Undervalued Small Caps With Insider Activity To Consider In December 2025

As of December 2025, the U.S. stock market is experiencing a downturn, with major indexes like the S&P 500 and Dow Jones Industrial Average posting their fourth consecutive losses amid concerns over an AI bubble and rising unemployment rates. Despite these challenges, small-cap stocks can offer unique opportunities for investors looking to diversify their portfolios, particularly when there is notable insider activity indicating potential confidence in a company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 11.1x | 3.0x | 37.42% | ★★★★★☆ |

| Wolverine World Wide | 17.6x | 0.8x | 36.34% | ★★★★★☆ |

| Merchants Bancorp | 8.4x | 2.8x | 46.81% | ★★★★★☆ |

| Innovative Industrial Properties | 13.1x | 5.7x | 47.29% | ★★★★★☆ |

| First United | 10.7x | 3.2x | 41.21% | ★★★★☆☆ |

| Metropolitan Bank Holding | 13.2x | 3.2x | 27.37% | ★★★★☆☆ |

| S&T Bancorp | 12.1x | 4.1x | 33.71% | ★★★☆☆☆ |

| Farmland Partners | 6.8x | 8.4x | -99.02% | ★★★☆☆☆ |

| Infinity Natural Resources | NA | 0.7x | -4.10% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -11.18% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

