Is There Now an Opportunity in Watsco After 25% Share Price Slide in 2025?

- Whether you are wondering if Watsco is starting to look like a bargain after a rough patch in the share price, or if the market is signaling a need for caution, this article is designed to give you a clear, valuation-first look.

- Watsco has drifted lower this year, with the stock down about 25.7% year to date and 26.2% over the last 12 months, even though longer term holders are still sitting on gains of roughly 49.5% over 3 years and 71.0% over 5 years.

- Recent headlines have focused on Watsco's strategic positioning in HVAC distribution, its role in the transition to higher efficiency and lower emission equipment, and ongoing investments in technology that make it easier for contractors to do business with the company. Together, these themes help explain why sentiment has cooled in the short term while the longer term story around energy efficiency, replacement demand, and market share remains firmly in play.

- Right now Watsco only scores a 2 out of 6 on our basic undervaluation checks. In this article, we will walk through what different valuation methods are saying about the stock today, and then finish with a more nuanced way to think about Watsco's true value beyond the usual ratios and models.

Watsco scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Watsco Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today. For Watsco, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $515.9 Million and then applies analyst forecasts for the next few years, with later years extrapolated by Simply Wall St.

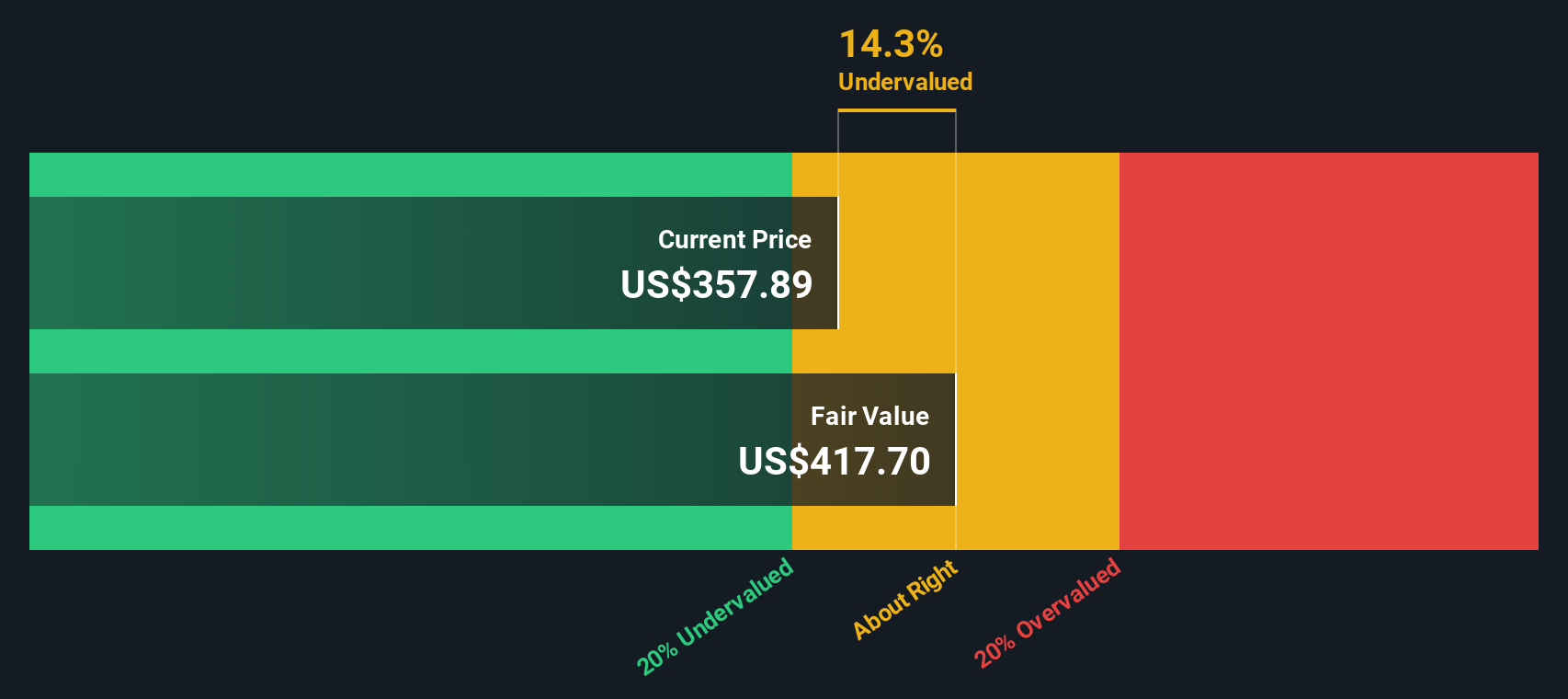

On this basis, Watsco's free cash flow is expected to grow steadily, reaching roughly $1.18 Billion in ten years. Aggregating and discounting these projected cash flows results in an intrinsic value estimate of about $479 per share. Compared with the current share price, this implies the stock is trading at a 27.3% discount. This suggests that the market is not fully pricing in Watsco's future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Watsco is undervalued by 27.3%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Watsco Price vs Earnings

For a consistently profitable business like Watsco, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. What counts as a normal or fair PE depends largely on how fast earnings are expected to grow and how risky those earnings are; faster, more reliable growth can justify a higher multiple, while slower or less predictable profits typically deserve a lower one.

Watsco currently trades on a PE of about 27.1x, which is richer than both the Trade Distributors industry average of roughly 20.1x and the peer group average near 18.2x. To go beyond these simple comparisons, Simply Wall St estimates a Fair Ratio of 23.5x. This proprietary metric reflects Watsco's specific mix of earnings growth, margins, industry dynamics, market cap and risk profile, making it a more tailored benchmark than broad peer or sector averages.

With the actual PE of 27.1x sitting above the Fair Ratio of 23.5x by a reasonable margin, the multiple based view suggests Watsco is trading at a premium to what its fundamentals alone would imply.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Watsco Narrative

Earlier we mentioned that there is an even better way to understand valuation. So let's introduce you to Narratives, a simple way to connect your view of Watsco's story with a concrete forecast and a Fair Value you can compare to today's share price.

A Narrative on Simply Wall St is your story behind the numbers, where you set out how you expect Watsco's revenue, earnings and margins to evolve. The platform then turns that perspective into a financial forecast and an estimated Fair Value.

Because Narratives live in the Community page used by millions of investors, they are easy to access, quick to adjust and automatically updated when new information, like fresh earnings or news on Southern demand, changes the outlook.

For example, one bullish Watsco Narrative might lean toward the higher analyst target near $550 by assuming strong A2L adoption, healthier margins and a premium PE. A more cautious Narrative could instead anchor closer to the $368 low target by baking in softer HVAC demand, slower growth and a lower multiple, giving each investor a tailored signal based on how their Fair Value compares with the current price.

Do you think there's more to the story for Watsco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报