China Coal Energy (SEHK:1898): Valuation Check After Coal Volumes Drop and Ammonium Nitrate Output Surges

China Coal Energy (SEHK:1898) just released its November 2025 operations update, showing coal production and sales under pressure, while ammonium nitrate output and sales jumped sharply, hinting at a quiet shift in the earnings mix.

See our latest analysis for China Coal Energy.

The stock has cooled off in recent weeks, with a 1 month share price return of minus 9.05 percent. However, momentum over the year still looks constructive, supported by a 1 year total shareholder return of 21.34 percent and a powerful 5 year total shareholder return of 490.42 percent that suggests long term holders are being rewarded for staying the course.

If this kind of shifting earnings mix has you thinking more broadly about cyclical opportunities, it may be worth exploring fast growing stocks with high insider ownership as a source of fresh, high conviction ideas.

With earnings growth modest but the shares still trading at roughly a 26 percent discount to intrinsic value estimates, is China Coal Energy a contrarian value play, or has the market already priced in its future growth?

Most Popular Narrative: Fairly Valued

With China Coal Energy last closing at HK$10.35 against a most popular narrative fair value of about HK$10.22, expectations point to a market that is roughly aligned with long term fundamentals.

The analysts have a consensus price target of HK$9.943 for China Coal Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$13.43, and the most bearish reporting a price target of just HK$6.42.

Curious why modest revenue shrinkage, slightly thinner margins and a higher future earnings multiple can still justify today’s price? The narrative’s cash flow path and discount rate assumptions quietly reshape what fair value really means here.

Result: Fair Value of $10.22 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained policy support for coal and faster growth in higher margin chemical operations could underpin stronger earnings and challenge the fairly valued narrative.

Find out about the key risks to this China Coal Energy narrative.

Another View: Earnings Multiple Signals Deeper Value

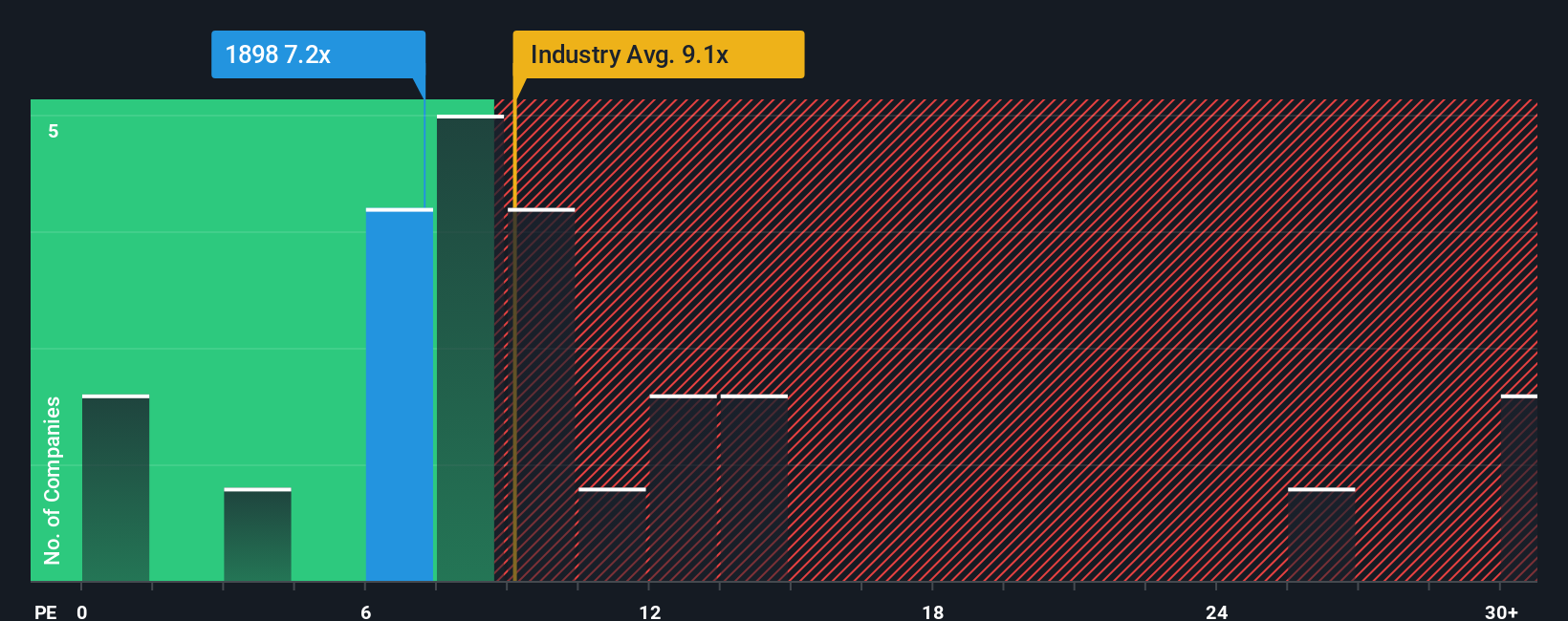

While the popular narrative says China Coal Energy is fairly valued, its 7.2x price to earnings ratio sits well below the Hong Kong Oil and Gas industry at 9.2x and a fair ratio of 11.1x, hinting at a sizeable value gap. Is the market still underestimating this cycle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own China Coal Energy Narrative

If you see the story differently or prefer to review the numbers on your own, you can build a complete view in minutes, Do it your way.

A great starting point for your China Coal Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity. The Simply Wall St Screener can quickly surface targeted stock ideas you may want to consider for the next market upswing.

- Look for potential multi baggers early by scanning these 3608 penny stocks with strong financials that pair smaller market caps with solid growth drivers and improving financial trends.

- Position your portfolio for the AI theme by targeting these 24 AI penny stocks that are generating revenue from machine learning, automation and intelligent software solutions.

- Explore different risk reward setups by filtering for these 918 undervalued stocks based on cash flows where current prices sit meaningfully below their estimated cash flow based fair values.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报