Life Time (LTH) Valuation Check as New Otay Ranch Club Expands Its California Footprint

Life Time Group Holdings (LTH) just cut the ribbon on its new Otay Ranch club in Chula Vista, a ground up build that doubles its San Diego presence and nudged the stock higher.

See our latest analysis for Life Time Group Holdings.

That enthusiasm fits a broader pattern, with the share price up 18.0% year to date and the 1 year total shareholder return at 18.4%. Meanwhile, a hefty 117.99% 3 year total shareholder return signals that long term momentum is still very much intact.

If this kind of expansion story has your attention, it might be worth scanning fast growing stocks with high insider ownership to see what other fast growing, management backed names the market is starting to notice.

With shares still trading at a steep discount to Wall Street’s price target despite solid double digit growth, investors now face a key question: is Life Time genuinely undervalued, or is the market already pricing in its next phase of expansion?

Most Popular Narrative Narrative: 33.8% Undervalued

With the narrative fair value sitting well above Life Time Group Holdings last close at $26.42, the story hinges on whether growth can keep compounding.

The expanding pipeline of new and larger club openings in affluent and high density markets positions Life Time for sustained membership and top line revenue growth, benefiting from the growing consumer demand for premium health, wellness, and lifestyle experiences.

Accelerating growth in ancillary, higher margin services including personal training, Life Time Digital offerings, nutritional supplements, and health or wellness programs supports increased average revenue per member and improved net margins as consumer expectations shift toward holistic wellness.

Want to see the math behind this optimism, from ambitious revenue ramps to richer margins and a punchy future earnings multiple? The full narrative spells it out.

Result: Fair Value of $39.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup could unravel if capital intensive club expansion collides with tighter financing, or if affluent members pull back in a downturn.

Find out about the key risks to this Life Time Group Holdings narrative.

Another Angle on Value

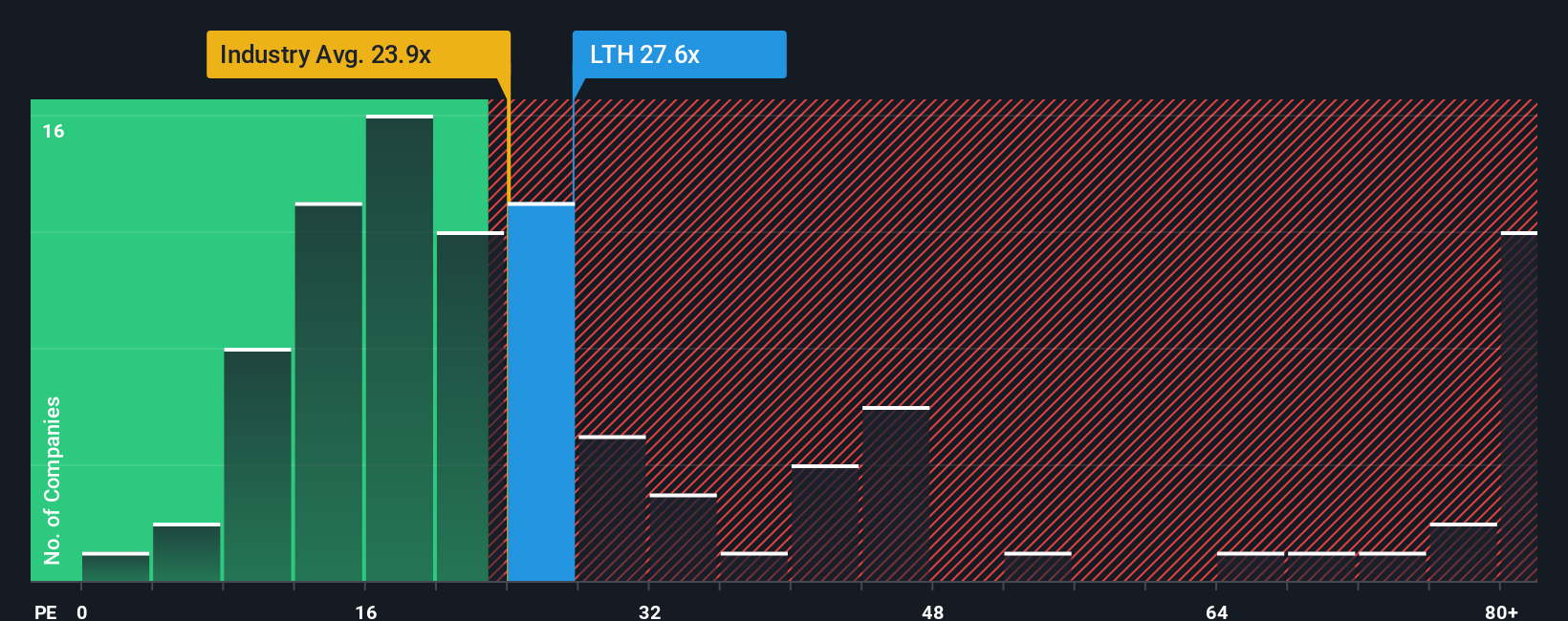

There is a twist when you compare Life Time’s earnings multiple to the market. At 20.2 times earnings, the stock trades cheaper than both the US Hospitality average at 23.5 times and peers at 25.4 times, and even below a 21.3 times fair ratio suggested by our analysis.

That discount hints at upside if sentiment catches up, but it also raises a question: is the market underestimating the growth story or quietly flagging balance sheet and execution risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Life Time Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Life Time Group Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Life Time Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover more stocks that fit your strategy before the market moves without you.

- Capitalize on breakthrough technologies by targeting companies at the forefront of artificial intelligence through these 24 AI penny stocks that could reshape entire industries.

- Lock in potential income streams by focusing on established businesses offering attractive yields with these 13 dividend stocks with yields > 3% that may strengthen portfolio cash flow.

- Ride the momentum of digital transformation by scanning these 80 cryptocurrency and blockchain stocks that are building real world solutions on blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报