also benefits from high insider ownership with more shares bought than sold recently. A merger with United Security Bancshares is underway, potentially enhancing its board and strategic direction. Despite a low forecasted return on equity, it maintains a reliable 2.06% dividend yield.

- Click here to discover the nuances of Community West Bancshares with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Community West Bancshares is trading behind its estimated value.

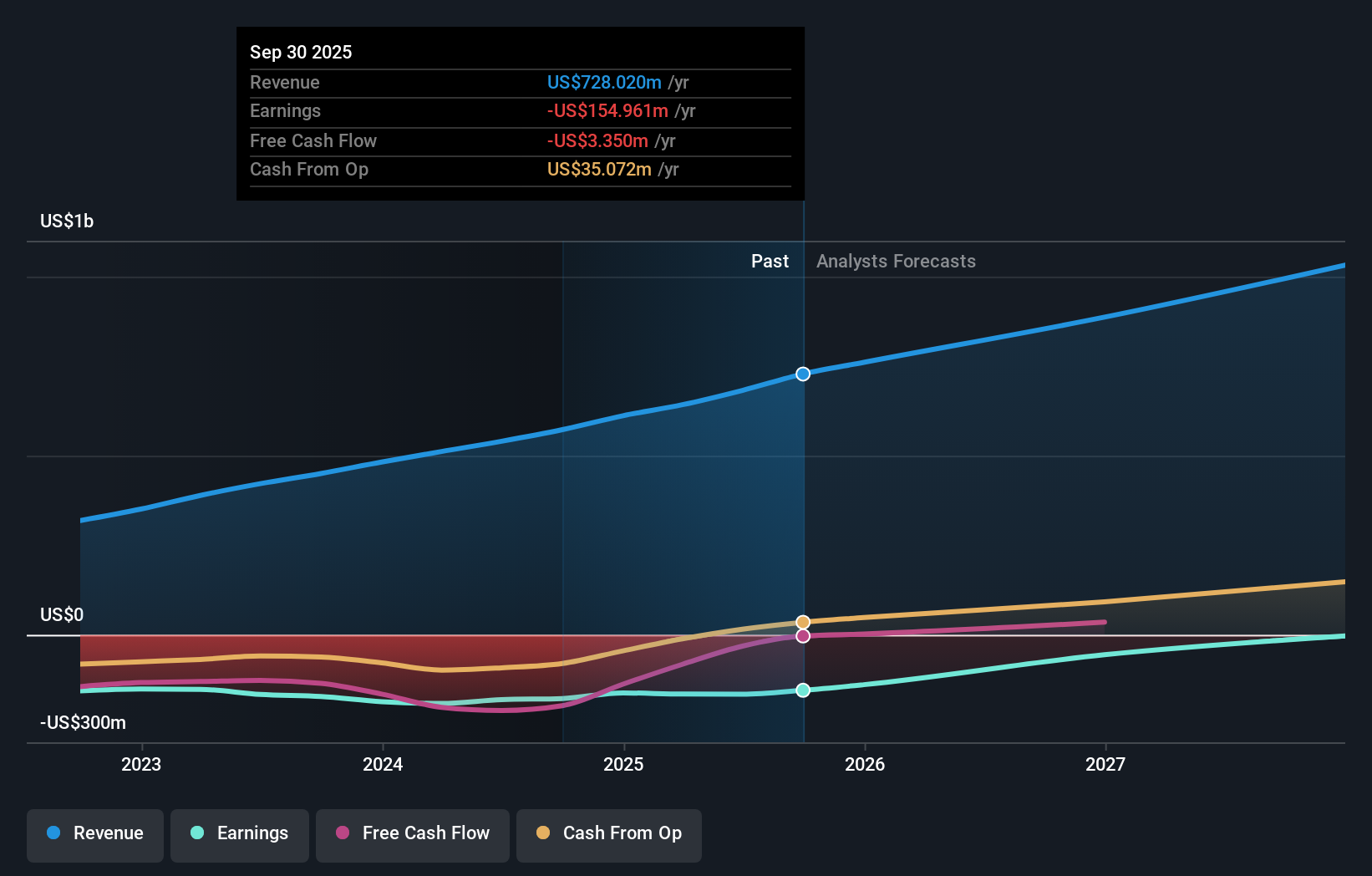

Alphatec Holdings (ATEC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphatec Holdings, Inc. is a medical technology company focused on designing and developing technologies for the surgical treatment of spinal disorders, with a market cap of approximately $2.91 billion.

Operations: Alphatec Holdings generates revenue from its Medical Products segment, amounting to $728.02 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 68.2% p.a.

Alphatec Holdings is poised for significant growth, with earnings projected to rise 68.16% annually and revenue expected to outpace the US market at 14% per year. Despite recent insider selling, the stock is trading below analyst price targets, suggesting potential upside. The company has raised its revenue guidance to US$760 million for 2025. However, it remains unprofitable with a net loss of US$28.58 million in Q3 2025 but anticipates profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Alphatec Holdings.

