How Investors Are Reacting To IAMGOLD (TSX:IMG) Debt Repayment And Nearly 10% Share Buyback Plan

- In December 2025, IAMGOLD Corporation fully repaid its remaining US$130 million 2nd Lien Term Loan and received Toronto Stock Exchange approval to launch a normal course issuer bid to repurchase up to 57 million shares, or about 9.92% of its public float.

- These balance sheet and capital allocation moves, coming as gold producers enjoy renewed interest, highlight IAMGOLD’s shift toward lower leverage and more active shareholder returns.

- We’ll now examine how IAMGOLD’s debt repayment and share buyback plan could reshape the company’s investment narrative for investors.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

IAMGOLD Investment Narrative Recap

To own IAMGOLD, you need to believe its core mines can convert higher production into durable cash flow while keeping costs under control, all in a supportive gold price backdrop. The full repayment of the US$130,000,000 2nd Lien Term Loan, combined with a share buyback of up to 57,000,000 shares, directly addresses leverage concerns and reinforces the near term catalyst around improving balance sheet strength, while asset concentration at Côté Gold and Essakane still stands out as the key risk.

Among the recent announcements, the launch of the normal course issuer bid is most relevant here, because it links IAMGOLD’s improving cash generation and reduced debt burden to a more visible capital return framework. For investors watching the Côté Gold ramp up and cost profile, the scale of the buyback program offers another lens on how management is prioritizing the use of excess cash in the context of these operational catalysts.

Yet investors should also factor in how concentrated exposure to a few key assets could amplify the impact of any disruption on...

Read the full narrative on IAMGOLD (it's free!)

IAMGOLD’s narrative projects $2.5 billion revenue and $553.7 million earnings by 2028.

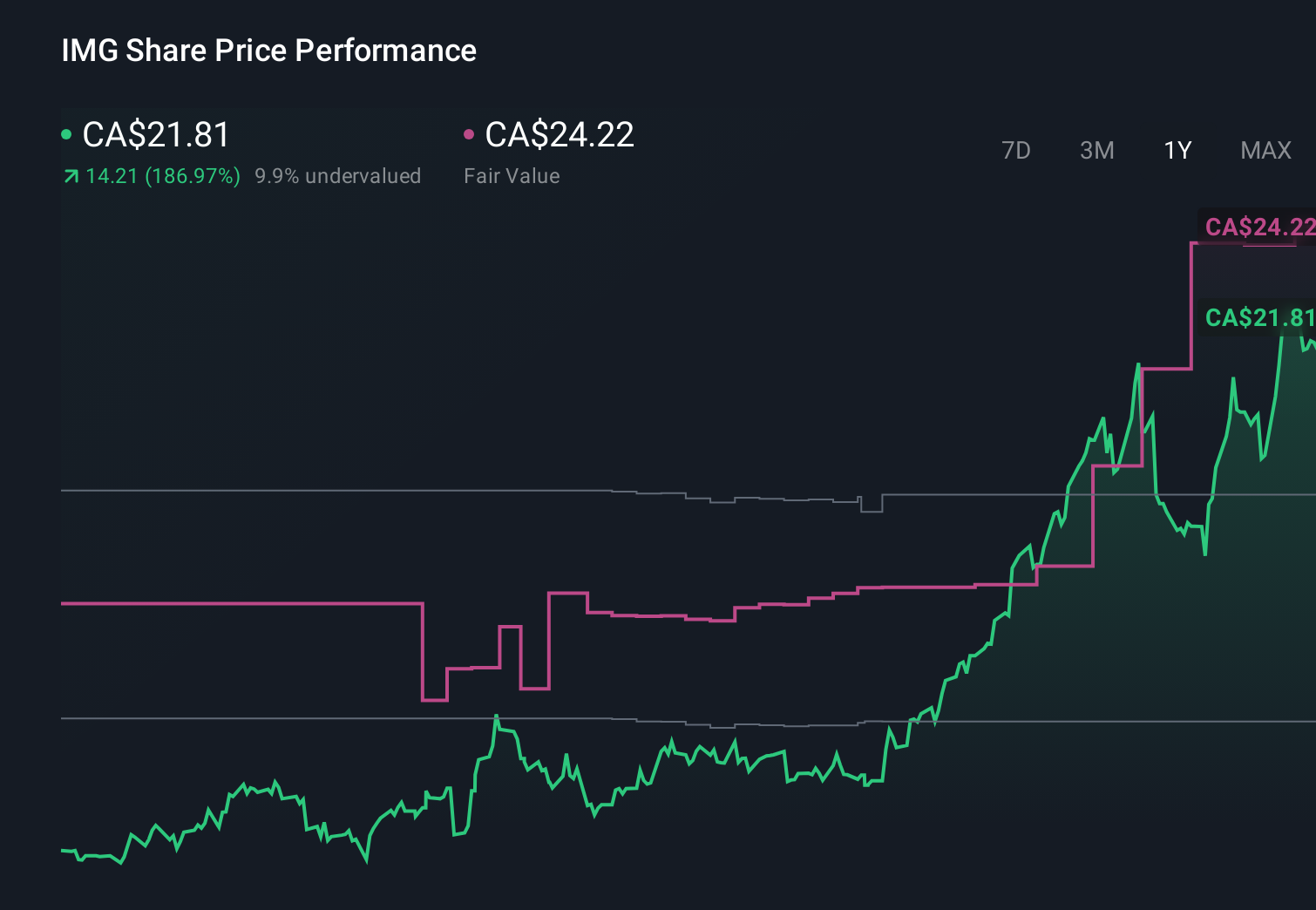

Uncover how IAMGOLD's forecasts yield a CA$24.69 fair value, a 11% upside to its current price.

Exploring Other Perspectives

The 11 fair value estimates from the Simply Wall St Community span roughly CA$11.04 to CA$62.75, reflecting very different views on IAMGOLD’s upside. Against that backdrop, the recent debt repayment and planned buybacks sharpen the focus on whether balance sheet progress can offset ongoing concentration and cost risks for the business.

Explore 11 other fair value estimates on IAMGOLD - why the stock might be worth over 2x more than the current price!

Build Your Own IAMGOLD Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IAMGOLD research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IAMGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IAMGOLD's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报