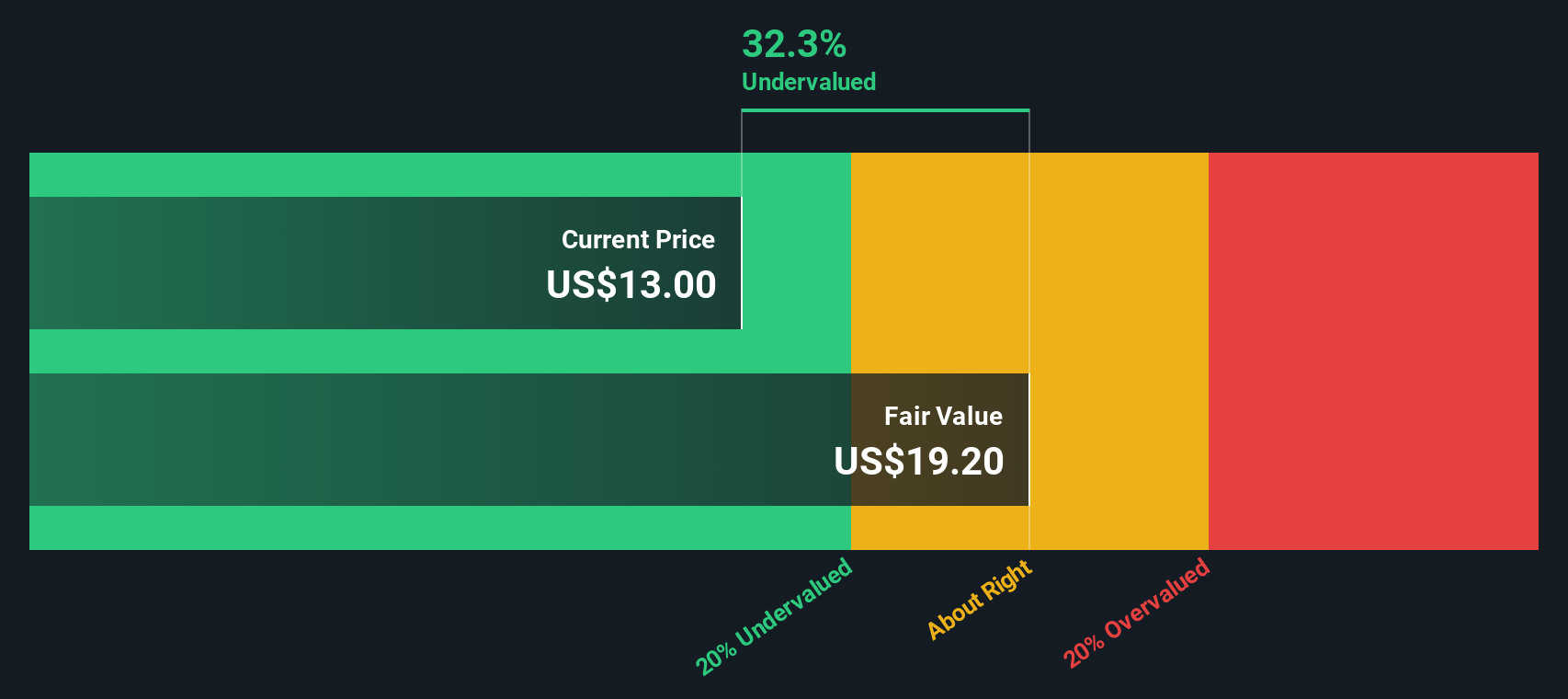

Diversified Healthcare Trust (DHC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diversified Healthcare Trust operates in the healthcare real estate sector, focusing on medical office and life science properties as well as senior housing, with a market capitalization of approximately $1.18 billion.

Operations: Revenue is predominantly derived from the Senior Housing Operating Portfolio (SHOP) at $1.30 billion, followed by the Medical Office and Life Science Portfolio at $197.74 million. The company's cost of goods sold (COGS) has seen an increase over time, impacting its gross profit margin, which was last reported at 17.49%. Operating expenses have consistently included depreciation and amortization along with general and administrative costs, influencing net income figures that have fluctuated significantly in recent periods.

PE: -3.5x

Diversified Healthcare Trust, a smaller company in the U.S. market, recently reported Q3 2025 earnings with revenue of US$388.71 million, up from US$373.64 million the previous year, despite a net loss increase to US$164.04 million. Insider confidence is evident as they made significant share purchases between September and November 2025. The company completed a private offering of US$375 million in senior secured notes to refinance debt due in 2026 and fund general business needs, reflecting strategic financial maneuvers amidst current unprofitability challenges.

- Get an in-depth perspective on Diversified Healthcare Trust's performance by reading our valuation report here.

Understand Diversified Healthcare Trust's track record by examining our Past report.

Greenlight Capital Re (GLRE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Greenlight Capital Re is a reinsurance company that provides property and casualty reinsurance services, with a market capitalization of approximately $0.22 billion.

Operations: Greenlight Capital Re generates revenue primarily from its Open Market segment, which accounts for $590.39 million, with additional contributions from Innovations at $70.28 million. The company's cost of goods sold (COGS) significantly impacts its gross profit margin, which has shown fluctuations over the years, reaching 20.64% in Q3 2023 and dropping to 7.88% by Q2 2025. Operating expenses have varied but are a notable component of overall costs alongside non-operating expenses that also influence net income results across periods observed.

PE: -266.5x

Greenlight Capital Re, a small company in the insurance sector, has recently shown insider confidence with Greg Richardson purchasing 50,000 shares for US$637,300. Despite facing challenges with third-quarter revenue dropping to US$146.07 million from US$188.01 million last year and reporting a net loss of US$4.41 million, the company repurchased 512,527 shares for US$7 million as part of its buyback program initiated in May 2025. This activity suggests potential realignment towards shareholder value amidst funding sourced entirely from external borrowing rather than deposits.

- Delve into the full analysis valuation report here for a deeper understanding of Greenlight Capital Re.

Gain insights into Greenlight Capital Re's past trends and performance with our Past report.

Oxford Industries (OXM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Oxford Industries is a lifestyle apparel company that operates brands such as Johnny Was, Tommy Bahama, and Lilly Pulitzer, with a market cap of approximately $1.70 billion.

Operations: The company's revenue is primarily driven by Tommy Bahama, Lilly Pulitzer, and Emerging Brands. Over recent periods, the gross profit margin has shown an upward trend, reaching 63.35% in early 2024 before slightly decreasing to 61.71% by late 2025. Operating expenses are significant and include general administrative costs and sales & marketing expenses.

PE: -189.4x

Oxford Industries, a smaller U.S. company, has faced challenges with recent financial performance. For the third quarter ending November 1, 2025, they reported a net loss of US$63.68 million compared to a US$3.94 million loss the previous year. Despite this, insider confidence is evident through share purchases made earlier in the fiscal year, signaling potential belief in future growth prospects. The company maintains its quarterly dividend of US$0.69 per share and forecasts annual sales between US$1.47 billion and US$1.49 billion for fiscal 2025 amidst ongoing impairments impacting earnings projections.

Seize The Opportunity

- Embark on your investment journey to our 74 Undervalued US Small Caps With Insider Buying selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报