3 Promising Penny Stocks With Market Caps Over $10M

As of December 2025, major U.S. stock indexes have been experiencing a downturn, with the S&P 500 and Dow Jones Industrial Average marking their fourth consecutive loss amid concerns over an AI bubble. In such volatile times, investors often seek opportunities in smaller or less-established companies that can offer value and potential growth. Penny stocks, despite their somewhat outdated name, remain a relevant investment area for those willing to explore companies with solid financials and promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.61 | $604.34M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.885 | $681.73M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.01 | $184.7M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.175 | $534.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.235 | $1.35B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.77 | $612.73M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.415 | $356.04M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.885 | $6.43M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.84 | $87M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 336 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

MoneyHero (MNY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MoneyHero Limited operates a personal finance aggregation and comparison platform for banking, insurance, and other financial products, with a market cap of $61.09 million.

Operations: The company's revenue is primarily derived from its operations in Hong Kong ($29.12 million), Singapore ($28.12 million), Taiwan ($4.11 million), and the Philippines ($7.82 million).

Market Cap: $61.09M

MoneyHero Limited, with a market cap of US$61.09 million, has been navigating its transformation strategy by embedding AI into operations to drive revenue growth and improve margins. Despite being unprofitable, it reported Q3 2025 sales of US$21.12 million and a net loss of US$3.47 million, reflecting ongoing challenges in achieving consistent profitability. The company remains debt-free with short-term assets exceeding liabilities and is expanding its digital asset offerings through partnerships like the one with HashKey Group in Hong Kong. However, management's limited experience may be a concern for investors seeking stability in this volatile penny stock space.

- Click here to discover the nuances of MoneyHero with our detailed analytical financial health report.

- Review our growth performance report to gain insights into MoneyHero's future.

Definitive Healthcare (DH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Definitive Healthcare Corp., along with its subsidiaries, offers a SaaS healthcare commercial intelligence platform both in the United States and internationally, with a market cap of $322.97 million.

Operations: The company generates revenue from its Internet Information Providers segment, amounting to $242.28 million.

