UK Penny Stocks To Watch In December 2025

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. Despite such broader market fluctuations, penny stocks remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, these investments can still offer potential when backed by strong financial health and resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.95 | £157.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.82 | £12.38M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.685 | $398.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.49 | £180.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.49 | £71.95M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £179.44M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 302 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cavendish (AIM:CAV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cavendish plc, along with its subsidiaries, functions as an investment bank in the United Kingdom and has a market cap of £34.41 million.

Operations: The company generates revenue of £56.31 million from its Corporate Advisory and Broking, M&A Advisory, and Institutional Stockbroking segments.

Market Cap: £34.41M

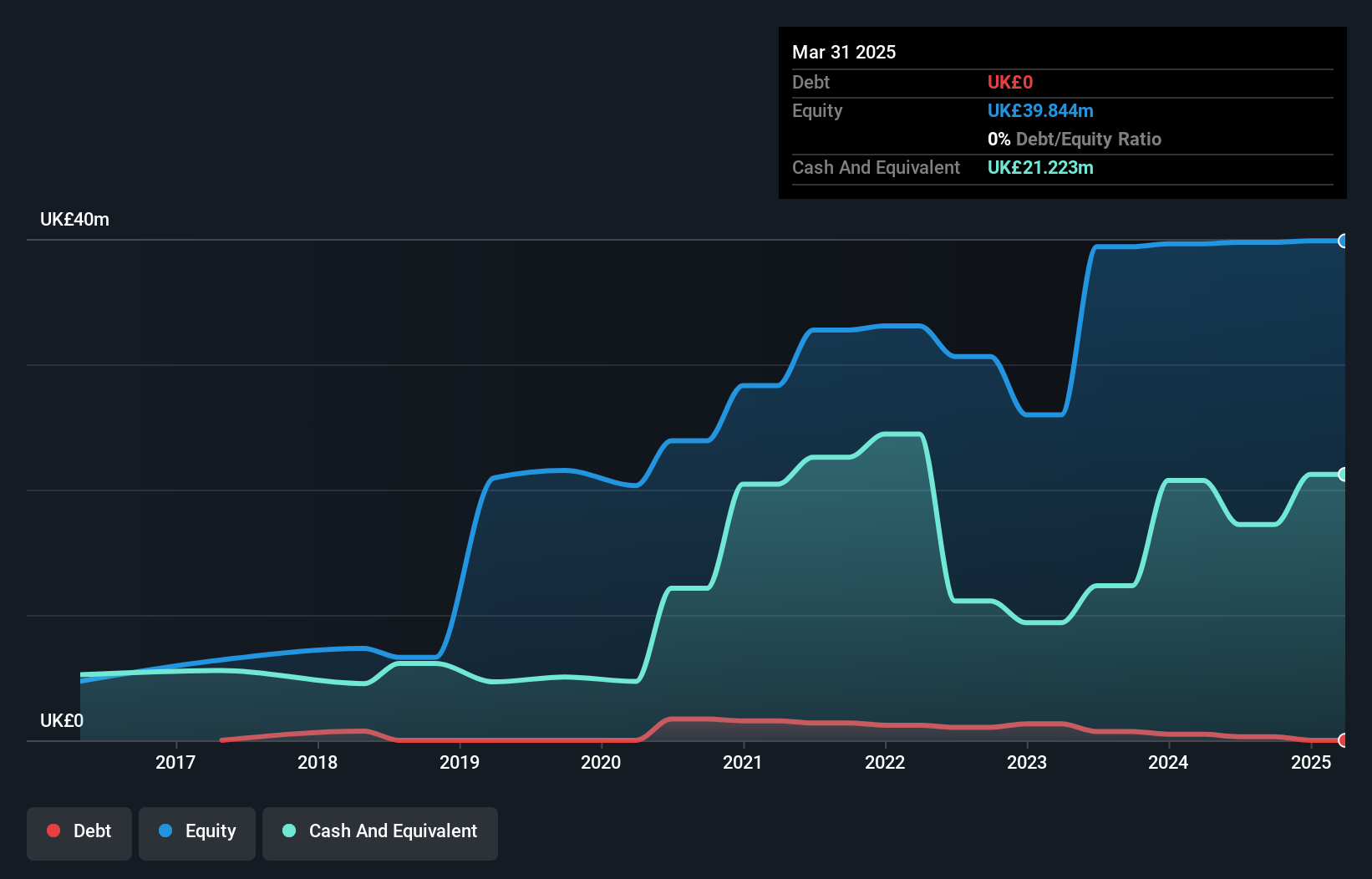

Cavendish plc, with a market cap of £34.41 million, has shown promising developments as it transitions to profitability. Recent earnings reports indicate net income growth to £0.726 million for the half-year ended September 2025, reflecting improved financial health despite a historically low return on equity of 3.7%. The company is debt-free and maintains strong short-term asset coverage over liabilities, but its dividend yield of 5.85% is not well-supported by earnings alone. While the board's average tenure suggests inexperience, the management team is seasoned with an average tenure of 2.3 years, offering stability amid moderate volatility and no recent shareholder dilution.

- Navigate through the intricacies of Cavendish with our comprehensive balance sheet health report here.

- Learn about Cavendish's future growth trajectory here.

