Abercrombie & Fitch (ANF): Assessing Valuation After Holiday Growth Plan, 2025 Record Sales Outlook and Unified Commerce Push

Abercrombie & Fitch (ANF) just put an ambitious holiday playbook on the table, pairing record 2025 sales targets with a tech heavy unified commerce push that has clearly brightened the mood around the stock.

See our latest analysis for Abercrombie & Fitch.

The holiday growth plans and unified commerce rollout appear to have flipped sentiment, with a 70.32% one month share price return signaling powerful short term momentum. The one year total shareholder return remains negative, but the five year total shareholder return is still very strong.

If this kind of rebound has your attention, it could be a smart moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

After that kind of spike, though, the stock now trades above some analyst targets and at a premium to its own implied value. Is this simply momentum, or a genuine entry point before the market fully prices in future growth?

Most Popular Narrative: 6.7% Overvalued

With Abercrombie & Fitch last closing at $118.68 against a narrative fair value near $111, the current share price leans ahead of its modeled trajectory.

The analysts have a consensus price target of $114.625 for Abercrombie & Fitch based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $84.0.

Want to see what kind of slowing earnings, steady top line growth, and shrinking margins still justify a richer future multiple than today? The narrative lays out the full math.

Result: Fair Value of $111.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including tariff headwinds and renewed promotional intensity, that could squeeze margins and challenge the upbeat earnings narrative.

Find out about the key risks to this Abercrombie & Fitch narrative.

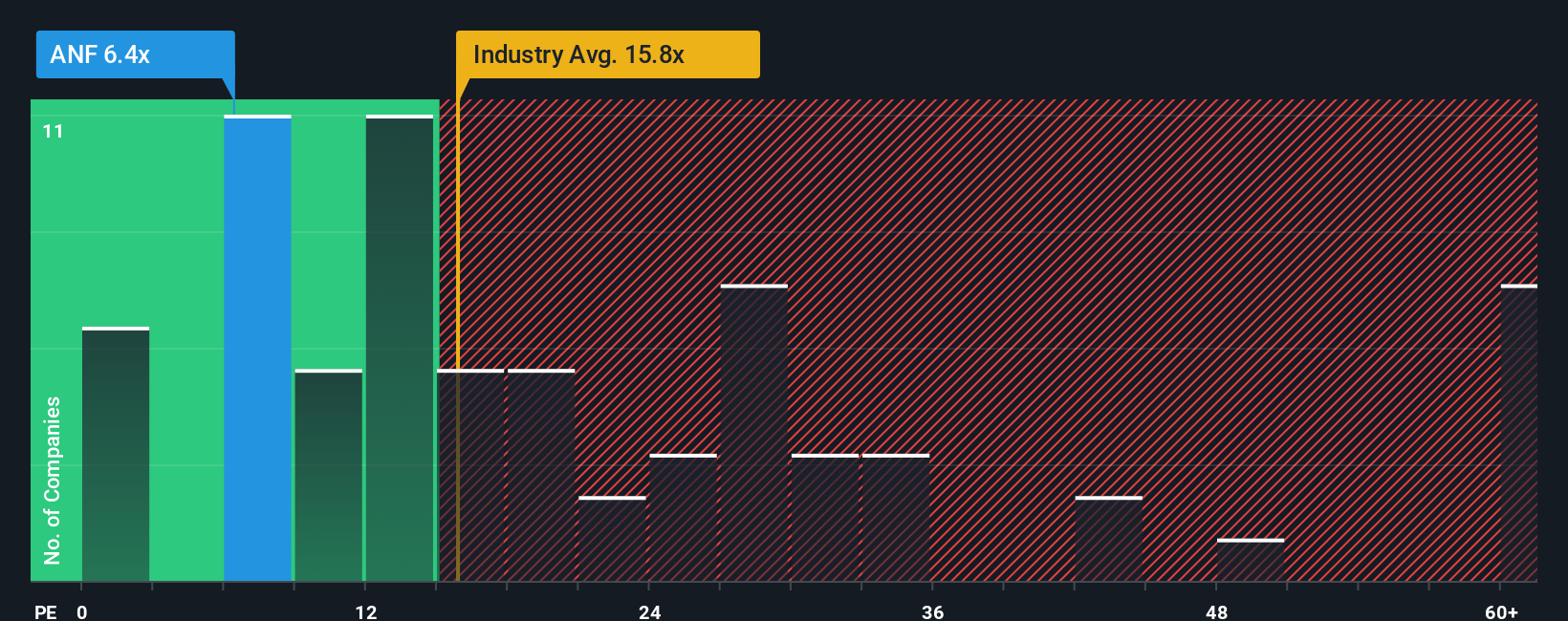

Another View: Earnings Multiple Says Cheap, Not Rich

While the narrative model sees Abercrombie & Fitch as 6.7% overvalued, the price to earnings lens tells a different story. At about 10.4 times earnings versus 21.1 times for the US Specialty Retail industry and a 13.9 times fair ratio, the stock screens as discounted, not stretched. Is the market underestimating how long this earnings power can last?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Abercrombie & Fitch Narrative

And if you see the story differently or want to dig into the numbers yourself, you can build a full narrative in minutes, Do it your way.

A great starting point for your Abercrombie & Fitch research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Abercrombie & Fitch has sparked your interest, do not stop here. Let Simply Wall Street’s powerful screener surface your next high conviction opportunity.

- Capture potential big movers early by reviewing these 3608 penny stocks with strong financials with improving fundamentals before the wider market catches on.

- Supercharge your growth hunt by targeting these 24 AI penny stocks at the forefront of real world artificial intelligence adoption.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that combine reliable payouts with solid financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报