SharpLink Gaming (SBET): Assessing Valuation After Recent Share Price Pullback and Rapid Revenue Growth

SharpLink Gaming (SBET) has quietly become a curiosity for traders, with a sharp pullback over the past week sitting against strong year to date gains and eye catching revenue growth that is nearly double.

See our latest analysis for SharpLink Gaming.

That 11.6% year to date share price return now looks fragile after a 21.8% seven day share price slide and a much steeper 47.9% three month selloff. This suggests momentum is fading even as the one year total shareholder return is roughly flat.

If SharpLink’s volatility has your attention, it might be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership for other fast moving opportunities with committed insiders.

With revenue nearly doubling, yet shares sliding sharply in recent months and still trading far below analyst targets, is SharpLink Gaming an underappreciated growth story for bold investors, or is the market already discounting its future potential?

Price to Book of 0.6 times, is it justified?

On a price to book basis, SharpLink Gaming looks inexpensive, with the last close of $9.02 implying a valuation well below both peers and our fair value estimate.

Price to book compares what investors are paying for each dollar of net assets on the balance sheet. This can be particularly relevant for asset light digital platforms and early stage ventures that are still loss making but building equity value.

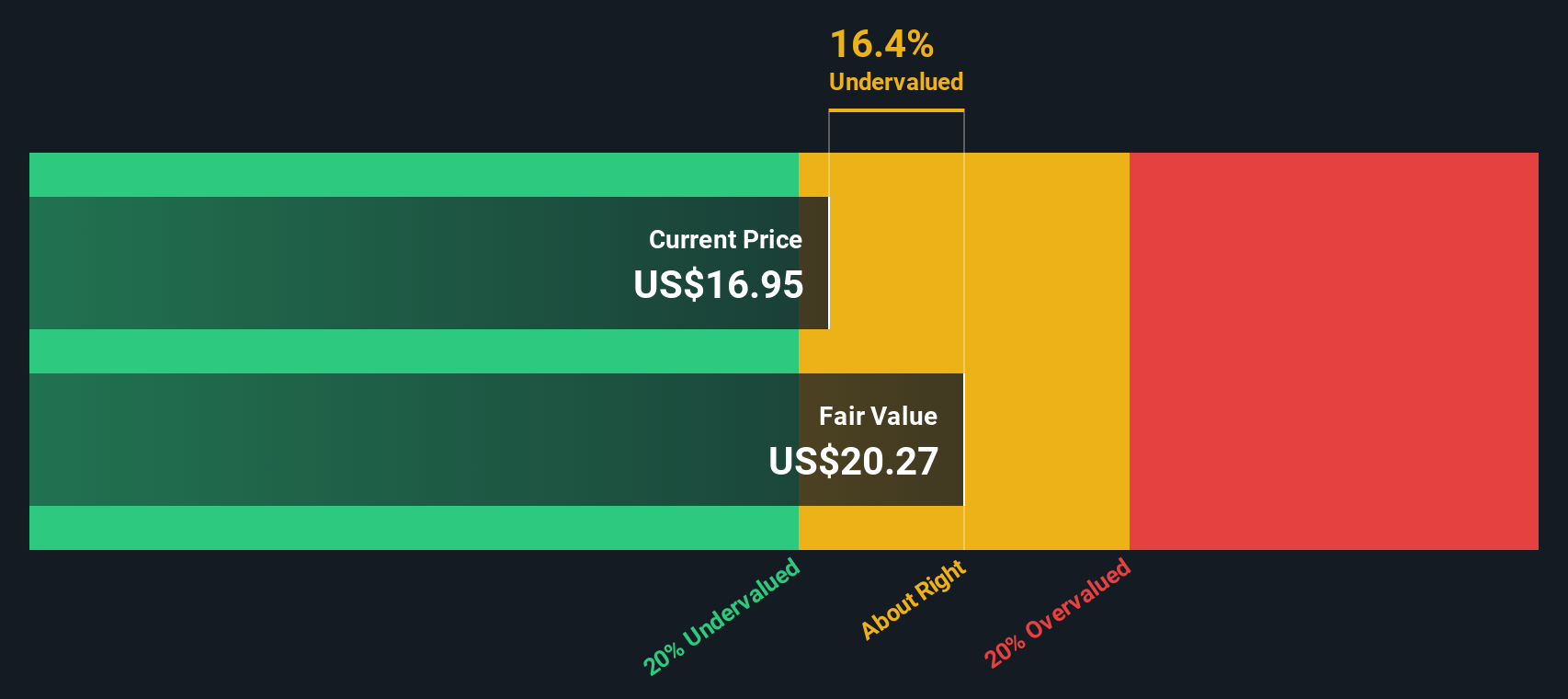

For SharpLink, a 0.6 times price to book ratio signals the market is pricing the company at a discount to its recorded net assets rather than assigning a premium for its rapid top line growth and expected path toward profitability. This is even though our DCF model estimates fair value at $13.74 per share, roughly 34.3 percent above the current price.

The contrast with the wider US Hospitality space is stark. SharpLink is trading at 0.6 times book versus an industry average of 2.6 times. It also screens cheaply against a peer average of 5.6 times, which suggests investors are heavily discounting its balance sheet and future growth relative to comparable companies.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 0.6 times (UNDERVALUED)

However, investors still face risks from ongoing losses and heavy reliance on crypto linked Ethereum staking, where regulatory or market shifts could quickly erode sentiment.

Find out about the key risks to this SharpLink Gaming narrative.

Another View on Value

Our DCF model also points to upside, with a fair value of $13.74 versus the current $9.02, suggesting SharpLink could be materially undervalued if growth and profitability targets are met. But can a young, loss making, crypto exposed business really deliver on those forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next smart move by scanning a few hand picked stock ideas our community tracks closely using the Simply Wall Street Screener.

- Target potential bargains that the market may be overlooking by running through these 916 undervalued stocks based on cash flows which is built around discounted cash flow insights.

- Explore transformational tech trends by checking these 24 AI penny stocks which is packed with companies focused on artificial intelligence.

- Review these 13 dividend stocks with yields > 3% to see companies offering dividend yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报