- Our valuation report unveils the possibility Alphatec Holdings' shares may be trading at a premium.

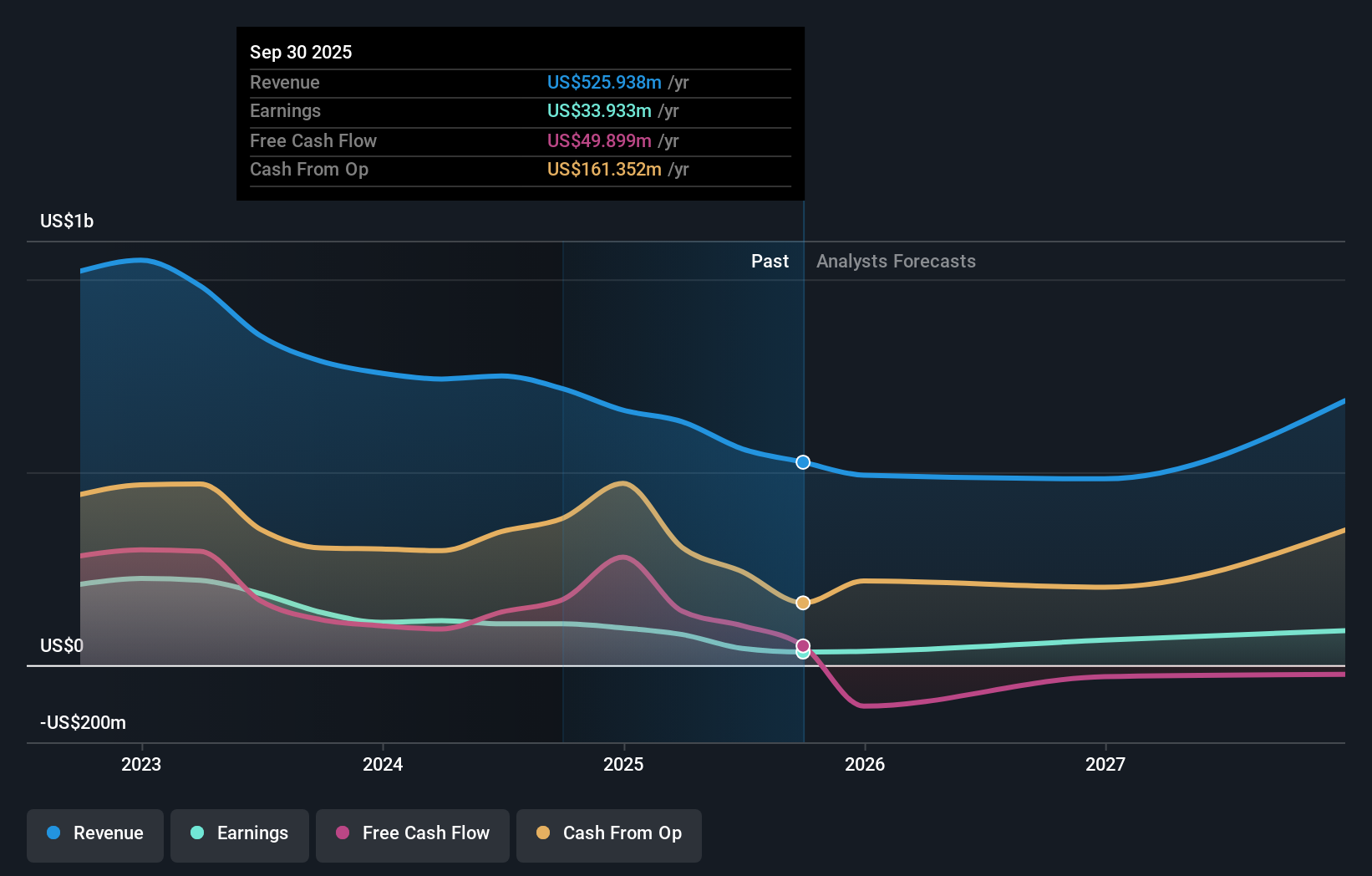

GeoPark (GPRK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company operating in several Latin American countries, with a market cap of approximately $365.26 million.

Operations: The company generates revenue primarily from its oil and gas exploration and production activities, amounting to $525.94 million.

Insider Ownership: 25.2%

Earnings Growth Forecast: 38.1% p.a.

GeoPark Limited is positioned for growth with earnings projected to increase 38.12% annually, surpassing US market expectations. Despite a decline in recent quarterly sales and net income, the company remains undervalued at 55.8% below fair value estimates. GeoPark's strategic acquisition in Argentina’s Vaca Muerta formation supports its expansion plans, although dividends are currently unstable due to capital requirements. The company's production guidance indicates increasing output through 2028, reflecting a commitment to long-term growth initiatives.

- Dive into the specifics of GeoPark here with our thorough growth forecast report.

- According our valuation report, there's an indication that GeoPark's share price might be on the cheaper side.

Taking Advantage

- Gain an insight into the universe of 207 Fast Growing US Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报