Kitwave Group (AIM:KITW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kitwave Group plc operates as a food and drink wholesaler in the United Kingdom, with a market capitalization of £177.52 million.

Operations: The company's revenue is derived from three main segments: Ambient (£222.49 million), Foodservice (£298.67 million), and Frozen & Chilled (£246.87 million).

Market Cap: £177.52M

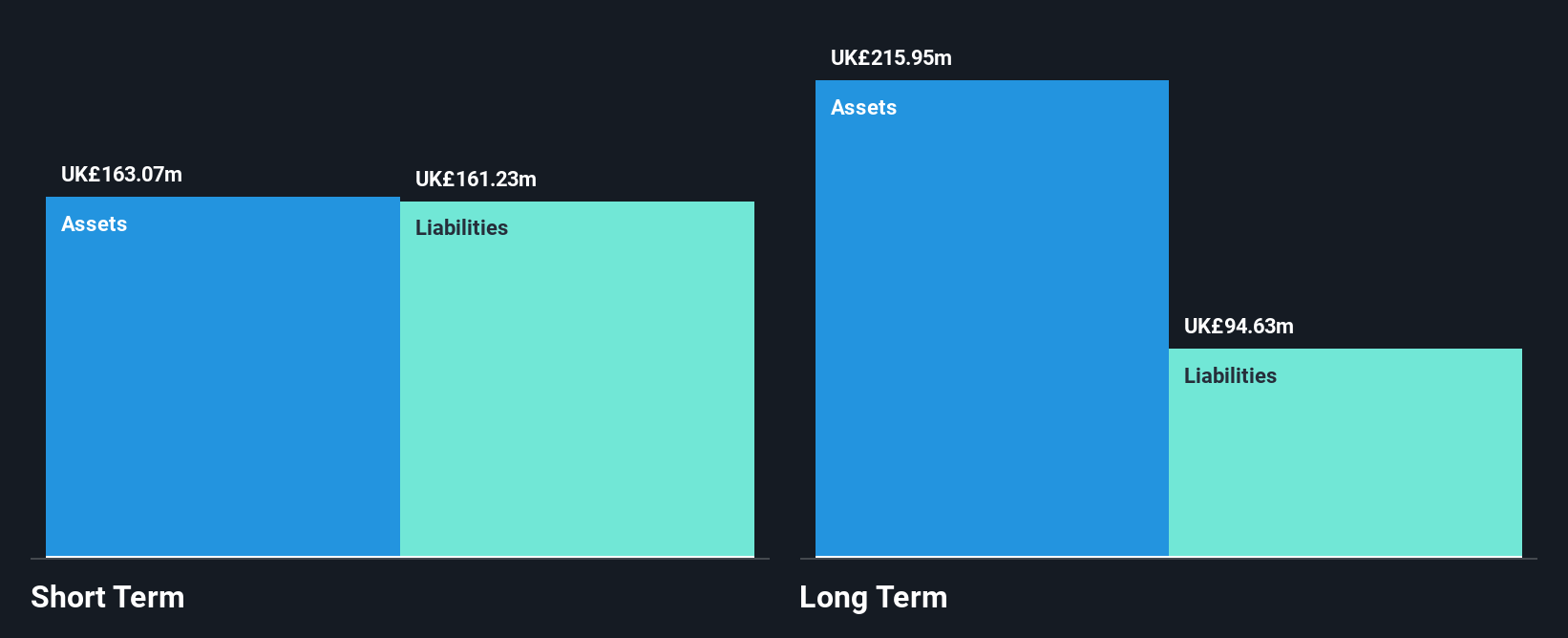

Kitwave Group plc, with a market cap of £177.52 million, operates across three segments: Ambient, Foodservice, and Frozen & Chilled. Despite high net debt to equity at 54.1%, the company's debt is well-covered by operating cash flow and EBIT covers interest payments 3.4 times over. The board is experienced; however, the management team has seen recent changes with an inexperienced average tenure of 1.2 years following the CFO's retirement announcement. Though earnings have declined recently, they are forecasted to grow annually by 15.46%. The stock trades below its estimated fair value and offers good relative value compared to peers.

- Click here and access our complete financial health analysis report to understand the dynamics of Kitwave Group.

- Evaluate Kitwave Group's prospects by accessing our earnings growth report.

OPG Power Ventures (AIM:OPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OPG Power Ventures Plc, along with its subsidiaries, focuses on developing, owning, operating, and maintaining private sector power projects in India and has a market cap of £22.84 million.

Operations: The company generates revenue from its thermal power segment, amounting to £156.74 million.

Market Cap: £22.84M

OPG Power Ventures, with a market cap of £22.84 million, is undergoing significant changes, including a proposed delisting from AIM and an equity buyback plan reduction. Despite generating £156.74 million in revenue from its thermal power segment, the company faces challenges such as low return on equity (0.9%) and declining earnings over recent years. However, OPG's financial position is bolstered by cash exceeding total debt and short-term assets covering liabilities comfortably. The management team is experienced with an average tenure of 4.3 years, while the share price remains highly volatile compared to most UK stocks.

- Dive into the specifics of OPG Power Ventures here with our thorough balance sheet health report.

- Learn about OPG Power Ventures' historical performance here.

Turning Ideas Into Actions

- Explore the 302 names from our UK Penny Stocks screener here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报