How Unicharm’s Ultra‑Low‑Water Diaper Recycling Breakthrough At Unicharm (TSE:8113) Has Changed Its Investment Story

- In December 2025, Unicharm announced it had developed a “Dry Washing Method” for its RefF disposable diaper recycling project, cutting water use in the washing process to about one-fiftieth of its previous in-house methods by using reusable solvents plus proprietary sterilization and bleaching technologies.

- This advance could help turn used disposable diapers into reusable resources even in regions with limited water infrastructure, broadening the potential reach of diaper recycling worldwide.

- Next, we’ll look at how this water-saving Dry Washing Method could influence Unicharm’s investment narrative and long-term competitive positioning.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Unicharm's Investment Narrative?

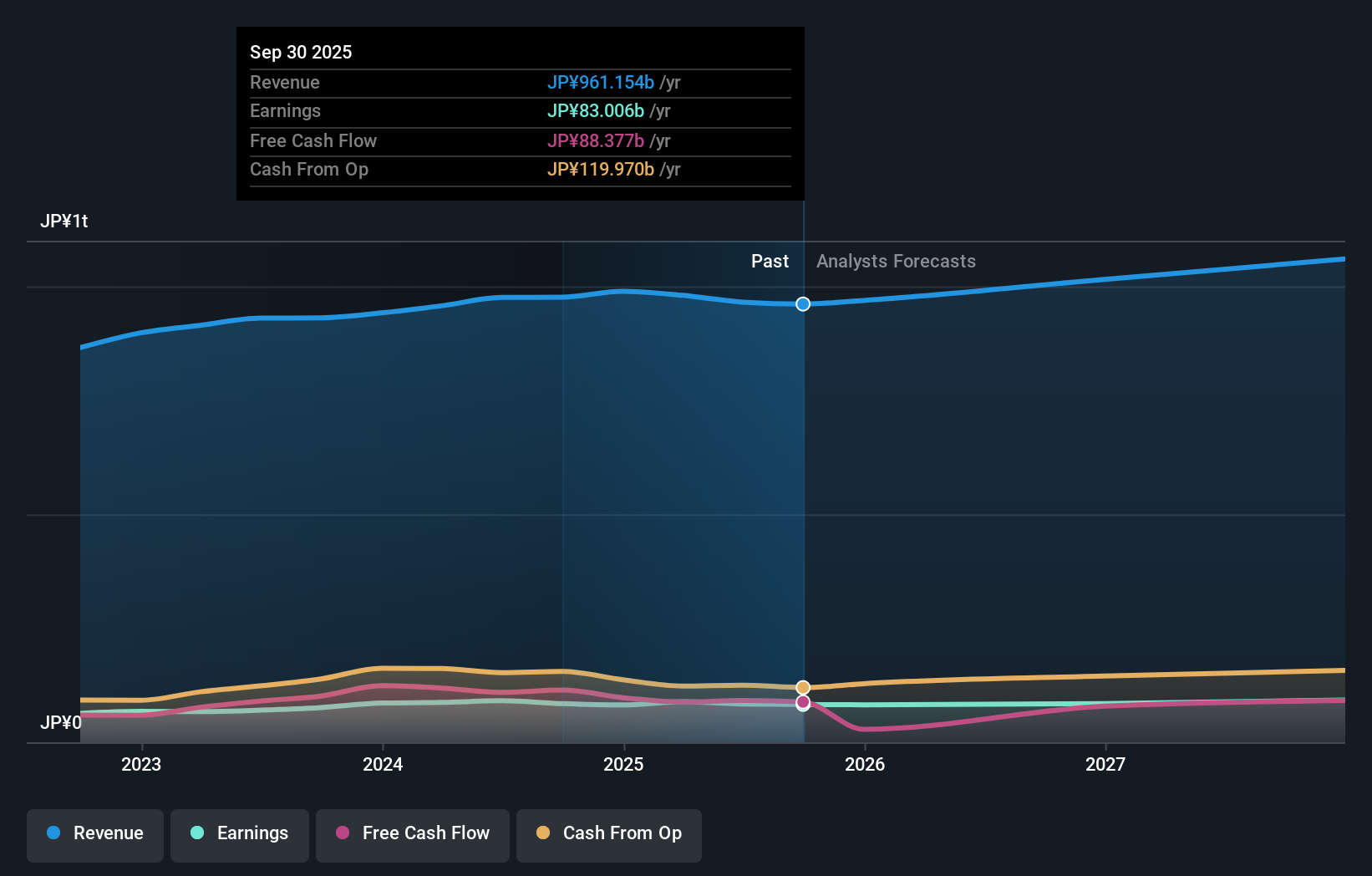

To own Unicharm, you need to believe its core hygiene brands can convert modest, steady growth and high‑quality earnings into attractive long‑term compounding, even after a tough share price stretch and slower forecast growth than the broader Japanese market. Recent guidance cuts for 2025, softer profit margins and a relatively full P/E versus peers keep near‑term execution and input‑cost management in focus, while a lower dividend payout shifts more emphasis onto buybacks and internal reinvestment. Against that backdrop, the new Dry Washing Method looks more like a long‑term optionality play than a near‑term catalyst, but it does strengthen Unicharm’s sustainability story and could, over time, reinforce its competitive positioning in emerging markets. For now, the immediate drivers remain earnings delivery, cost discipline and capital allocation.

Unicharm's shares have been on the rise but are still potentially undervalued by 42%. Find out what it's worth.Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate clusters at about ¥1,547.91, while recent weakness in earnings momentum and reduced 2025 guidance give that optimism a real test and highlight why opinions can diverge. You can use these contrasting views to weigh the potential of innovations like the Dry Washing Method against softer near‑term expectations.

Explore another fair value estimate on Unicharm - why the stock might be worth as much as 72% more than the current price!

Build Your Own Unicharm Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unicharm research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Unicharm research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unicharm's overall financial health at a glance.

No Opportunity In Unicharm?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报