Market Cap: $322.97M

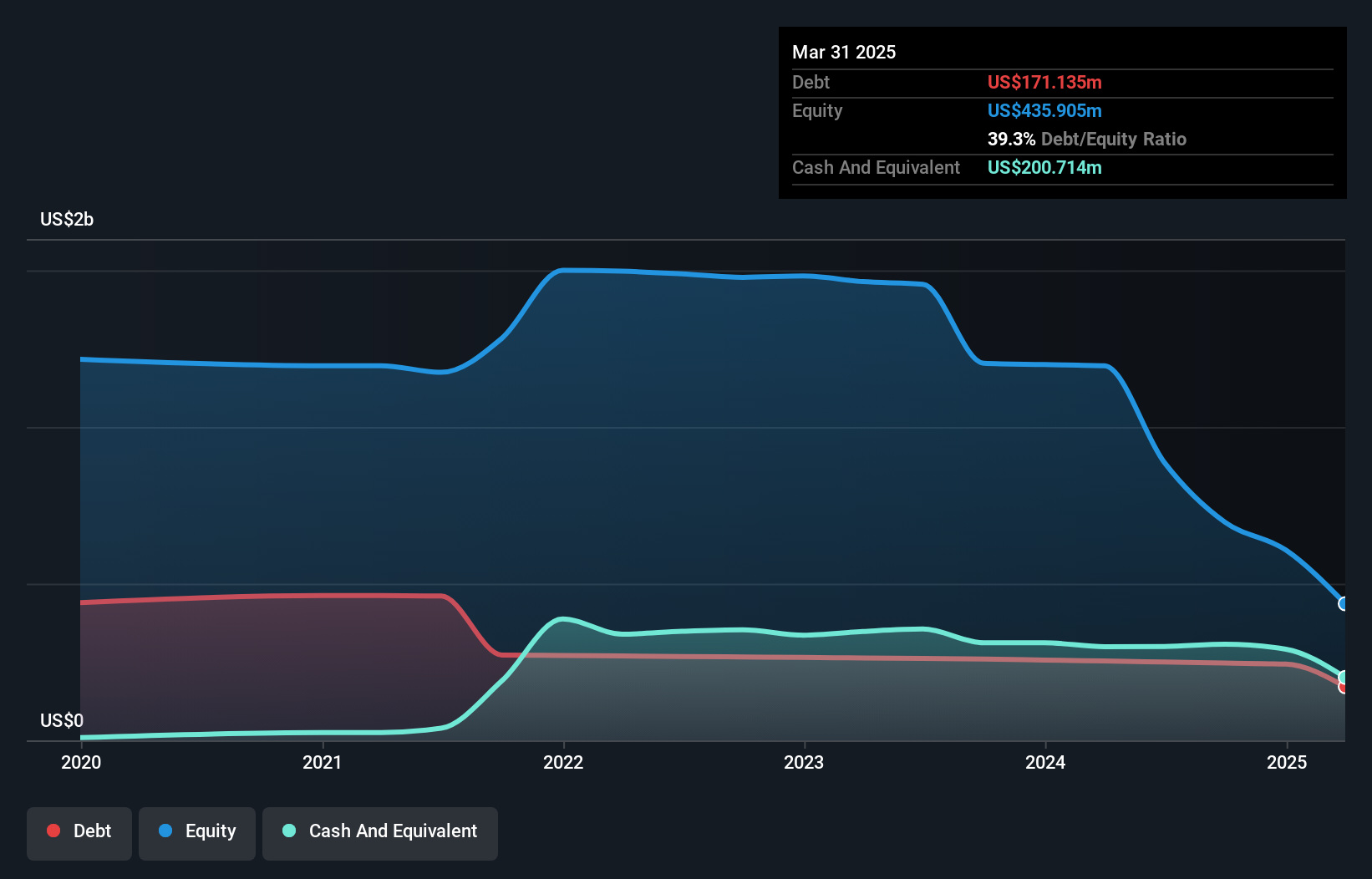

Definitive Healthcare Corp., with a market cap of US$322.97 million, operates in the SaaS healthcare sector and has shown resilience despite being unprofitable. The company reported Q3 2025 sales of US$60.05 million, a decrease from the previous year, yet significantly reduced its net loss to US$14.84 million from US$130.9 million year-over-year. It has maintained a strong cash position with assets exceeding liabilities and executed a significant share buyback program, repurchasing 13% of shares for US$51.41 million since November 2024, suggesting confidence in its valuation amidst ongoing financial challenges and an inexperienced management team.

- Jump into the full analysis health report here for a deeper understanding of Definitive Healthcare.

- Assess Definitive Healthcare's future earnings estimates with our detailed growth reports.

CV Sciences (CVSI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CV Sciences, Inc. develops, manufactures, markets, and sells herbal supplements, hemp-based cannabidiol (CBD), and plant-based food products in North America with a market cap of $16.03 million.

Operations: The company generates revenue primarily from its hemp-based CBD wellness products, totaling $14.37 million.

Market Cap: $16.03M

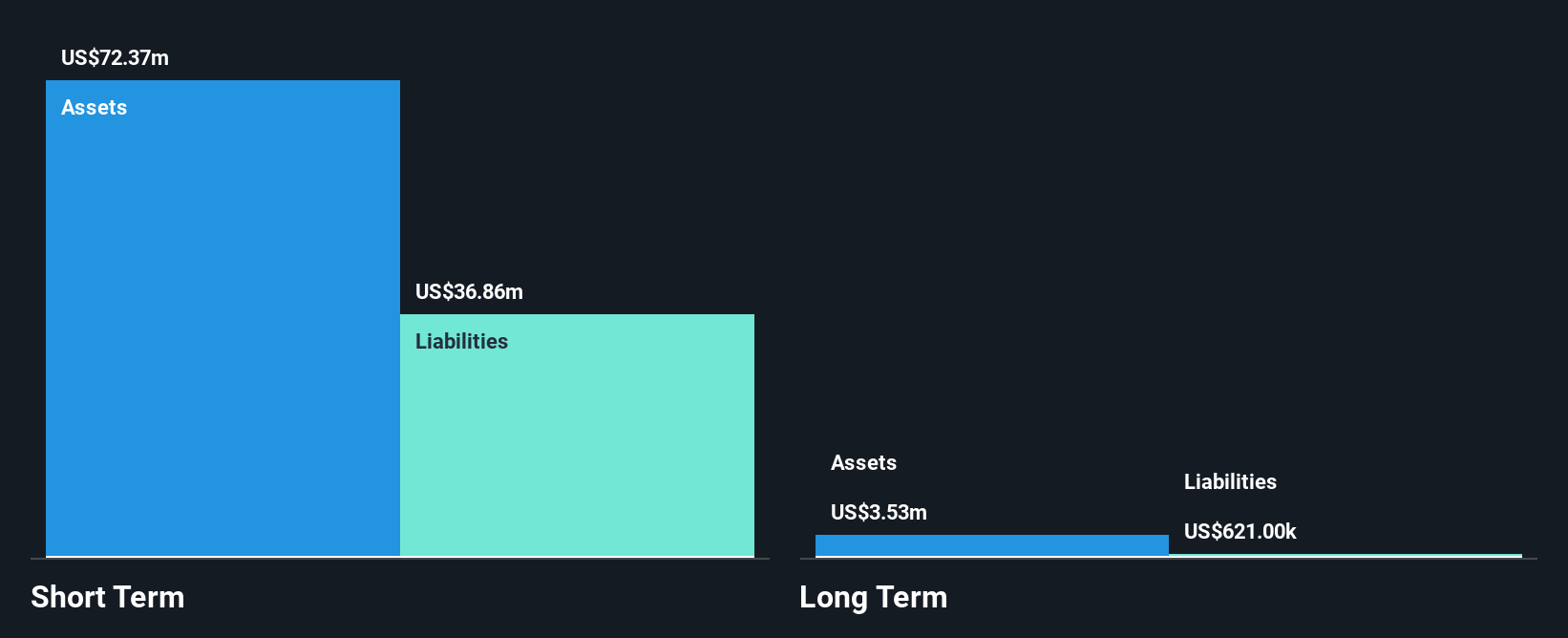

CV Sciences, Inc., with a market cap of US$16.03 million, focuses on hemp-based CBD wellness products generating US$14.37 million in revenue. Despite being unprofitable, the company has consistently reduced its losses over five years by 52.9% annually and improved its net loss to US$0.752 million for the first nine months of 2025 from US$1.67 million a year ago. The company's short-term assets exceed both short-term and long-term liabilities, providing some financial stability despite increased debt levels over time and high share price volatility recently observed in the market.

- Take a closer look at CV Sciences' potential here in our financial health report.

- Gain insights into CV Sciences' historical outcomes by reviewing our past performance report.

Summing It All Up

- Click this link to deep-dive into the 336 companies within our US Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报