ZIM Integrated Shipping Services (NYSE:ZIM): Reassessing Valuation After a 34% Three-Month Share Price Rebound

ZIM Integrated Shipping Services (NYSE:ZIM) has quietly outperformed over the past 3 months, with shares climbing roughly 34% even as annual revenue and earnings have been trending sharply lower.

See our latest analysis for ZIM Integrated Shipping Services.

That recent 30 day share price return of nearly 15% and 90 day share price return of around 34% contrast with a weaker year to date share price return. The 1 year and 3 year total shareholder returns suggest momentum is rebuilding as investors reassess earnings risk and potential recovery in global freight demand.

If ZIM’s rebound has you thinking about where else momentum could show up next, it might be a good time to explore fast growing stocks with high insider ownership.

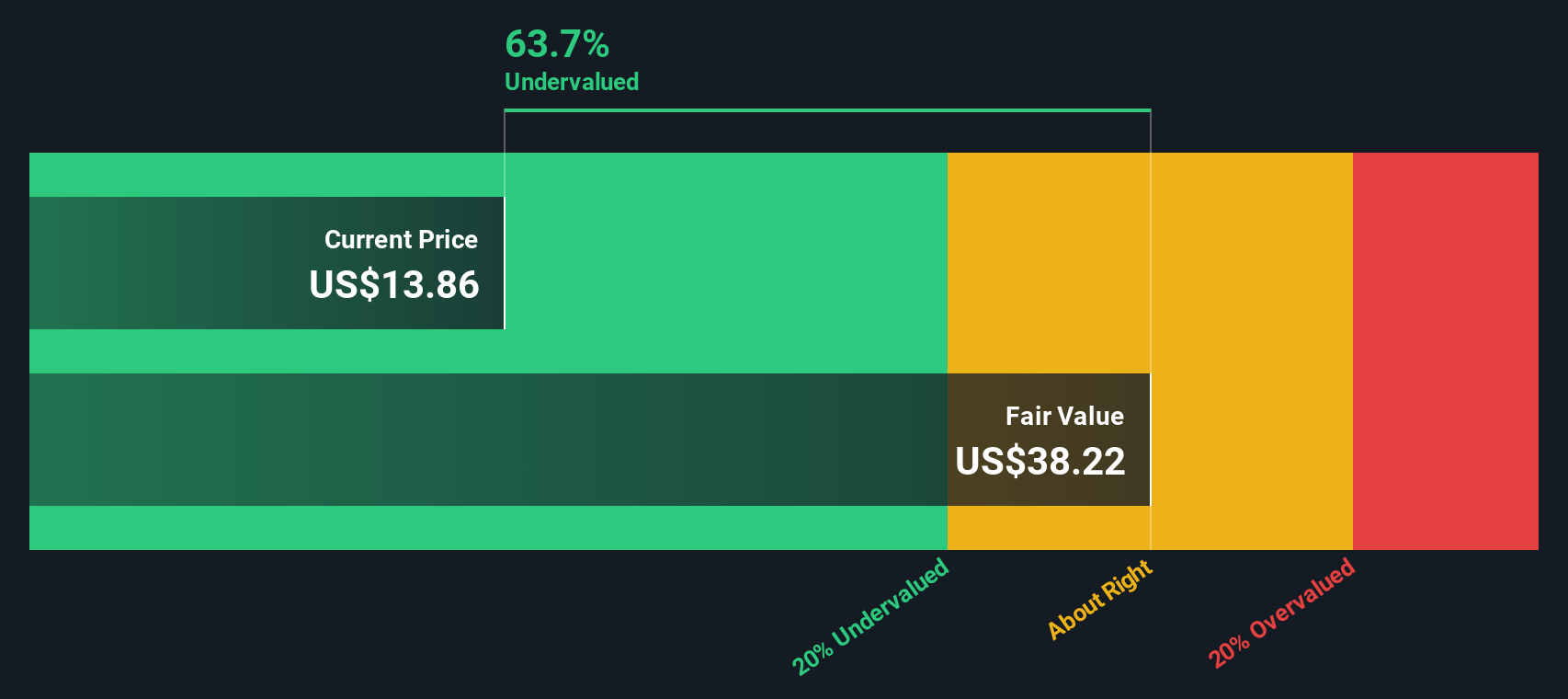

With earnings under pressure but the share price climbing and intrinsic value screens flagging a sizable discount, the real question is whether ZIM is now a contrarian bargain or whether the market already anticipates a freight rebound.

Most Popular Narrative Narrative: 49% Overvalued

Against a last close of $19.25, the most followed narrative sees fair value closer to $12.92, framing ZIM as richly priced despite recent momentum.

The company's significant exposure to volatile Transpacific trade leaves earnings highly sensitive to tariff changes and geopolitical shifts; the current overhang of U.S. China tariffs, unpredictable regulatory moves, and alliance restructurings threaten both volume and rate stability, challenging assumptions that future earnings will be resilient or steadily expanding.

Want to see why shrinking revenues, razor thin margins, and a lofty future earnings multiple still add up to this valuation call? The full narrative unpacks the math, the timelines, and the assumptions driving that price tag.

Result: Fair Value of $12.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if ZIM’s LNG powered fleet upgrades and trade lane diversification translate into stronger margins, today’s overvaluation narrative could quickly look outdated.

Find out about the key risks to this ZIM Integrated Shipping Services narrative.

Another Angle on Value

While the consensus narrative flags ZIM as nearly 49% overvalued, our cash flow focused lens tells a different story. The SWS DCF model suggests shares at $19.25 trade roughly 55% below an estimated fair value of about $42.60. This indicates a potentially significant valuation gap if cash flows normalize.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ZIM Integrated Shipping Services Narrative

If you are not fully convinced by this view, or simply prefer to dig into the numbers yourself, you can craft a fresh perspective in just a few minutes: Do it your way.

A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Broaden your watchlist with hand picked ideas that match your strategy so you are not late to the next move.

- Capture high yielding income potential by scanning these 13 dividend stocks with yields > 3% that aim to balance reliable payouts with underlying business strength.

- Position yourself early in transformative technologies by reviewing these 24 AI penny stocks that could benefit from accelerating adoption of artificial intelligence across industries.

- Strengthen your value hunting toolkit by screening these 915 undervalued stocks based on cash flows that appear mispriced relative to their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报