How Investors May Respond To Delta Air Lines (DAL) Leadership Transition And New Wells Fargo Coverage

- Delta Air Lines recently announced that long-time president Glen Hauenstein will retire in February 2026, with current network planning head Joe Esposito stepping up as E.V.P. – Chief Commercial Officer while Hauenstein remains a strategic advisor through the end of 2026.

- At the same time, Wells Fargo has begun covering Delta with a favorable view, emphasizing the airline’s strength in premium travel and loyalty economics as key elements of its commercial profile.

- We’ll now examine how Wells Fargo’s constructive sector stance and Esposito’s expanded commercial role may influence Delta’s existing investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Delta Air Lines Investment Narrative Recap

To own Delta, you generally need to believe its focus on premium cabins, loyalty and a disciplined capacity plan can offset softer main cabin and corporate demand. The Hauenstein retirement and Esposito promotion look more like planned continuity than a change that materially alters the near term catalyst around protecting margins and free cash flow, or the key risk that a weaker economy could pressure main cabin volumes and pricing.

The most directly related development is Wells Fargo’s new, positive coverage of Delta, which leans heavily on the same premium and loyalty story that Esposito will now oversee. That aligns with the current catalyst of resilient premium, loyalty and international revenue supporting cash generation, even as investors weigh ongoing risks from economic uncertainty and competition in lower fare segments.

Yet while premium and loyalty look comparatively resilient, investors should still be paying close attention to the risk that...

Read the full narrative on Delta Air Lines (it's free!)

Delta Air Lines' narrative projects $68.4 billion revenue and $4.6 billion earnings by 2028. This requires 3.4% yearly revenue growth and a modest $0.1 billion earnings increase from $4.5 billion today.

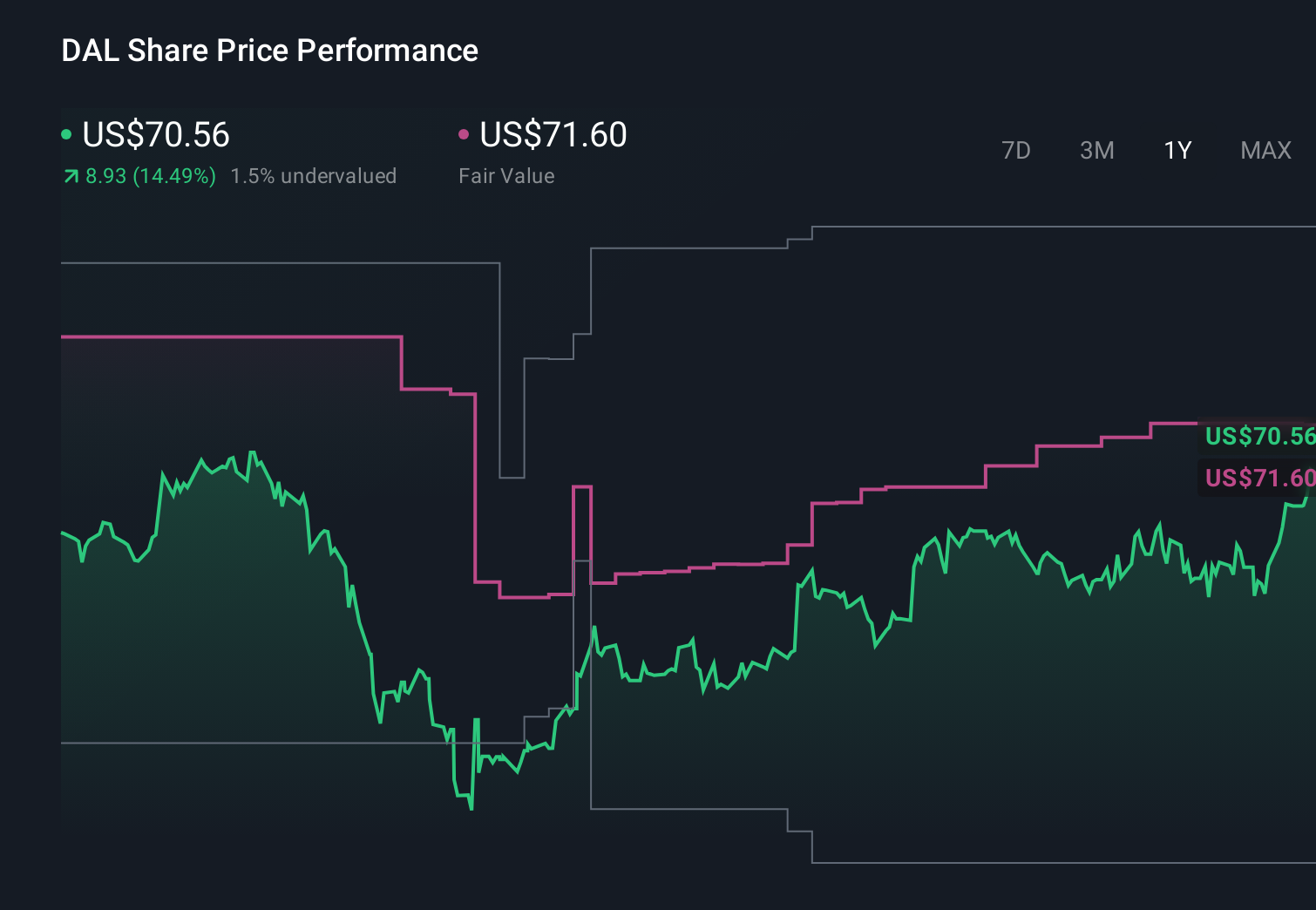

Uncover how Delta Air Lines' forecasts yield a $73.64 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community value Delta anywhere between about US$40.57 and US$143.04 per share, showing how far apart individual views can be. When you set those opinions against the current focus on margin protection through flat capacity growth, it underlines why many investors like to compare several different narratives before deciding what Delta’s future might mean for its share price.

Explore 9 other fair value estimates on Delta Air Lines - why the stock might be worth 42% less than the current price!

Build Your Own Delta Air Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delta Air Lines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报