Assessing BKV Corp (BKV) Valuation After Announcing a $100 Million Share Repurchase Program

BKV (BKV) just rolled out a two year, $100 million share repurchase plan, a move that often signals management feels the stock undervalues the business and that it wants more flexibility in capital allocation.

See our latest analysis for BKV.

That confidence comes after a choppy stretch, with a recent pullback leaving the share price at $26.02 despite a strong 90 day share price return of 21.76 percent and a 1 year total shareholder return of 19.96 percent. This suggests momentum is still building rather than fading.

If this buyback has you thinking about what else could surprise to the upside, now is a good time to explore fast growing stocks with high insider ownership beyond the usual names.

With buybacks now in play, robust double digit revenue and profit growth, and a share price still below analyst targets, is BKV quietly undervalued, or is the market already pricing in its next leg of growth?

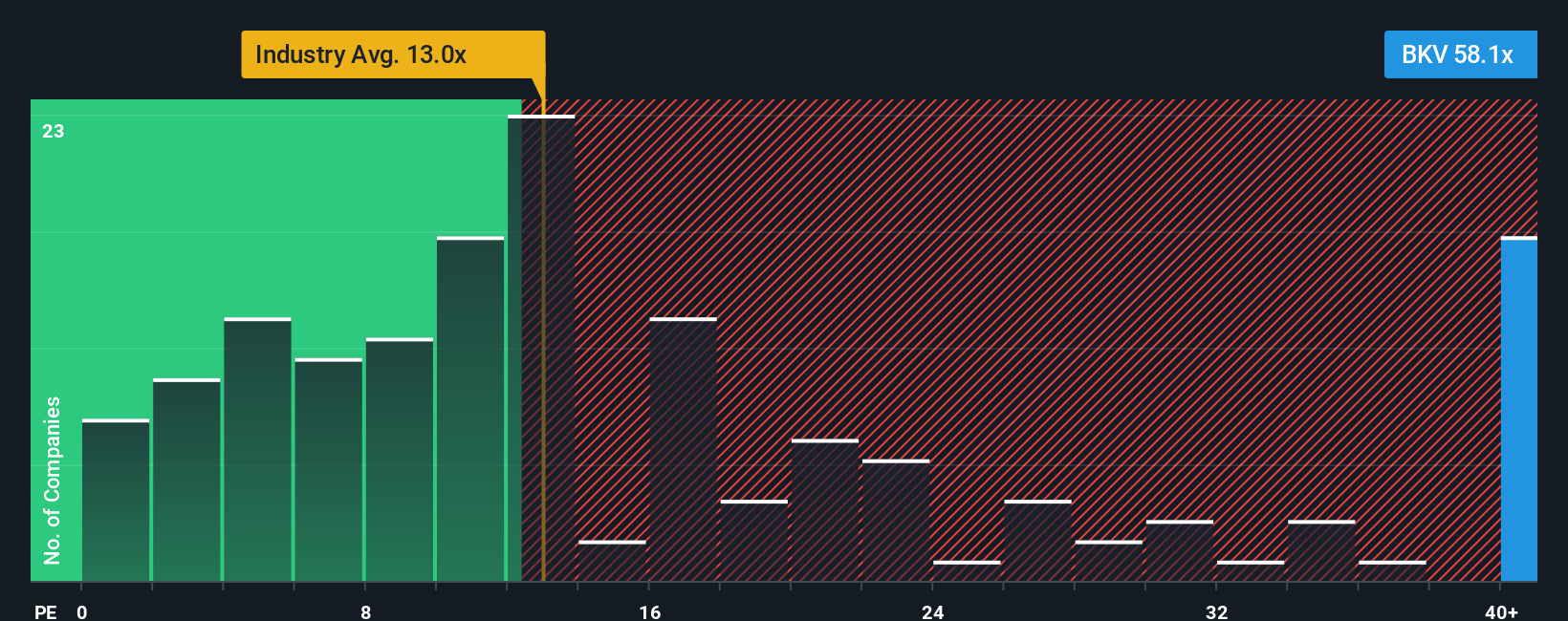

Price-to-Earnings of 56.5x: Is it justified?

BKV screens as significantly undervalued on our SWS DCF model, with an estimated fair value of $60.06 versus the last close at $26.02.

Our DCF model projects BKV's future cash flows over time and discounts them back to today using a required rate of return, producing a single fair value estimate per share.

For a recently profitable, fast growing energy producer exposed to natural gas, power generation, and carbon capture, that long term cash flow profile can look very different from what near term earnings multiples imply.

Against that backdrop, the current market price implies a 56.7 percent discount to our fair value estimate. This suggests investors may still be underestimating the durability and trajectory of BKV's cash generation if forecasts play out.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of $60.06 (UNDERVALUED)

However, investors still face meaningful risks, including commodity price volatility and execution challenges in capital intensive power and carbon capture projects.

Find out about the key risks to this BKV narrative.

Another View on Valuation

On earnings, BKV looks pricey, trading on a 56.5x price to earnings ratio versus 30.8x for peers and just 13x for the wider US Oil and Gas industry, while our fair ratio sits nearer 27.4x. That gap points to real valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BKV for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BKV Narrative

If you want to stress test these assumptions or follow your own process, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BKV.

Ready for more high conviction ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh stocks that match your strategy before the market catches on.

- Capture potential bargains trading below their worth by running through these 916 undervalued stocks based on cash flows and focusing on businesses with support from strong cash flows.

- Ride structural trends in automation and machine learning by targeting companies featured in these 24 AI penny stocks with fast expanding addressable markets.

- Strengthen your income stream and reduce guesswork by filtering for reliable payers via these 13 dividend stocks with yields > 3% with yields above three percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报