Sezzle (SEZL): Assessing Valuation After Expanded $100m Buyback and New S&P Index Inclusions

Sezzle (SEZL) just doubled down on itself, authorizing another $100 million in share repurchases after wrapping up a prior $50 million program, while simultaneously landing spots in several key S&P indices.

See our latest analysis for Sezzle.

Those moves seem to be catching investors attention, with Sezzle trading at $72.14 and posting a roughly 38% 1 month share price return and about 59% 1 year total shareholder return, suggesting momentum is rebuilding after a choppy quarter.

If Sezzle’s renewed buybacks have you thinking about what else could run next, it might be worth exploring fast growing stocks with high insider ownership as a curated hunting ground for the next wave of momentum names.

With buybacks accelerating, earnings growing over 20% annually and the stock still trading roughly 50% below its consensus target, is Sezzle quietly undervalued, or are investors already paying up for the next leg of growth?

Most Popular Narrative: 33.5% Undervalued

With the most followed narrative pinning fair value well above the current $72.14 share price, Sezzle is being framed as a discounted growth story.

Strategic expansion of product offerings (On Demand, Premium, and Anywhere) and cross selling efforts targeting migration from low margin On Demand to higher margin subscription products lays groundwork for increased consumer lifetime value and sustained improvement to net margins and earnings.

Curious how aggressive growth forecasts, firm margins and a rich future earnings multiple can still point to upside from here? See what assumptions power that view.

Result: Fair Value of $108.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy marketing spend and rising credit losses, especially among lower income customers, could quickly erode margins and challenge the upbeat growth story.

Find out about the key risks to this Sezzle narrative.

Another View: Multiples Send a Different Signal

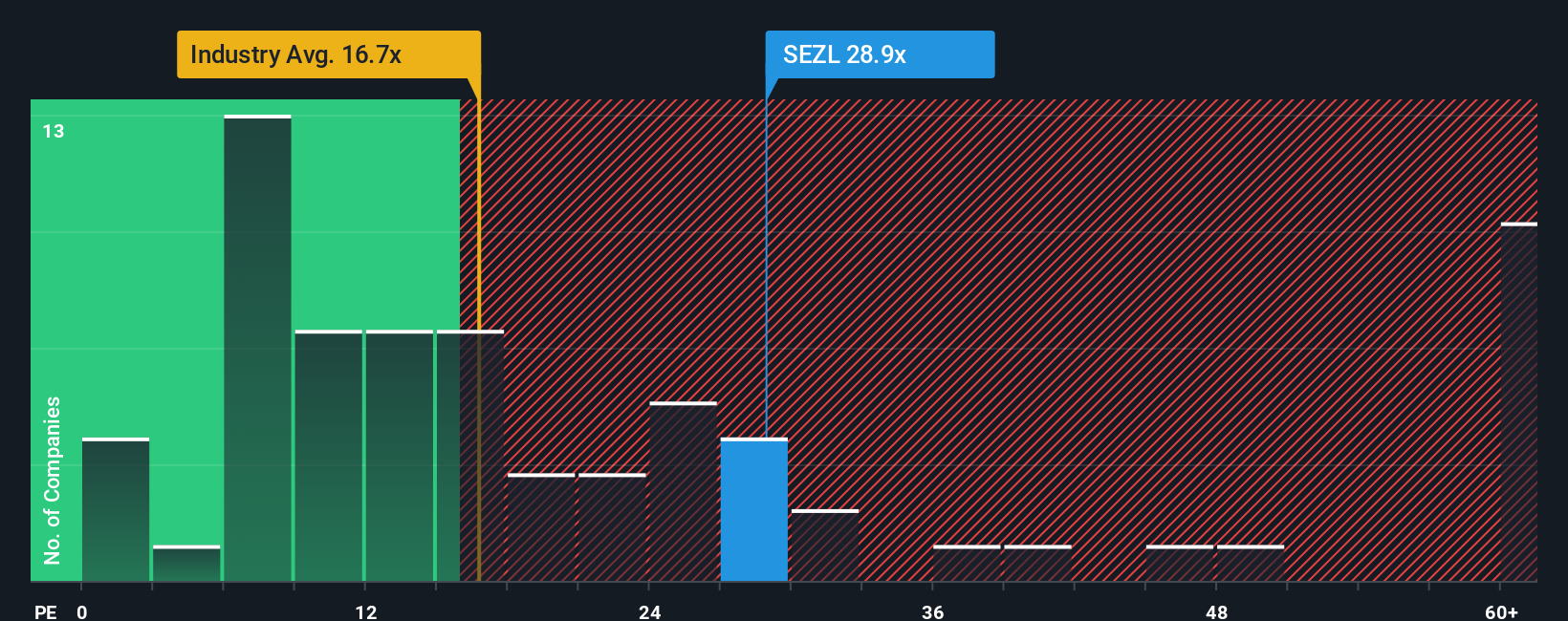

While narratives point to upside, Sezzle’s price to earnings ratio of 21.3 times is well below its fair ratio of 29.9 times and far cheaper than peer averages near 62.5 times. Yet it still trades richer than the US Diversified Financial industry at 13.7 times. This raises the question: is this a bargain with growth attached, or a premium that could compress if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sezzle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sezzle Narrative

And if you see the story unfolding differently or simply want to dig into the numbers yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want an edge beyond Sezzle, let Simply Wall Street’s screener surface targeted opportunities, so you are not left watching others capture the upside first.

- Capture sharp mispricings by scanning these 916 undervalued stocks based on cash flows that combine strong cash flows with attractive entry points before the crowd catches on.

- Ride structural trends in medicine by targeting these 29 healthcare AI stocks using artificial intelligence to reshape diagnostics, treatment pathways, and patient outcomes.

- Tap into next generation payment and blockchain platforms through these 80 cryptocurrency and blockchain stocks positioned to benefit as digital assets move further into the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报