How Investors May Respond To Star Bulk Carriers (SBLK) Upgraded Earnings Outlook And Rising Analyst Attention

- Recently, Star Bulk Carriers drew increased attention on Zacks.com as analysts projected very large year-over-year earnings growth and meaningful changes in earnings estimates.

- This surge in investor interest, alongside expectations of a significantly improved earnings profile, highlights how sensitive sentiment can be to shifts in profit outlook for dry bulk shipping companies.

- We’ll now examine how this improved earnings outlook and heightened investor attention could reshape Star Bulk Carriers’ broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Star Bulk Carriers Investment Narrative Recap

To own Star Bulk Carriers, you have to believe that its exposure to dry bulk trade and its ability to refresh an aging fleet can offset structurally weak demand and high leverage. The Zacks spotlight on sharply higher earnings expectations may influence short term sentiment, but it does not fundamentally change the key near term catalyst of earnings recovery or the main risk around balance sheet pressure in a cyclical, capital intensive business.

The recent combination of a higher quarterly dividend to US$0.11 per share and ongoing share buybacks is the most relevant backdrop to this earnings focused news, because it ties capital returns directly to cash generation in a volatile rate environment. These actions can amplify the impact of any earnings upswing, but they also sit alongside significant capex needs for fleet upgrades if dry bulk volumes remain close to flat and regulatory costs keep rising.

Yet while earnings expectations are improving, investors should still be aware of how Star Bulk's US$1.12 billion debt load could limit...

Read the full narrative on Star Bulk Carriers (it's free!)

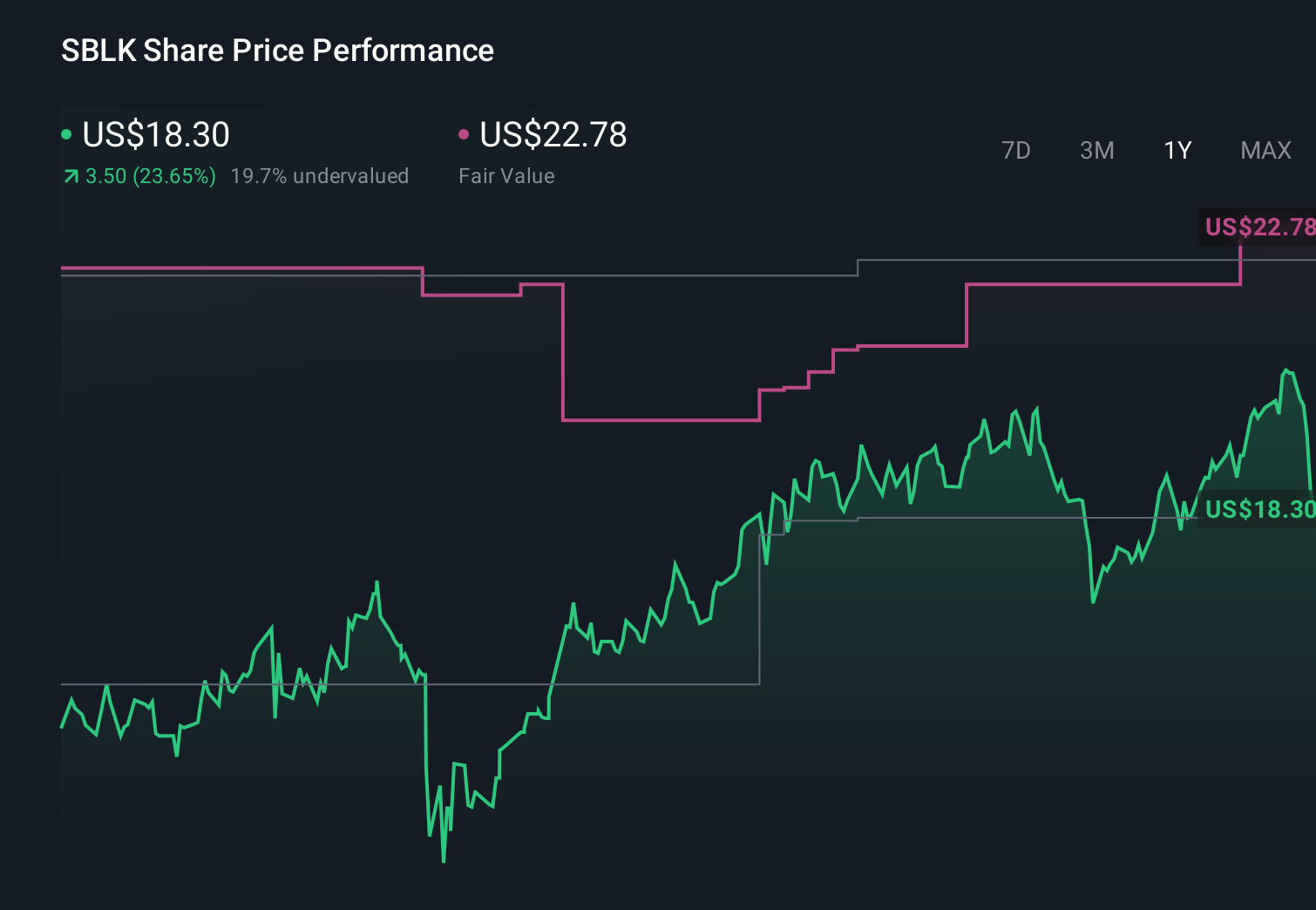

Star Bulk Carriers' narrative projects $1.0 billion revenue and $521.3 million earnings by 2028. This implies revenue declining by 3.8% per year and an earnings increase of about $397 million from $124.2 million today.

Uncover how Star Bulk Carriers' forecasts yield a $22.78 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see fair value anywhere between US$22.78 and US$108.49 per share, underlining how far opinions can stretch. Set this against the risk that structurally flat dry bulk trade volumes and an aging fleet may cap how much of any earnings recovery actually flows through over time, and it becomes worth examining several of these viewpoints before deciding how Star Bulk fits into your portfolio.

Explore 7 other fair value estimates on Star Bulk Carriers - why the stock might be worth just $22.78!

Build Your Own Star Bulk Carriers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Star Bulk Carriers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Star Bulk Carriers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Star Bulk Carriers' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报