Revenues Tell The Story For Emerald Holding, Inc. (NYSE:EEX) As Its Stock Soars 33%

Emerald Holding, Inc. (NYSE:EEX) shareholders are no doubt pleased to see that the share price has bounced 33% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 6.1% isn't as impressive.

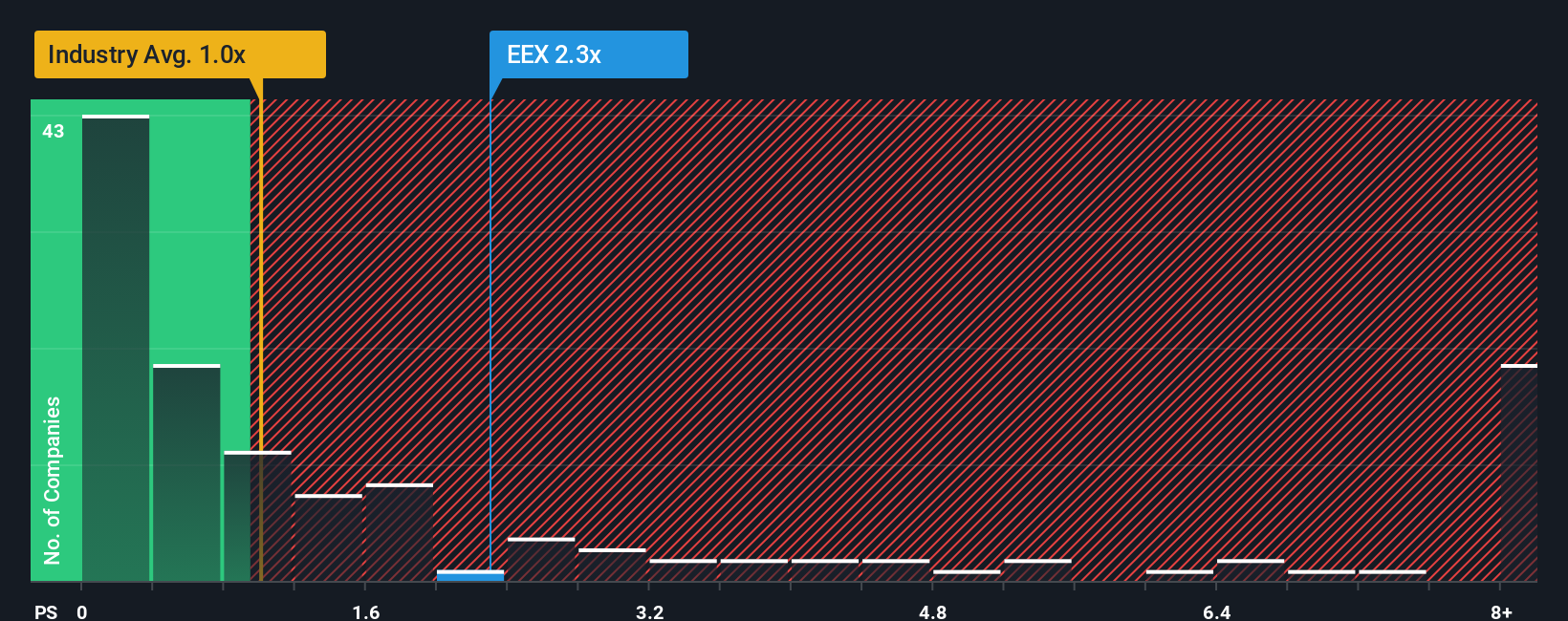

Since its price has surged higher, you could be forgiven for thinking Emerald Holding is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in the United States' Media industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Emerald Holding

How Has Emerald Holding Performed Recently?

Recent revenue growth for Emerald Holding has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Emerald Holding.How Is Emerald Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Emerald Holding's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 60% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.7%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Emerald Holding's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Emerald Holding's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Emerald Holding shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Emerald Holding (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报